Tokenized assets are everywhere this year, with big financial players like BlackRock and JPMorgan making major moves with tokenization. On the market side, tokenized RWAs have recorded real growth this year, with over 108% increase in market cap within one year. Over $25.12 billion worth of assets are currently tokenized on-chain.

The stablecoin market is worth a total of $252.05B and had a monthly transfer volume of over $3 trillion in June alone. Even regulators have started paying attention to tokenized assets, especially stablecoins; the U.S. just signed the Genius Act into law to regulate payment stablecoins.

Despite this momentum, a lot of investors still can’t make sense of the different tokenized assets and what they do. If you’re struggling with this problem, then this guide is for you. This article breaks down the major categories of tokenized assets and what they tokenize on-chain.

What are Tokenized Assets?

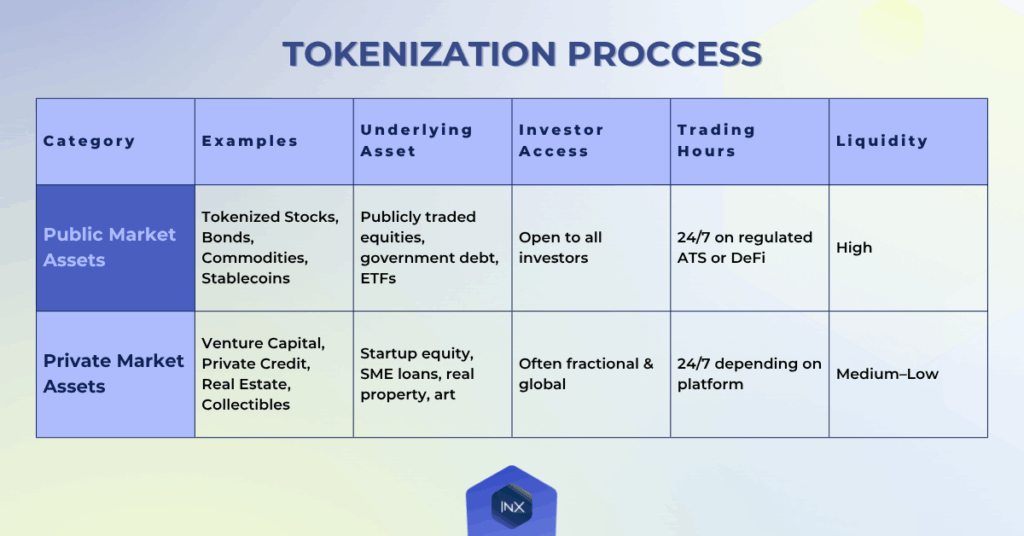

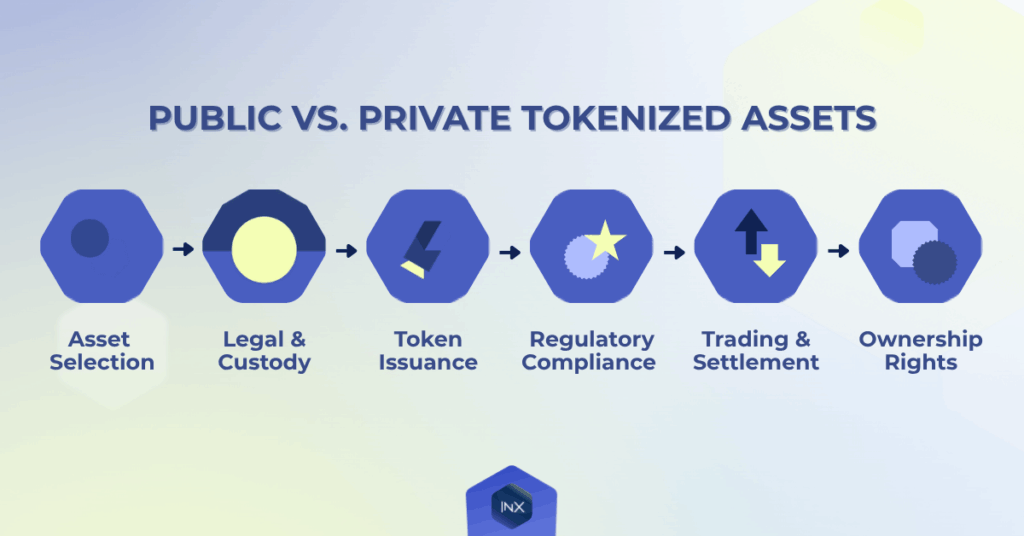

Tokenized assets refer to any token minted on-chain with a real-world counterpart. They’re not just wrapped tokens; there is a physical representation of that token somewhere. To help you make sense of the different tokenized assets in this guide, we’ve grouped them into two broad categories based on the underlying asset class:

- Tokenized public market assets: tokenized stocks, securities, and bonds issued by companies or governments available for public trading

- Tokenized private market assets: tokenized private equity, credit, and off-market real estate that are offered to investors in a closed market

10 Types of Tokenized Assets

In this section, we walk through these categories, including a general overview of how they work and what they tokenize.

Tokenized Public Market Assets

Tokenized public market assets are the most familiar tokenized asset class; they tokenize publicly traded stocks, securities, government bonds, and commodities on-chain. These assets are also the easiest to start with since their underlying assets are available for trade on public markets like stock exchanges.

