What are Tokenized Securities? The Thrilling Frontier of Security Tokens

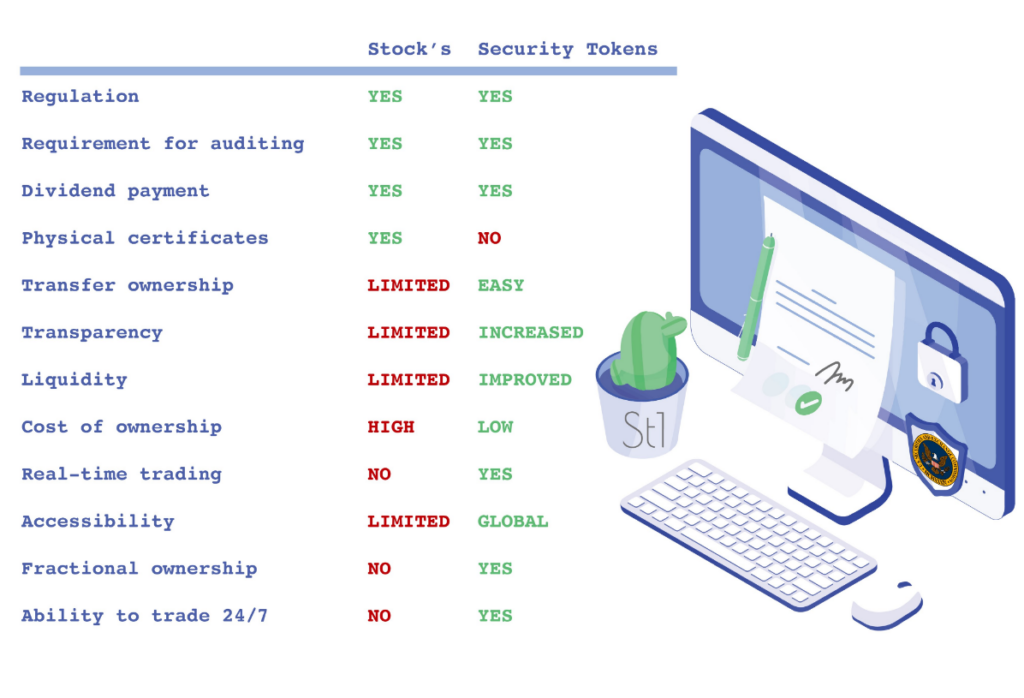

Capital markets are making sure to join humanity’s shift to the digital realm, thanks in part to tokenized securities. Representing ownership of an underlying asset, such as stocks, bonds, real estate, or other investment products, security tokens are becoming increasingly important in the financial world. By digitizing traditional securities, security tokens can democratize access to investments, reduce transaction costs, and increase liquidity for individuals and businesses. A deep understanding of tokenized securities requires a grasp of both traditional finance and novel concepts in blockchain.

What is a security?

A security is any type of financial instrument that holds some tangible monetary value. Any security is only worth what a buyer and seller agree it’s worth. Indeed, most people think of stocks—an equity stake in a publicly traded company—when they think of securities. While stocks are historically the principal example of a security, they are not alone. A bond is a security. As is an exchange-traded fund.

Even within the world of stocks, not all stocks are created equal. Most people think of public stocks that trade on exchanges like the Nasdaq when thinking about stocks. Yet, there are certain securities that are technically considered stocks in companies but are not publicly traded on Nasdaq, NYSE or any other major stock exchanges. These securities can be stocks in companies that raised capital through a registration-exempt offering.

From a legal perspective in the US, a security is defined as any asset that meets the four requirements set out in the Supreme Court ruling on the SEC v. W.J. Howey Co. case in 1946. Known as ‘the Howey Test,’ the ruling determined that a security is any asset which involves:

☑️ An investment of money

☑️ In a common enterprise

☑️ An expectation of profits

☑️ From the effort of others

While the Howey Test remains the standard for defining securities in the US, its applicability was challenged by the rise of digital assets, a new class of instruments built on blockchain technology. Nevertheless, the SEC made it clear that no adjustments to the Howey test would be forthcoming for tokens, and token issuers would need to comply with existing securities laws like everybody else.

What is a token?

