Earn While You Hold: 6 Tokenized Assets That Pay Dividends in 2026

While crypto traders chase volatile price swings, a quieter wealth-building strategy has been gaining traction: tokenized assets that pay regular dividends just like traditional securities, but with blockchain efficiency and accessibility. BlackRock’s BUIDL fund alone has distributed $62.5 million to tokenholders, proving that institutional-grade cash flow generation works just as effectively on-chain as it does […]

A Step-by-Step Guide to Buying Tokenized Gold Safely on INX

For centuries, owning gold meant dealing with brokers, paying for vault storage, and meeting minimum purchase requirements that often ran into thousands of dollars. A single London Good Delivery gold bar weighs 400 troy ounces and costs over $1.3 million at current prices, placing physical gold ownership out of reach for most investors. Even smaller […]

Earn While You Hold: 6 Tokenized Assets That Pay Dividends in 2026

While crypto traders chase volatile price swings, a quieter wealth-building strategy has been gaining traction: tokenized assets that pay regular dividends just like traditional securities, but with blockchain efficiency and accessibility. BlackRock’s BUIDL fund alone has distributed $62.5 million to tokenholders, proving that institutional-grade cash flow generation works just as effectively on-chain as it does […]

Mapping the Future of Real-World Assets: The Top RWA Tokenization Projects in 2025

Three years ago, suggesting that BlackRock would tokenize Treasury bills or that Nasdaq would file to trade blockchain-based stocks would have gotten you laughed out of any Wall Street conference room. When a market grows 5x in two years, from $7.9 billion to $33 billion, it’s crossed from “interesting experiment” to “the next big thing.” […]

Ethereum or Solana? Inside the Battle for the $30B RWA Market

For years, Ethereum reigned supreme in RWA tokenization, its network effect unmatched and its protocols untouchable. Ethereum may have built the foundation for real-world asset (RWA) tokenization, but Solana is stealing the spotlight in 2025. Although Ethereum still commands over 55% of total RWA market share and powers more than 400 tokenized assets, Solana’s growth is impossible to ignore with a 200% surge in its tokenized stock assets in just six months.

A Behind-the-Scenes Look At Tokenized Asset Custody: How It Works in 2025

If you’re a crypto-native investor used to self-custody and DeFi protocols, the idea of asset custody might feel out of place. With tokenized assets like stocks, treasuries, and real estate, custody is the legal backbone of the entire structure. Before you invest in any tokenized assets, you should understand how your assets are managed and […]

10 Must-Know Tokenized Assets for Smart Investors

Tokenization is reshaping global finance, with the U.S. leading new regulatory efforts like the Genius Act for stablecoins. From tokenized stocks and bonds to real estate and venture capital, investors now have 24/7 access to both public and private markets through compliant platforms. This FAQ breaks down the latest developments, opportunities, and safeguards shaping the regulated tokenization landscape.

How Tokenized Stocks Work: The 4-Step Process Powering a Multi-Billion Dollar Market

Tokenized stocks are transforming global equity access. Learn how a 4-step process from real asset custody to on-chain trading is powering a market already worth over $420 million and growing fast.

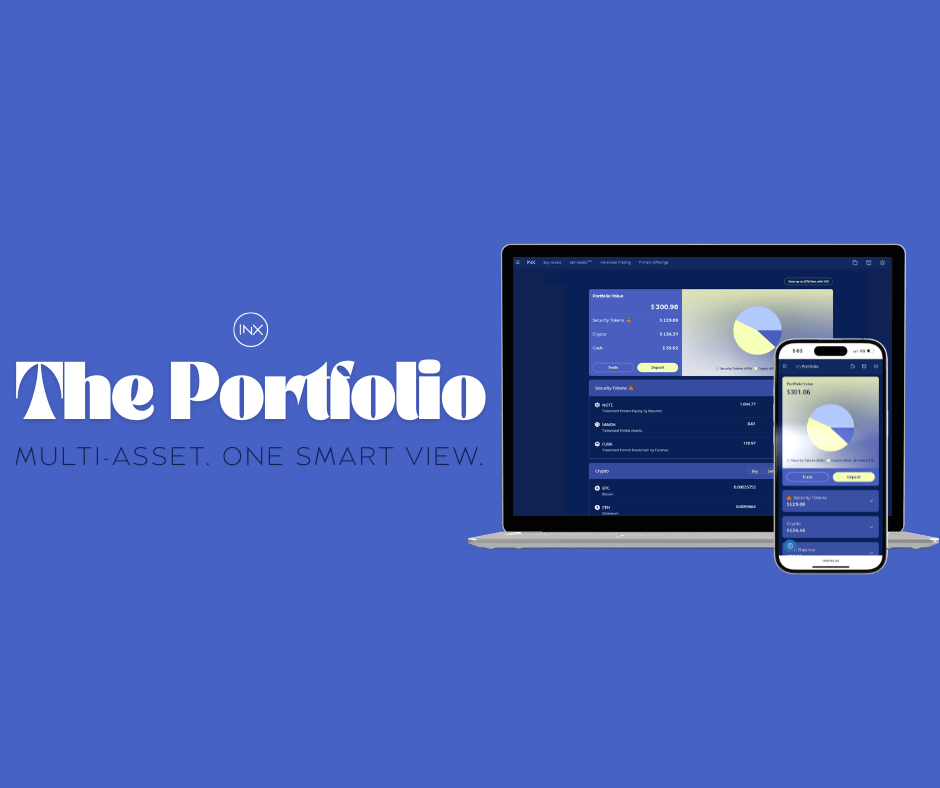

The New INX Portfolio.

Explore the INX Portfolio—a unified interface for managing crypto and tokenized real-world assets. Built for smarter diversification and real-time visibility across asset classes.