Earning yield on-chain used to feel like playing Russian roulette with your portfolio; 20% APY in a DeFi lending protocol? Hope it doesn’t get exploited in the next million-dollar hack or get rugpulled by a scam developers. It is not surprising that a lot of investors are opting for low-risk DeFi like tokenized treasuries that can assure stability and fund safety.

Tokenized treasury combines the safety of U.S. government debt assets with the accessibility and efficiency of blockchain infrastructure, creating the first genuinely low-risk yield option for on-chain investors. The market has exploded from under $100 million two years ago to over $8 billion in October 2025, growing over 256% year-over-year. BlackRock, Franklin Templeton, and Ondo Finance now manage billions in tokenized Treasury products that provide 4-5% yields backed by the U.S. government.

This guide explains how tokenized Treasuries work, why they represent the safest way to earn yield on-chain, and how investors can access them through regulated platforms in 2026.

What are Tokenized Treasuries?

Tokenized treasuries are an on-chain representation of government debt securities issued on a blockchain and backed 1:1 with a real Treasury bill managed by a regulated custodian.

A tokenized treasury correlates to an ownership interest in a short-term or long-term U.S. government debt. As such, they inherit the safety and security associated with debt instruments, which makes them one of the safest RWA assets.

Why Should You Care about Tokenized Treasuries?

Since these assets are backed 1:1 by real-world government treasuries, investors’ assets are always protected. As Keyrock’s research puts it, “Tokenized Treasuries bridge the gap between traditional fixed-income instruments and DeFi, allowing both institutional and retail investors to earn risk-free yield on-chain.”

Let’s not forget that Treasury bills are classified as some of the most stable instruments traditionally. Tokenized treasuries take that stability on-chain and add the benefits of tokenization and blockchain to it. Investors get 24/7 access to buy tokenized bills, global settlement, and transparent collateral verification through decentralized Oracles like Chainlink.

How do Tokenized Treasuries Work?

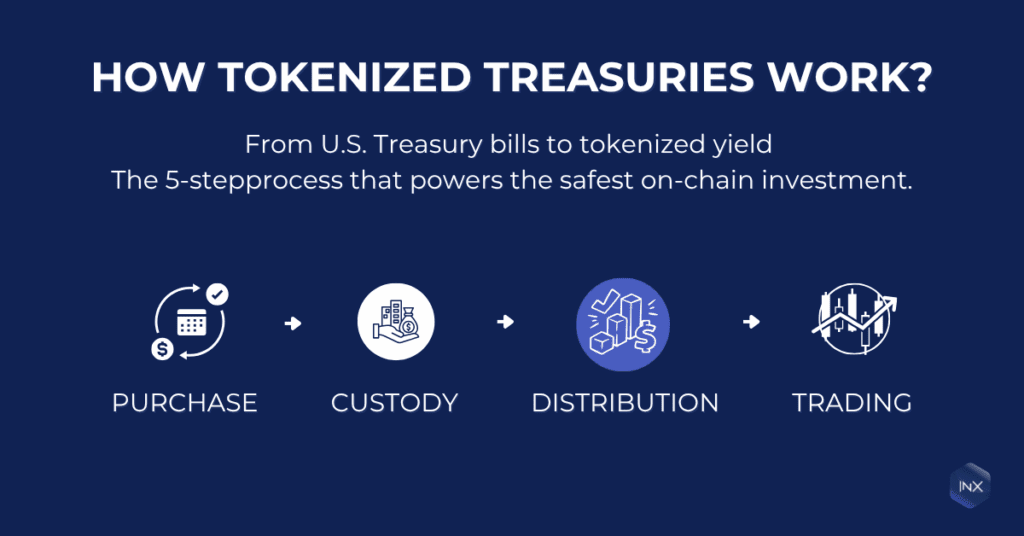

Most of the tokenized treasuries follow a similar process, which starts with a licensed issuer buying tokenized securities from the government. The issuer must hold the appropriate regulatory requirements that authorize them to operate in securities markets.

After securing the underlying Treasury bills, they are held with a qualified custodian under regulated conditions. The custodian ensures that customer assets are separate from the issuer’s operational funds, which protects token holders in case of any financial troubles.

