Tokenized Bonds: The Revolution in Investment You Can’t Ignore

Tokenized bonds are digital representations of traditional bonds, leveraging blockchain technology to transform the way we invest. They have been termed ‘the future of investment,’ and represent the mix of traditional bonds and blockchain technology

What makes tokenized bonds different? They offer liquidity, accessibility, security, and transparency. Unlike their paper counterparts, tokenized bonds can be traded seamlessly 24/7, making it potentially a highly liquid asset.

Tokenized Bonds – The Basics

The rise of central bank interest rates around the world and the collapse of yield farming on decentralized finance presents a unique opportunity for tokenized bonds. This is one financial revolution you simply cannot afford to ignore.

Tokenized bonds are a financial innovation that digitizes traditional bonds, transforming them into blockchain-based assets. Unlike conventional bonds issued on paper, tokenized bonds are represented as digital tokens, providing investors with greater flexibility, accessibility, and transparency. This concept enables the fractional ownership of bonds, making it possible for a broader range of investors to participate in the bond market.

How Tokenization Works? Converting Bonds into Digital Form

The process of tokenization involves the digital representation of bond assets on a blockchain network. This transformation typically includes the issuance of tokens that correspond to specific bond denominations, allowing for easy trading and transfer. Through smart contracts and distributed ledger technology, the bond’s terms and conditions are encoded, ensuring automated compliance and trust in transactions. Tokenization simplifies the transfer of ownership, streamlines settlement processes, and reduces administrative overhead, making it a key part of modern finance.

Tokenized Bonds vs. Traditional Bonds

Tokenized bonds differ significantly from their traditional counterparts. Unlike conventional bonds, which are often inconvenient and subject to geographical limitations, tokenized bonds have the capacity to be extremely liquid, accessible 24/7, and eliminate the need for middle parties.

