Every empire eventually meets its challenger.

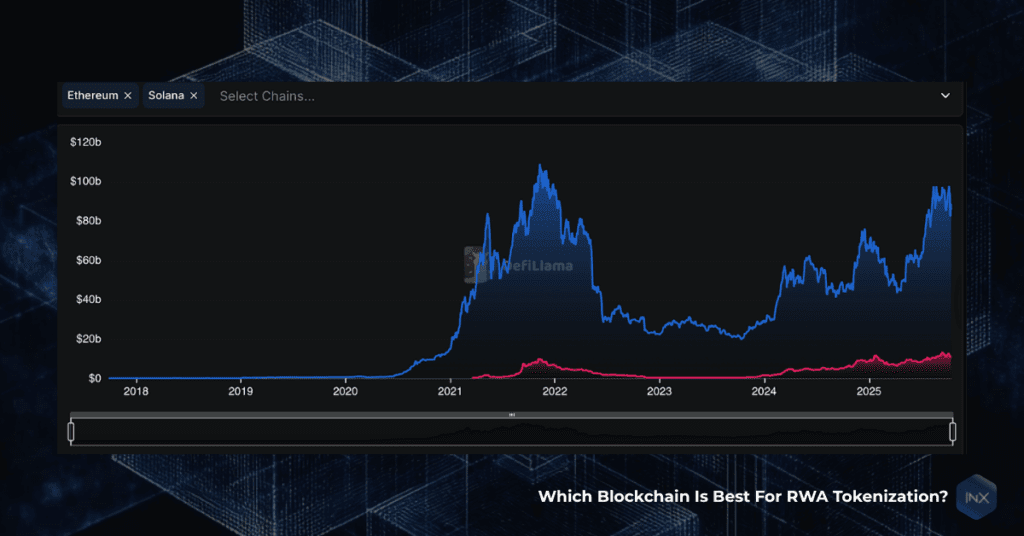

For years, Ethereum reigned supreme in RWA tokenization, its network effect unmatched and its protocols untouchable. Ethereum may have built the foundation for real-world asset (RWA) tokenization, but Solana is stealing the spotlight in 2025. Although Ethereum still commands over 55% of total RWA market share and powers more than 400 tokenized assets, Solana’s growth is impossible to ignore with a 200% surge in its tokenized stock assets in just six months.

In this article, we compare both blockchains through the lens of tokenized asset growth, institutional adoption, and infrastructure maturity, and what their differences mean for investors looking to enter the RWA market.

