How to Buy and Trade Bitcoin in 2024: A Beginner’s Guide

The easiest way to buy Bitcoin is through a crypto exchange with either fiat or another cryptocurrency. You’ll need to open an account with the exchange to buy Bitcoin through its platform.

Bitcoin is the first and most popular cryptocurrency in the world. It has enjoyed an astronomical growth of over 81,000,000% from $0.048 in 2010 to its current price of over $39,000. It is no surprise that Bitcoin has maintained its status as the face of the digital economy

Want to buy Bitcoin but don’t know where? This comprehensive guide walks you through the process of how to buy Bitcoin in 2024.

Common Ways to Buy Bitcoin in 2024

It’s 2024, and you can buy Bitcoin in several ways now. Your choice of payment method depends on what is convenient for you. Here are some of the popular ways you can buy Bitcoin:

- With a Credit Card: Credit/debit cards are quick and popular options to buy Bitcoin in 2024. Generally, you’ll need a centralized exchange, like INX, to buy Bitcoin with your card. The process is usually simple and fast – deposit on the platform or buy directly with your card details.

- With Bank Transfers/ACH deposits: Most centralized crypto exchanges will allow you to make fiat deposits through bank transfers and ACH deposits. You can then buy Bitcoin on the platform with the deposited funds.

- On Paypal and other online payment systems: Paypal offers their users the option to buy BTC directly with USD on the platform. Note that PayPal charges a transaction fee that depends on the amount of Bitcoin you buy. After buying, you can send your BTC from your PayPal to your external Bitcoin wallet.

- Using other Cryptocurrencies: You can also convert other cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), and Litecoin (LTC) to BTC. You will need a crypto exchange to carry out this type of transaction.

The next section covers how to buy Bitcoin with both fiat currencies and cryptocurrency.

How to Buy Bitcoin on INX

INX.One is a crypto exchange for buying and selling Bitcoin, best known for its user-friendly interface with robust regulation and security. INX has money transmitter licenses in 47 states.

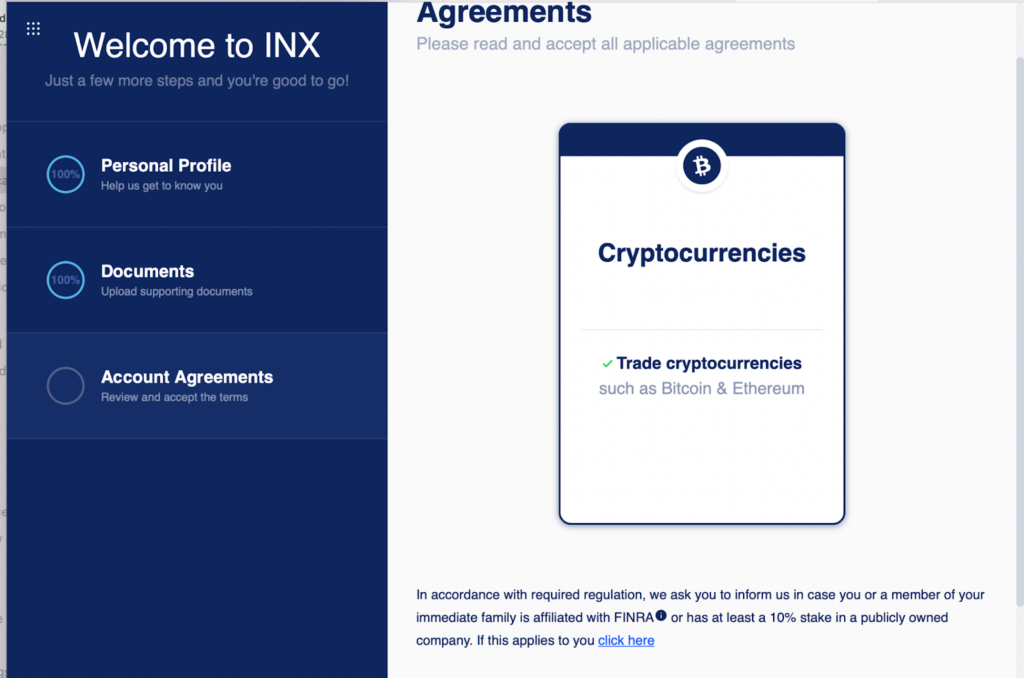

To start your INX journey, you must create an account and follow a KYC process to verify your account to buy or trade Bitcoin on INX. Open an account, sign up, fill out the form, upload your identity documents, and sign the account agreement.