- Tokenized Stocks: tokenized shares of public companies backed 1:1 by real shares held by a licensed custodian. They grant exposure to the asset’s price performance but often don’t include voting rights. Example: INX’s tokenized Apple or Nvidia shares.

- Tokenized Bonds: represent government securities like the U.S. T-bill, T-bonds, municipal bonds, and other government debt instruments like municipal bonds to allow 24/7 global access.

- Collateralized Loan Obligation (CLOs): structured financial products that group multiple tokenized assets, like loans or credit contracts, into a single investment pool. Instead of offering a one-size-fits-all product, the pool is divided into tranches, or slices, with different levels of risk and return. The safest tranches get paid out first and offer lower yields, while the riskiest ones are paid last but offer higher yields.

- Tokenized Commodities: represent commodities like gold, oil, carbon credits, and industrial metals that are available on traditional exchanges via futures contracts or exchange-traded funds (ETFs).

- Currencies (stablecoins): Stablecoins represent fiat currencies like the U.S. dollars on a blockchain. They are usually pegged to the fiat 1:1 with the underlying currency to maintain stability.

Tokenized Private Assets

Traditionally, assets like private credit, loans, or venture capital are often reserved for institutions or accredited investors. The tokenized versions open up access to these assets and are available to any investor.

- Private Credit and Debt Instruments: includes tokenized versions of private loans, invoice financing, and SME credit issued and settled on-chain. They offer higher yields but often come with reduced liquidity compared to traditional public market securities.

- Tokenized Venture Capital: fractional investment into startup equity or venture funds through tokenized offerings through platforms like Republic. These products are often issued under Regulation A or D exemptions. As a subset of Security Token Offerings (STOs), tokenized VC is typically limited to specific fund structures and early-stage opportunities.

- Revenue-Sharing Tokens: commonly used by startups or DAOs to distribute revenue on-chain. These tokens give investors the right to a portion of future revenue from a platform, company, or product.

- Tokenized Real Estate: Residential and commercial properties can now be divided into tokenized shares that investors can buy and trade. This can come in two forms: individual properties and tokenized Real Estate Investment Trusts (REITs). REITs function much like their traditional counterparts but are recorded and traded on-chain, making it easier for a wider range of investors to gain exposure to rental income and property value appreciation.

- Tokenized Collectibles and Art: High-value physical goods like fine art, vintage wines, or rare collectibles can also be tokenized. These tokens represent fractional ownership in authenticated items, opening the door to asset classes that were once reserved for private collectors or institutional buyers.

INX Is Your Home For Regulated Multi-Asset Trading

The explosive growth of tokenized assets makes them a must-have in every investor’s portfolio. Besides, they open the door to markets that were once hard to reach, like private credit, early-stage startups, real estate, and even government bonds. One of the key benefits of tokenized assets is accessibility; you can easily buy into private investments or shares without going through any intermediary.

But accessibility shouldn’t come at the cost of compliance, so it’s crucial to use regulated platforms like INX that are designed with investor protection in mind. INX, for example, is a U.S.-regulated platform that is registered with the SEC and holds an ATS broker license to cater to U.S. users. It is the first SEC-registered exchange that offered investors to both tokenized public market assets and private offerings.

Whether you’re crypto-native, looking to diversify with tokenized assets or a traditional investor looking to start, INX.one is a great place to start. You can buy and trade tokenized securities like stocks, U.S. treasuries, and real assets in a fully compliant exchange. INX also facilitates secondary trading of security tokens and offers access to primary offerings from companies issuing compliant digital securities.

1. How are tokenized public market assets different from private ones?

Answer:

Public market tokenized assets mirror assets already available on public exchanges, like stocks, bonds, and commodities. They’re open to all investors and often trade 24/7 on regulated platforms.

Private market tokenized assets, on the other hand, include venture capital, real estate, and private credit traditionally reserved for institutions. Tokenization makes these accessible to a wider audience but usually with lower liquidity.

2. What makes tokenized assets valuable to everyday investors?

Answer:

Tokenized assets make investing more inclusive by allowing fractional ownership and global access. Investors can buy small portions of high-value assets like real estate or startup equity without traditional intermediaries, while still benefiting from on-chain transparency and faster settlement.

3. Are tokenized assets regulated?

Answer:

Yes but regulation depends on the asset type and platform. For example, stablecoins are now subject to new U.S. regulations under the Genius Act, while security tokens and tokenized stocks must be traded on SEC-registered platforms like INX that follow strict investor protection and custody standards.

4. What risks should investors consider when buying tokenized assets?

Answer:

While tokenization improves access and liquidity, investors should be aware of risks like limited secondary markets for private assets, potential regulatory changes, and the need to verify that tokens are fully backed by real-world assets through licensed custodians.

5. What recent U.S. developments support trading tokenized assets on regulated platforms like INX?

Answer:

Recent regulatory actions in the U.S., such as the passage of the Genius Act to regulate payment stablecoins, reflect a growing governmental focus on tokenized assets. Such legislation signals that tokenization is becoming a regulated and legitimate part of the financial ecosystem. Platforms like INX, already operating under SEC registration and holding an ATS broker license, are well-aligned with this evolving regulatory framework and positioned to offer compliant, secure access to tokenized securities and private offerings.