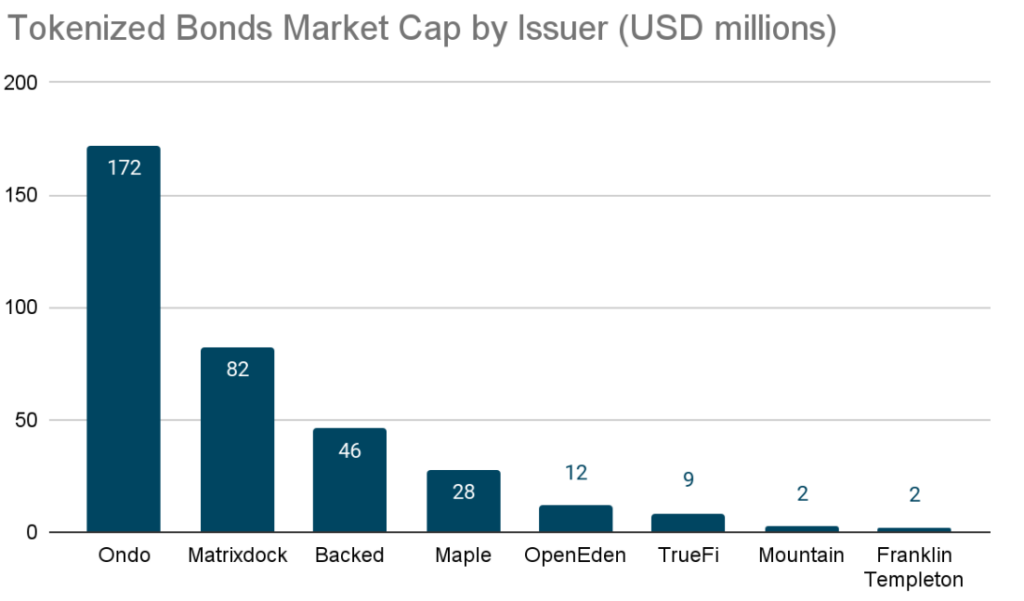

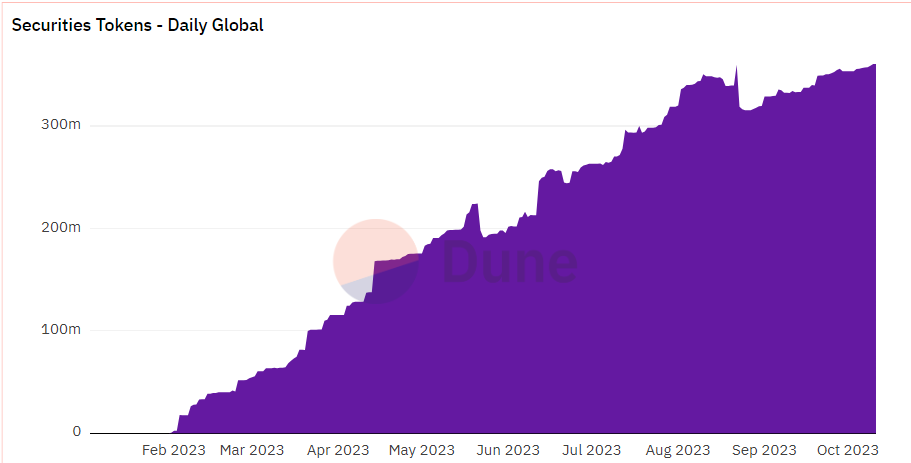

The rise in bond yields worldwide has led to a rush for tokenized bonds. US treasuries currently make up a significant portion of the tokenized bond market. Tokenized bonds generate a yield resembling the underlying assets, and can be used as collateral for loans.

Corporate organizations and projects have also embraced the benefits of tokenized bonds. For instance, the World Bank issued its first blockchain bond, demonstrating the viability of tokenized securities.

This showcases how tokenized bonds are gaining momentum and reshaping the traditional financial landscape, proving their value in the modern investment arena.

Advantages of Tokenized Bonds

- Enhanced Liquidity: Tokenized bonds introduce a new era of liquidity by allowing investors to buy and sell bonds at any hour of the day, seven days a week. This opportunity for increased liquidity can be likened to the convenience of trading stocks, ensuring that your investment is always available.

- Accessibility: Tokenization democratizes the bond market, enabling investors of all sizes to participate. Fractional ownership makes it possible to invest with smaller amounts, eliminating the barriers that traditionally limited access to the bond market, thus supporting a more diverse range of investors.

- Robust Security Measures: Tokenized bonds offer a fortified layer of security through blockchain technology. Blockchain cryptography ensures that transactions are tamper-proof. This minimizes the risk of fraud and counterfeiting, increasing the overall security of the investment.

- Transparency: Blockchain-driven transparency is a hallmark of tokenized bonds. Every transaction, from issuance to trading, is recorded on a public ledger. This builds trust and enables investors to access a wealth of information regarding the issuer, the bond’s history, and the market, ensuring a more informed investment decision.

Market Risks in Tokenized Bonds

Investing in tokenized bonds, like any financial venture, comes with inherent risks. Market volatility, liquidity fluctuations, and the potential for rapid price swings are key factors to consider. It’s essential for investors to remain vigilant and make informed decisions, keeping a close eye on the ever-changing market dynamics.

Also, the regulatory landscape for tokenized bonds is still evolving. It’s crucial to stay informed about regulatory updates and work with tokenization platforms that prioritize compliance for a smooth investment experience.

Tokenized Bonds and DeFi

The growing acceptance of tokenized bonds could see them surpass traditional bonds due to their enhanced liquidity and accessibility.

The relationship between tokenized bonds and decentralized finance (DeFi) is undeniable. Tokenization leverages the efficiency and transparency of blockchain, while DeFi platforms are increasingly integrating tokenized bonds to expand their offerings. This integration is poised to reshape the financial industry, providing investors with more diversified and inclusive investment options.

Tokenized Bonds – FAQ

What is the difference between tokenized bonds and traditional bonds?

Tokenized bonds are digital representations of traditional bonds, stored on blockchain technology, which provide opportunities for higher liquidity, accessibility, and transparency, enabling investors to trade them 24/7, whereas traditional bonds are paper or digital certificates with limited trading hours and less transparency.

Can I trade tokenized bonds 24/7?

Yes, you can trade tokenized bonds 24/7, thanks to their digital nature and the global reach of blockchain technology.

Are tokenized bonds suitable for first-time investors?

Tokenized bonds can be suitable for first-time investors due to their fractional ownership and lower investment thresholds, making them more accessible. However, it’s crucial to understand the risks and conduct due diligence.

Can I use tokenized bonds for retirement planning?

Tokenized bonds can be a part of retirement planning, offering diversification, and potentially enhanced returns. However, it’s important to consult with a financial advisor to ensure they align with your overall retirement strategy.

What is the future outlook for tokenized bonds?

The future of tokenized bonds appears promising, with growing acceptance and integration into the financial industry. These digital assets will continue to gain traction and potentially become the standard for bond investments due to their potential advantages in liquidity and accessibility.

The INX Digital Company INC October 19, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.