The KYC process is quite straightforward and takes less than 5 minutes. Here is a video that works you through the KYC process step-by-step:

After submitting the required documents, you usually have to wait for a short period for the team to review your application. Once approved, you are set to make a deposit and start trading bitcoin.

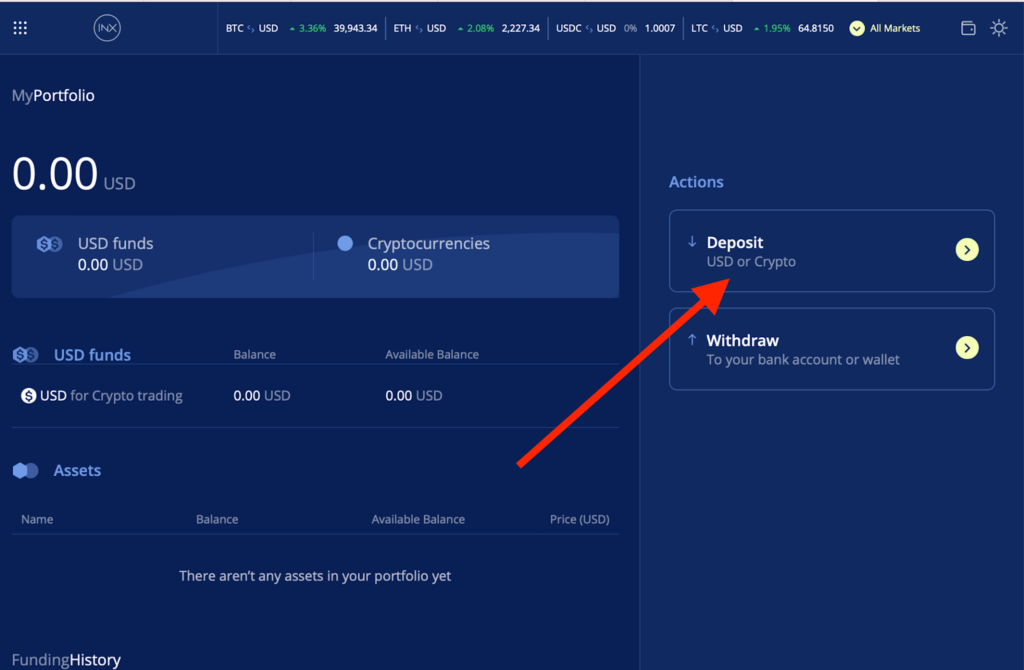

You can fund your account to buy Bitcoin by depositing fiat currency (USD) or cryptocurrencies (USDC, ETH, LTC). You can start the deposit process by clicking on Deposit

Your INX.one account comes with a digital wallet for each currency you can trade on the platform. To deposit a cryptocurrency on INX, click on the “Deposit” under Actions from the sidebar.