Ethereum: The Institutional standard

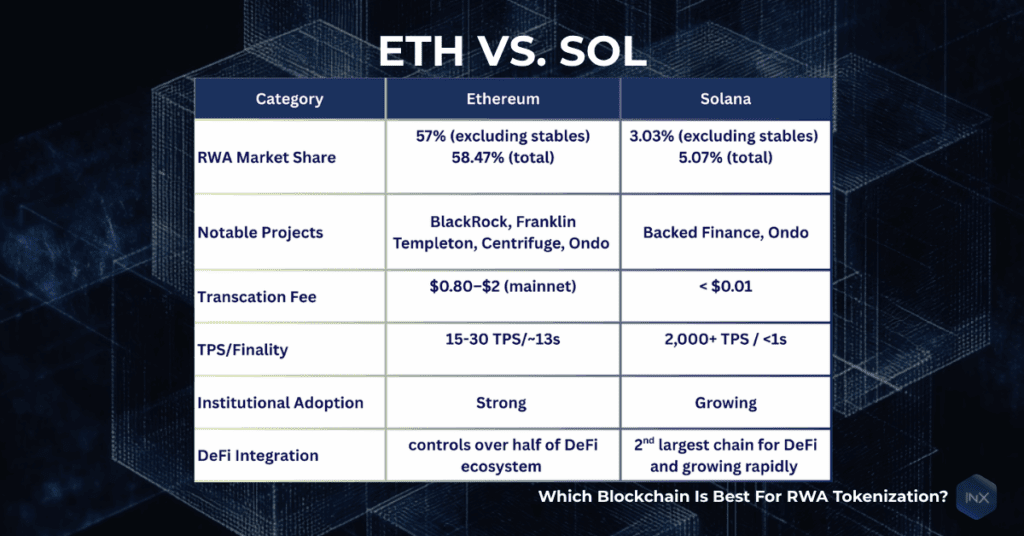

Ethereum continues to dominate RWA (over 50% of the tokenization market), hosting over 400 tokenized assets worth more than $11 billion, including some of the largest institutional products. BlackRock’s BUIDL fund, Franklin Templeton’s FOBXX, Ondo Finance’s Treasury products, Centrifuge’s private credit pools, and MakerDAO’s RWA vaults all launched on Ethereum first.

The big institutions continue to favor Ethereum for its trust and decentralization. It is widely considered the most tested network for building dapps and protocols. It doesn’t hurt that it is backed by a well-developed community of developers and on-chain tools like Chainlink’s proof of reserve.

A drawback to the adoption of the Ethereum chain is tied to its higher transaction fees and transaction speed, which might make it less scalable than newer chains like Solana. However, major upgrades over the last few years have significantly reduced transaction fees and increased scalability efforts.

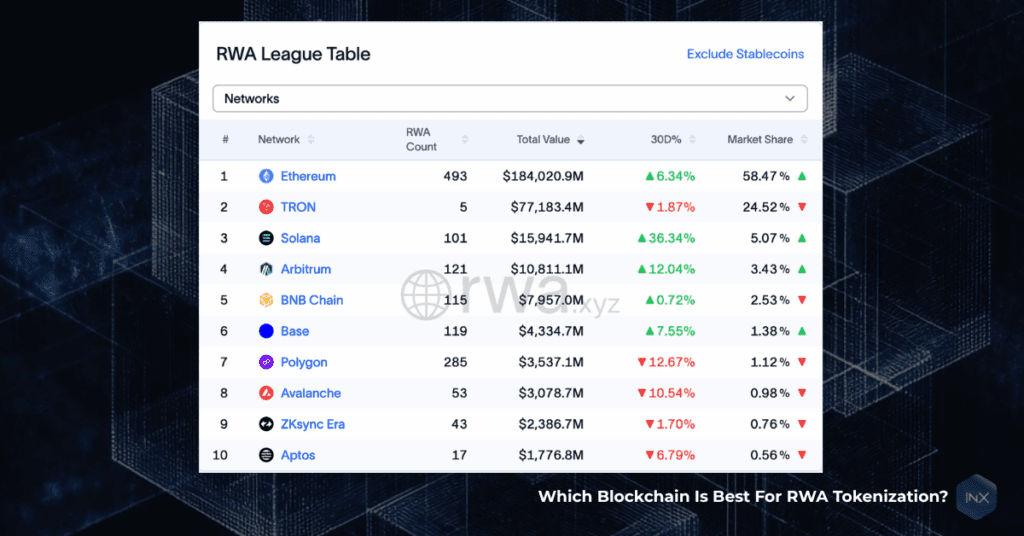

Layer 2 scaling solutions like Arbitrum and Base are also a major scalability development for the Ethereum mainnet. Ethereum L2 chains are attractive to issuers and institutions since they offer significantly lower transaction fees, high TPS, and still tap into Ethereum’s security and decentralization. This is why L2s like Polygon, Arbitrum, Zksync, and Algorand control a significant percentage of the RWA market (higher than Solana in most cases).

Solana: The Efficiency Standard

Solana currently controls around 3.28% of the RWA market share (excluding stablecoin) and over 5.07% of the total RWA market (including stablecoins). Its growth to the third biggest share in the total RWA market, following Ethereum and Tron, mostly fueled the network speed, scalability, and accessibility. Its low transaction speed (less than $1) and fast block finality time make it ideal for high-frequency and consumer-facing products like RWA tokenization.

