What is MEV: Decoding the Hidden Power Shaping Crypto Markets

In the world of cryptocurrencies, a hidden force silently wields immense power over the markets – Maximal Extractable Value (MEV). Behind the scenes, MEV plays a pivotal role in shaping the fate of digital assets, affecting traders, miners, and investors alike.

In this article, we unravel the workings of MEV, exposing the mechanisms that drive its influence on the crypto landscape. From decentralized finance to transaction order manipulation, MEV’s fingerprints are everywhere, making it crucial for anyone seeking success in crypto to comprehend its intricate workings.

What is MEV and how does it work?

Maximal Extractable Value (MEV) means the profit potential embedded within blockchain transactions. It arises from the ability of miners and traders to manipulate the order of transactions, thereby capitalizing on price differences and exploiting the vulnerable moments in the blockchain’s execution process. This stealth operation holds immense significance in the crypto ecosystem, as it can profoundly impact price volatility, liquidity, and overall market efficiency. By frontrunning or backrunning trades, clever participants in crypto transactions can sway market outcomes, giving rise to potential risks for traders and investors. Understanding MEV is paramount for navigating the intricate crypto landscape and safeguarding against unfair practices that could disrupt the integrity of decentralized networks.

MEV – Relationship between miners and traders

Miners and traders share a unique and intricate relationship in blockchain transactions. Miners, as blockchain validators, have the authority to prioritize and order transactions in a block. Traders, on the other hand, seek to exploit this transaction ordering to their advantage, capitalizing on arbitrage opportunities. The actions of miners directly impact the profit potential for traders, while traders’ strategies can incentivize miners to prioritize certain transactions over others. This interplay between miners and traders in the pursuit of MEV can significantly influence market dynamics and profitability within the crypto ecosystem.

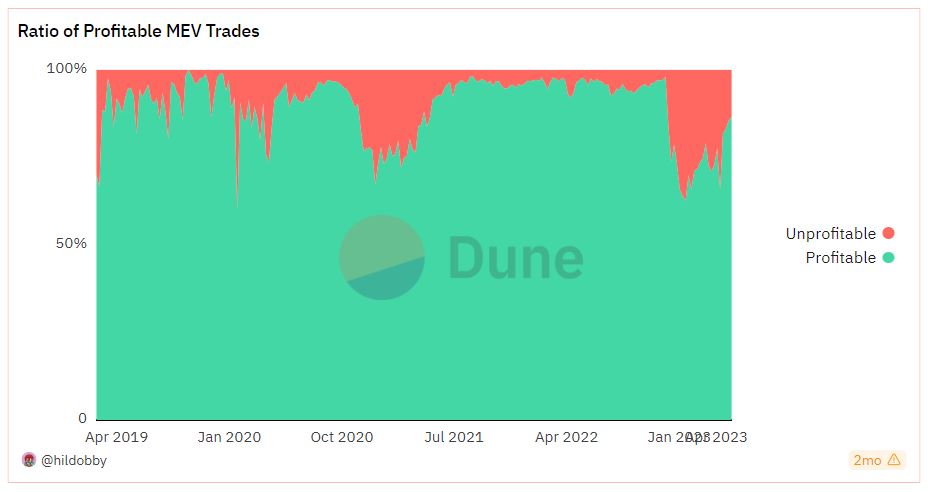

MEV trades have proven to be very profitable, as highlighted by the chart below.

Flash Crash highlighted the dangers of MEV

MEV has been exemplified through incidents like the “Flash Crash” of the popular decentralized exchange (DEX) Uniswap. In this scenario, a trader executed a large sell order, causing a significant price drop. However, before the trade was confirmed on the blockchain, an opportunist miner quickly executed multiple trades at the lower price, capitalizing on the momentary dip. Consequently, the initial seller received a reduced value for their assets, while the miner pocketed the price difference. This cunning manipulation showcased the potential impact of MEV on market participants and highlighted the need for diligence in the crypto trading landscape.