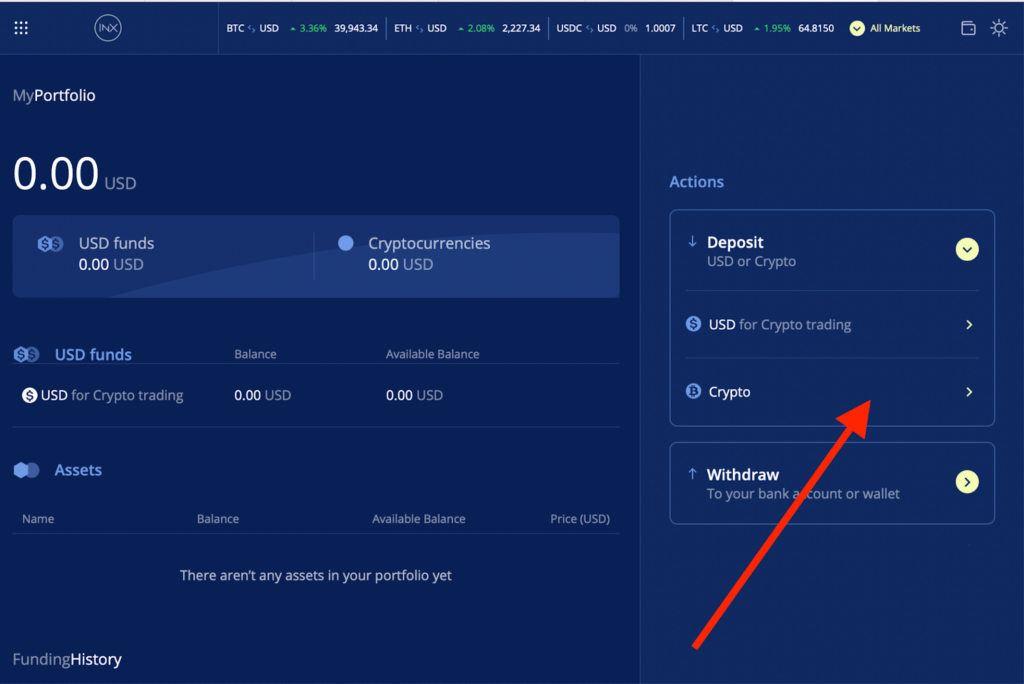

This menu drops down to show two options – USD and Crypto. Click on crypto to get the wallet address to send your cryptocurrency.

For example, you want to send ETH into your wallet from your existing Metamask. You would click the Crypto option to generate a wallet address on the Ethereum blockchain. You’d then copy and paste this wallet address as the recipient when you transfer from Metamask. Once your transaction is completed, you’ll get an email confirmation, and your crypto balance is updated immediately.

To deposit fiat currency directly, select the USD option. You can fund your account with USD using a Bank wire, a credit/debit card, or ACH deposits. Select the most convenient payment method and make a deposit; with the card option, you can deposit up to $20,000 daily.

Read our guide on how to deposit with a credit card, how to deposit with Bank Wire, and ACH to learn more about funding your account.

Once your deposit is confirmed and your account balance has been updated, you’re set to buy your Bitcoin.

How to Buy Bitcoin with USD

Navigate to the trading terminal of BTC/USD to buy Bitcoin directly with USD. Click on “Market” to buy at the current market price immediately. Input the amount you want to convert to BTC and Click on the green Buy Button.

Use the limit option; if you have a price you want to buy your BTC at, the order will be executed if/when the price gets to that point. The video explains better how to buy Bitcoin on INX.

How to Safely Store Your Bitcoin in 2024

How you store your coins is one of the important things to consider after buying Bitcoin. It is important to keep your crypto away from malicious actors and scams. Your first line of defense is selecting a safe wallet to store your Bitcoin. Bitcoin wallets are generally divided into two types – Hot and Cold Wallets.

Hot Storage refers to keeping cryptocurrencies in wallets that are connected to the internet (hot wallets). These wallets are software-based, like desktop, mobile, or web wallets. Hot wallets are known for their convenience; they allow easy access for quick transactions. This makes them great for regular trading and spending.

A major drawback of hot wallets is the increased security risk because they are connected to the internet. They are more susceptible to phishing attacks, malware, and other cyber threats. Hot wallets are best for holding only the amount of Bitcoin you need to access quickly for trading or spending. On the other hand, cold storage refers to keeping cryptocurrencies offline, disconnected from the internet. This is usually through using hardware wallets and storing private keys in paper wallets.

The offline nature of cold storage significantly reduces the risk of online hacking attempts. Therefore, cold wallets are considered the safest way to store large amounts of Bitcoin for long periods. They are ideal for you if you are a long-term holder and don’t require frequent access to your Bitcoin.

What to Consider when Setting Up a Bitcoin Wallet

A significant thing to consider when setting up your Bitcoin wallet is the centralization of your wallet; depending on the nature of your wallet, your wallet security might be entirely in your hands.

Centralized wallets are managed by third-party services like the INX.one wallet. Meanwhile, decentralized wallets are non-custodial, and you have complete control over your private keys and, in turn, your crypto assets.

For decentralized wallets like Metamask, you’re completely responsible for safeguarding your private keys/seed phrases. While this gives you complete control over your assets, it comes with some responsibilities. For example, losing your seed phrase can mean losing access to your wallet without a way to recover your keys.

The security of centralized wallets depends on the security measures of the wallet provider. For example, INX.one custodial wallets use standard security encryptions to protect them against cyber threats. Custodial wallets may be better for users who prefer not to manage their private keys.