In the context of blockchain, a token is a digital asset or unit of value that is created and managed using blockchain technology. Tokens can represent a variety of things, such as a specific asset, a share in a company, or a form of cryptocurrency. Not only can tokens represent ownership in an asset of sorts, but they can also function as unique identifiers used for authentication and verification. One of the key benefits of security tokens is the fact that they are programmable, allowing for the automation of functions like dividend distribution and voting rights.

Tokenized Securities: Combining the Best of Tokens With the Best of Securities

Tokenized securities typically function using smart contracts, which are self-executing digital contracts that automatically enforce the terms of the token. These contracts can include provisions for things like dividend payments, voting rights, or even buyback options, and are designed to help ensure that the token operates in a fair and transparent manner.

Central to the smooth functioning of tokenized securities is a new class of token standards that are purpose-built to comply with regulation. A token standard is basically a set of characteristics that determine how new tokens should be created. Instead of having to create tokens from scratch, developers can adapt a specific token standard for their own use case. In the case of security tokens, the ERC-1404 token standard bakes compliance into the token by making it impossible for someone that has not verified themselves to send or receive the token.

Overall, security tokens offer a new way for investors to access a wide range of assets while also benefiting from blockchain technology’s transparency, security, and efficiency

What is a Security Token Offering (STO)?

Companies looking to raise capital can leverage digital assets by holding a security token offering (STO) in which they offer their token to the investing public. Raising capital through token offerings was first popularized during the Initial coin offerings (ICO) boom as many companies discovered the ease with which they could raise money by issuing tokens to the public. While ICOs

An STO requires a significant amount of pre-compliance preparation. Anyone can start an ICO and participate (unless their local laws say they can’t). However, in order for a company to offer an STO, they need to do it under a valid exemption or regulation so it can then be traded on a regulated platform.

Advantages of a Security Token Offering (STO) Over Traditional Fundraising Methods

- Security token offerings enable retail investors to invest in privately-owned companies and assets not listed on public stock exchanges, democratizing finance.

- Security token offerings allow firms to launch global STOs, attracting investors from untapped sources and facilitating liquidity for long-dated private markets.

- Fractionalization of securities allows more investors to participate in previously restrictive markets, improving overall depth and level of activity.

- Security token offerings introduce instant settlement and 24/7/365 secondary markets, unlocking liquidity and increasing efficiency for investors.

- Programmatic compliance is facilitated by smart contracts built into security token offerings, limiting potential fraud and misappropriation of funds by incorporating compliance requirements such as KYC and AML checks, profit sharing, voting rights, and bankruptcy protection clauses.

Introducing Digital Asset Regulation

What separates tokenized securities from other digital asset classes is the fact that tokenized securities are subject to various securities law. Around the world, different countries are taking different approaches to regulating tokenized securities and digital assets in general. In the US, SEC Chairman Gary Gensler believes almost all tokens are considered securities, and therefore must comply with existing regulations, and that only Bitcoin can be considered a commodity that falls outside the SEC’s jurisdiction.

It’s crucial that token issuers consider the regulatory implications of offering a security before launching. According to the law, any company that wants to offer a security must either register for an initial public offering with the SEC, or take advantage of one of the SEC’s registration exemptions. Since the full IPO is too costly and time-consuming for most companies, many choose to go the route of an exemption such as Reg D and Reg S.

A Word on Terminology

A recent op-ed in CoinDesk tried to draw a distinction between security tokens and tokenized securities, a distinction we believe is out of place. According to Noelle Acheson, security tokens refer to crypto tokens with security characteristics, such as revenue share or voting rights, whereas a tokenized security is a digital representation of a classical security, such as stock or bond. In our view, this distinction is unnecessary.

Any token that is compliant with securities law can be called both a security token and a tokenized security. In fact, the distinction between revenue-sharing security tokens and tokenized securities, stocks and bonds on the blockchain, overlooks the fact that security tokens combine the best of both traditional finance and blockchain technology. The stocks and bonds of the future are likely to have additional functionality powered by smart contracts, while the tokens of the future are likely to adhere to securities law like stocks and bonds.

Security Tokens The INX Way

Ever since INX issued the first SEC-registered security token in history, we have been heads-down helping businesses launch their own compliant tokens and list them for trading on our US-regulated exchange. From launching your token, to investor due diligence and cap table management, we have everything you need to raise capital through a security token offering.

Discover STOs with us by visiting our Raise page.

David Azaraf February 23, 2023

Crypto enthusiast, help businesses plug into the token economy