The growth of tokenization in 2025 has been mostly driven by the launch of Backed Finance, listing of over 60 tokenized ETFs and equities on Solana. That move alone positioned Solana to control over 12% of the tokenized stock market. Other players like Ondo Finance have also expanded to the Solana chain, and even institutions are trying the chain. Maple Finance currently offers credit pools on the Solana chain.

A major drawback to institutional adoption of Solana is the perception that Ethereum is still considered the safer bet. Ethereum is widely considered as the most decentralized and secure blockchain after Bitcoin. Also, some institutions have mixed feelings about Solana being the “blockchain for memecoins.” This certainly doesn’t help their reputation for institutional adoption.

Ethereum Vs. Solana: Is this an institutional versus efficiency tradeoff?

There is no doubt that Ethereum is winning on the institutional adoption front mostly because of the chain. The chain already has institutional trust and regulatory recognition because of its established security, decentralization, and compliance model. Its depth of liquidity is also significantly higher since it controls most of the DeFi ecosystem (over 55% of the total DeFi market) which is an attractive option for assets, regulators, and fund managers.

Solana, on the other hand, as the newer chain is explicitly built for efficiency and scale, it is faster and cheaper already without needing scalability solutions like L2s. This makes it ideal for asset tokenization built for consumers and might require high transaction throughput. Its DeFi share is also growing; it has since grown to become the largest chain for DeFi after Ethereum, controlling about 8% of the market.

Furthermore, the two chains differ in terms of their use and how they operate. Ethereum’s infrastructure advantage comes from its years of building infrastructure developed for institutional adoption. Solana’s growing infrastructure stack reflects its different user base and priorities; instead of building for institutions, Solana focuses on consumer-facing apps, as illustrated by its meme/degen culture.

So, while Ethereum caters to the compliance-first institutional segment, Solana’s trajectory positions it as the network of choice for next-generation financial products that prioritize accessibility and efficiency.

Final Thoughts: Where Should Investors Look?

The future of tokenized assets is a winner-takes-all move since both chains have their purpose and edge. Cross-chain collaboration is how issuers and asset managers are leveraging the advantage of both blockchains. At the end of the day, the best move is to use regulated platforms like INX.one that provide compliant access to tokenized Treasuries, equities, and private markets regardless of the chain they’re issued on. With INX, you don’t have to bother about switching from one chain to another or deal with the hassle of gas fees. The INX.one platform is designed to offer safe, regulated entry into a multi-chain tokenized economy.

Frequently Asked Questions (FAQs)

- Why are Ethereum and Solana the leading blockchains for RWA tokenization?

Ethereum and Solana are the leading networks for RWA tokenization because they offer the infrastructure and developer ecosystems needed to issue and trade tokenized assets at scale. Ethereum is preferred by institutional issuers for its regulatory maturity and security. Solana, on the other hand, is favored for speed, low transaction costs, and scalability, making it ideal for consumer-facing and high-frequency RWA products.

- How much of the RWA market does Ethereum control?

As of 2025, Ethereum hosts over 55% of all tokenized RWA market share and powers more than 400 tokenized assets, including major institutional products from BlackRock, Franklin Templeton, Ondo Finance, and Centrifuge.

- Which blockchain is better for investors: Ethereum or Solana?

Ethereum offers stability, regulatory clarity, and institutional trust, making it ideal for investors focused on long-term, regulated opportunities like tokenized Treasuries or funds. Solana provides faster, cheaper transactions, making it suitable for investors who prefer accessible, consumer-focused products like tokenized stocks and stablecoins.

- How fast is Solana growing in the RWA sector?

Solana has recorded a 200% increase in tokenized asset value in the first half of 2025 and currently holds around 5% of the total RWA market, making it the third-largest blockchain for tokenized assets after Ethereum and Tron. Its fast transaction speed and low fees have attracted projects like Backed Finance, Ondo Finance, and Maple Finance to deploy on the network.