Tips to Keep Your Bitcoin Safe

Due to the nature of cryptocurrencies, you should always be careful with Bitcoin trading and storage. Here are some tips to help you keep your assets safe from malicious actors and trade safely.

- Use Strong, Unique Passwords: Create strong, unique passwords for your wallet and exchange accounts, and change them regularly.

- Use Two-Factor Authentication (2FA): Ensure you turn on 2FA security methods for your online and exchange wallets. This adds an extra layer of security beyond your password.

- Use Cold Storage with large amounts of Bitcoin: A hardware wallet is the safest option for significant amounts of Bitcoin. These devices store your private keys offline, making them immune to online hacking attempts.

- Keep your Private Keys (Seed Phrase) private: If you use a decentralized wallet like Metamask, never share your keys with anyone. With your private keys, anyone can gain control of your wallet and send out your assets. For centralized wallets, don’t share your password with anyone.

- Beware of Phishing Emails: Be cautious about unsolicited emails or messages that ask for your Bitcoin or personal information. Always verify the authenticity of websites and emails.

- Use a Secure Internet Connection: Avoid conducting Bitcoin transactions over public or unsecured Wi-Fi networks. These can be susceptible to interceptions and hacking.

- Avoid connecting your decentralized wallets to suspicious sites: Connecting your wallet to suspicious sites can give them control over your Bitcoin and can lead to loss. Make sure you confirm the security of any website before connecting and approving transactions.

- Consider a Multi-Signature Wallet: For additional security, consider using a multi-signature wallet. This requires multiple private keys to authorize a Bitcoin transaction.

- Always Update Your Wallet’s Software: Regularly update your wallet software to ensure you have the latest security enhancements and bug fixes.

Is Now the Right Time to Buy Bitcoin?

The general outlook on Bitcoin is bullish with the recent approval of the Bitcoin Spot ETF and a Bitcoin halving coming up. However, your choice of when to buy Bitcoin largely depends on several factors, including your risk tolerance and investment strategy.

Consider your investment strategy: Are you looking for short-term gains, or are you planning to hold onto your Bitcoin for the long term?

For short-term gains, you’ll need a trading/investment strategy to guide when to buy and sell. Your strategy will dictate when and how you get into and out of the market. You should also always invest only what you can afford to lose at any time because the Bitcoin price is quite volatile.

At the end of the day, there is no right or wrong time to buy Bitcoin because there are opportunities at all times. It is only ” wrong ” when there is no sound investment strategy and proper risk assessment.

Where to Buy Bitcoin Safely in 2024?

Regulated crypto exchanges like INX allow you to buy and trade Bitcoin comfortably without losing sleep. The process is simple and secure, with standard security protocols to protect your assets. INX is also well-regulated with licenses from the SEC and FINRA and measures for full regulatory compliance.

You can learn more about how to open an INX.one account here and how to fund your account here. Our customer support is also available 24/5 to assist you with any problem in case you run into any.

FAQs (Frequently Asked Questions)

How much do I need to Invest in Bitcoin?

The minimum amount you need to buy Bitcoin usually depends on the platform you use. Some exchanges allow you to buy Bitcoin with as low as $10.

How Much Bitcoin will $100 get me?

The amount of Bitcoin you can get with $100 depends on the current market price of Bitcoin. Since Bitcoin can be divided into smaller units, you can buy a portion of a Bitcoin equivalent to $100 at its current value.

How long Can I hold my Bitcoin?

There is no time limit for holding Bitcoin. You can hold onto your Bitcoin for as long as you wish. Unlike certain financial instruments that might have maturity dates or expiration, Bitcoin does not expire or become invalid over time.

Where can I Sell Bitcoin?

You can sell your bitcoins on several platforms, including crypto exchanges like INX, or peer-to-peer platforms like Paxful. You can also find Bitcoin ATMs that allow you to withdraw cash from your wallet.

How Do I Know When to Buy Bitcoin?

You can Bitcoin anytime! While some investors try to time the market or buy during a dip, predicting the ‘best time’ can be challenging. Many adopt a long-term investment strategy or use dollar-cost averaging to mitigate timing risks. You can also consider market trends, Bitcoin’s price movements, and any global economic factors that might influence the market.

David Azaraf March 15, 2023

Crypto enthusiast, help businesses plug into the token economy