How To Leverage The 4 Pillars of Successful Tokenomics

Tokenomics, or token economics, is a crucial aspect of cryptocurrencies and blockchain projects. It’s the lifeblood of digital assets, shaping their economic policies and regulating their supply and demand. It’s a burgeoning field, one that’s quickly becoming indispensable in the rapidly-evolving world of blockchain technology. According to Statista, the blockchain industry is expected to grow 15x by 2027, and the proper design of tokenomics will contribute tremendously to this growth.

Why Must You Understand Tokenomics?

For investors, understanding tokenomics is like looking under the hood of a potential investment. It helps them evaluate the functionality, sustainability, and long-term potential of a crypto asset. It’s not just about the current price or hype, but rather about how well the economic structure of the token is designed and whether it’s conducive to long-term growth.

For entrepreneurs, designing the tokenomics of their blockchain projects is a crucial strategic decision. The token model they choose will significantly influence user behavior, resource allocation, and ultimately, the success or failure of the project. The tokenomics needs to incentivize the right actions to keep the network secure, users engaged, and the token’s value appreciating.

Furthermore, it’s essential for businesses and investors to consider regulatory implications when dealing with tokenomics. The rapidly evolving landscape of blockchain technology has led to increased scrutiny from regulatory bodies worldwide. Tokens that are deemed as securities might fall under specific regulatory obligations, which could impact everything from investor eligibility to exchange listing policies. Running afoul of these regulations could not only hamper growth but could disqualify the offering and lead to hefty penalties.

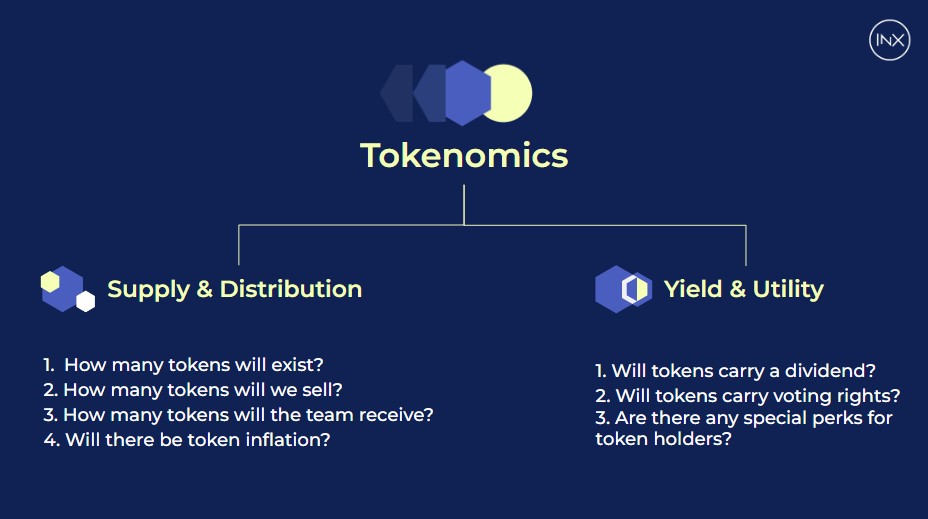

Mastering Essential Aspects of Tokenomics

In the realm of tokenomics, several core concepts define the underlying economic structure of a blockchain project. They dictate the behavior of a token, its distribution, its value proposition, and how it contributes to the ecosystem. Understanding these terms isn’t just jargon—it’s fundamental to navigating the world of blockchain. Let’s delve into some of these essential elements:

Token Offering: The concept of token offerings has evolved over the years. In the early days, Initial Coin Offerings (ICOs) were the main method for blockchain companies to raise funds. Companies would create a new token and offer it to investors, who typically purchased these tokens with established cryptocurrencies like Bitcoin or Ethereum. However, ICOs gained a poor compliance record over time due to lack of regulation, which led to numerous scams and ultimately, a decline in their popularity. Today, other forms of token offerings, such as Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), have emerged, which prioritize compliance and investor protection.

Staking: Staking is a key element in many blockchain networks, especially those using a Proof-of-Stake (PoS) consensus mechanism. It involves participants, known as validators, locking up a certain amount of their tokens as a form of ‘collateral.’ These staked tokens help maintain the network’s security, validate transactions, and earn the staker rewards, akin to interest.

DAO (Decentralized Autonomous Organizations): DAOs are organizations governed by smart contracts on the blockchain and owned by members who hold its tokens. Unlike traditional companies, there’s no centralized authority in a DAO. Token holders have the power to vote on proposals, effecting change and governing the DAO democratically.

Token Burns: A token burn is a strategy employed by some blockchain projects, where a certain number of tokens are intentionally destroyed or ‘burned.’ This reduces the overall supply and, assuming demand remains the same or increases, can lead to a rise in the token’s value. It’s a deflationary mechanism and a way for projects to manage token supply actively.

Mining: Mining is a fundamental aspect of many blockchain networks. In Proof-of-Work (PoW) systems like Bitcoin, miners use computational power to solve complex mathematical problems. The first miner to solve the problem gets to add a new block to the blockchain and is rewarded with a certain number of newly minted tokens. Mining not only results in the creation of new tokens but also provides security to the network by validating and recording transactions.

The 4 Pillars of Tokenomic Success

Creating a sustainable and successful token requires meticulous planning and strategic decision-making. One of the essential elements is designing robust tokenomics that align with both the project’s goals and regulatory compliance.

Notably, the following techniques—attaching equity to your token, providing dividends to token holders, and allowing token holders to vote—are hallmarks of a security token, a digital asset subject to securities regulations. Implementing these strategies requires navigating complex legal landscapes, but they can significantly increase the token’s appeal and value.

1. Attach Equity to Your Token: Equity-linked tokens are a powerful way to align the interests of the token holders and the success of the project. By attaching equity to your tokens, you’re providing token holders with a direct stake in the company or project’s success. This not only incentivizes the community to contribute to the project’s growth but also allows them to share in the profits. It adds a tangible, real-world value to the token, making it more attractive to potential investors.

2. Give Token Holders a Dividend: Much like traditional stocks, some tokens can also provide dividends to their holders. By distributing a portion of the profits back to the token holders, you can incentivize holding and demonstrate the token’s profitability. This can help stabilize your token’s price, as the promise of regular dividends can deter short-term selling.

3. Allow Token Holders to Vote: Decentralization and community involvement are some of the most appealing aspects of blockchain projects. By allowing token holders to vote on key decisions, you’re not only encouraging community participation but also fostering a sense of ownership among your token holders. This democratic approach can lead to more engaged and loyal token holders and create a system of checks and balances within the organization.

4. Create Gated Experiences for Token Holders: Offering exclusive benefits or experiences to your token holders can add extra utility to your token. This could range from access to premium features, early access to new products or services, exclusive events, and more. These gated experiences make holding your token more appealing and can help build a stronger, more dedicated community around your project.

Getting tokenomics right is critical to the success of any blockchain project. INX is leading the way in showing how these principles can be put into practice. If you’re considering tokenizing your business, visit our raise page to understand how INX can help guide you through this process. Embrace the future of finance with INX, where compliance meets blockchain technology

David Azaraf July 6, 2023

Crypto enthusiast, help businesses plug into the token economy