When it is time to exit the open position, you get the option to redeem for fiat currency at maturity or to roll that matured position into new treasury instruments. The redemption varies per platform/issuer, but it usually involves token holders submitting/burning their

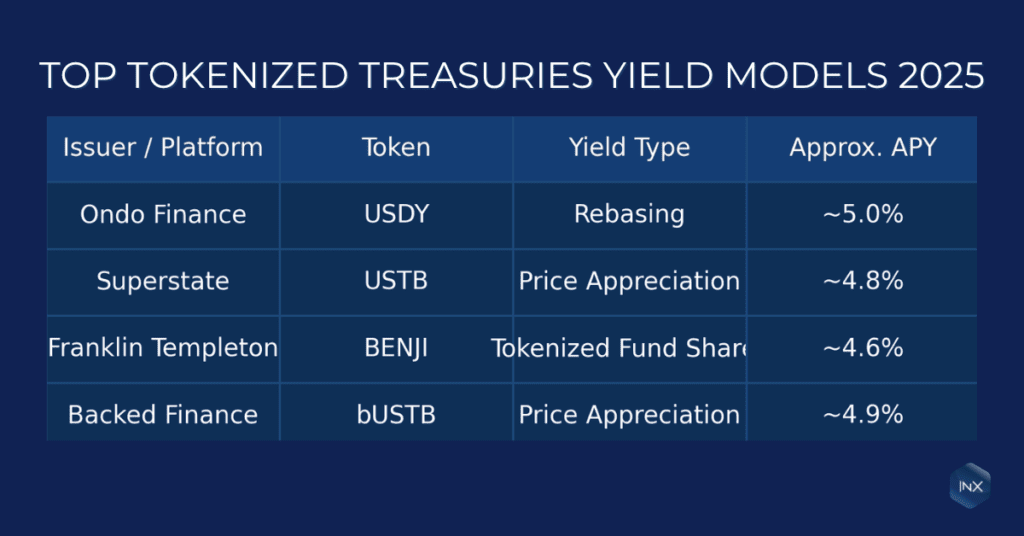

Yields for tokenized treasuries are distributed via two models: by rebasing interest or price appreciation. Rebasing yield automatically increases the holder’s balance to reflect the yield from the underlying assets. Price appreciation model increases the token values to reflect the interest of the Treasury Bill; some issuer takes it further and tokenize the interest itself.

An example of this is how Ondo Finance’s USDY offers approximately 5% annual yield through token rebasing. SuperState USTB, on the other hand, uses price appreciation with its token value increasing daily to reflect the yield. While Templeton BENJI tokenizes the fund shares (yield) to unlock further utility for the yield.

What You Should Know about Regulation for Tokenized Treasuries

One of the advantages of Tokenized Treasuries is the regulatory clarity around their issuance on-chain. Tokenized securities are duly recognized by regulatory bodies, and the U.S. Treasury Department, in its 2024 TBAC report, acknowledges that:

“Responsible tokenization of Treasury securities could expand participation in government debt markets while maintaining robust investor protections.”

These tokens represent real securities that are heavily regulated under the securities laws, and they offer this protection on-chain. To maintain this chain regulation, issuers and custodians of tokenized treasuries must operate under a regulation framework with SEC registration and can be traded on Alternative Trading Systems (ATS) platforms like INX.one.

How to Buy Tokenized Treasuries Safely Through INX

If you’re interested in tokenized treasuries, the most essential part is to choose a regulated and compliant platform that prioritizes compliance and investors’ protection. INX.one is a good choice, it provides that foundation as a SEC-registered exchange with both broker-dealer and Alternative Trading System (ATS) licenses. Here is a step-by-step

- Complete verification: Complete KYC/AML checks to ensure full regulatory compliance.

- Explore available assets: Browse tokenized Treasuries, equities, and yield-bearing funds transparently listed under INX’s broker-dealer and ATS licenses.

- Invest and monitor yield: Once you buy your treasuries, you can hold, trade or redeem your tokens from your wallet account. You get yield automatically based on the underlying Treasury performance, and your holdings remain visible and traceable on-chain.

FAQs (Frequently Asked Questions)

Are tokenized Treasuries safe?

Yes. Tokenized Treasuries are backed 1:1 by real U.S. Treasury bills held by regulated custodians. They combine the safety of government-backed debt with the transparency and efficiency of blockchain. As long as the issuer operates under proper regulatory oversight, tokenized Treasuries carry the same credit quality as the underlying U.S. government securities.

What kind of returns can I expect from tokenized Treasuries?

Yields vary based on the maturity and interest rate of the underlying Treasury bills. As of mid-2025, tokenized Treasuries typically offer between 4.5% – 5.2% annualized yield, comparable to traditional Treasury yields but accessible 24/7 on-chain.

How can I buy tokenized Treasuries?

Investors can purchase tokenized Treasuries through regulated platforms like INX.one after completing KYC and AML verification. The process is similar to buying any other digital security: browse available offerings, invest, and track your yield directly from your account dashboard.

Are tokenized Treasuries regulated?

Yes. These assets are recognized as securities and must comply with existing securities laws. In the U.S., tokenized Treasuries can be issued or traded only through SEC-registered broker-dealers or Alternative Trading Systems (ATS) such as INX.one.

Do I need to be an accredited investor to invest in tokenized treasuries?

Not necessarily. While some offerings are limited to accredited investors, most tokenized treasuries, especially those listed on regulated exchanges like INX.one, are open to qualified retail investors under SEC exemptions.