Smart contracts and transaction ordering in MEV

Looking at the broad scope of MEV, smart contracts act as gateways for potential profit extraction. The design and execution of these contracts dictate the sequence of transactions within a block. As miners prioritize transactions, they strategically select the order that maximizes their own gains, often at the expense of traders. This transaction ordering power enables miners to engage in front-running, back-running, and other MEV-related tactics, influencing the outcomes of trades and capitalizing on price differentials. The dynamics of smart contracts and transaction ordering form the foundation upon which MEV operates, shaping the profitability landscape in the crypto markets.

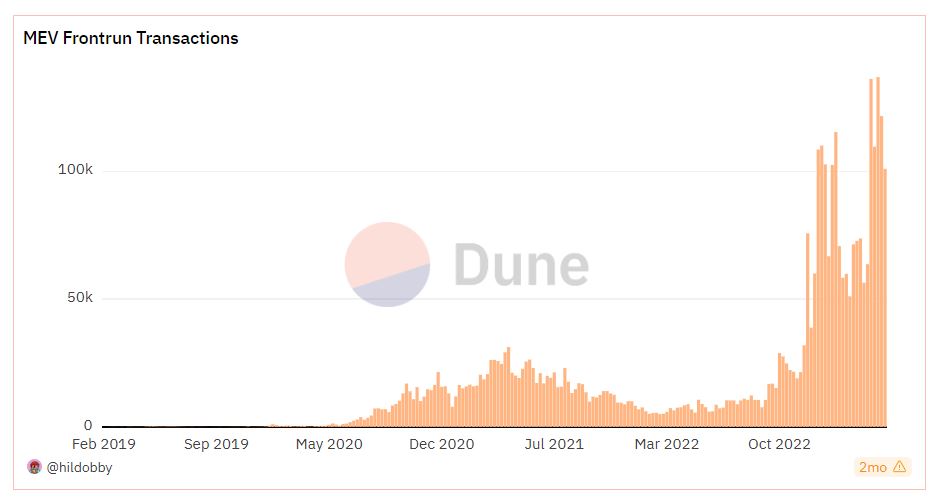

Data from Dune Analytics showed that MEV frontrun transactions have experienced a huge spike since November 2022.

MEV trading algorithms

MEV bots are sophisticated automated trading algorithms programmed to exploit Maximal Extractable Value opportunities in blockchain transactions. These bots continuously monitor the pending transactions pool, identifying sequences that offer potential profit. Once a profitable opportunity is detected, they swiftly execute their own transaction, taking advantage of price differences before other trades are confirmed. By leveraging speed and precision, MEV bots capitalize on the fast-paced nature of blockchain transactions, making them formidable players in the quest for lucrative gains within the crypto markets.

One example of an MEV trading algorithm is a frontrunning bot. This bot can detect an upcoming large buy order by a crypto wallet for a specific cryptocurrency and strategically place its own buy order just ahead of it. As the original order is executed, the bot can sell its purchased assets at a slightly higher price, profiting from the price increase caused by the initial buy order.

Impact of MEV on price volatility and liquidity

MEV’s influence on price volatility and liquidity is multi-dimensional. The tactics employed by traders and miners through MEV can heighten market volatility, leading to sudden price fluctuations. Moreover, the potential for large profits in MEV-related activities can incentivize traders to prioritize specific trades over others, affecting liquidity dynamics and potentially causing market imbalances. As a result, understanding and addressing the impact of MEV becomes crucial for maintaining stability and fostering a healthy trading environment within the crypto markets.

MEV’s impact on the efficiency and fairness of crypto markets is a contentious issue. While it offers opportunities for profit and liquidity, it can also lead to unfair advantages and market distortions. The prioritization of transactions based on profitability can create an uneven playing field, disadvantaging regular traders. Also, excessive MEV extraction may hamper the overall efficiency of the blockchain, resulting in delayed transactions and higher fees. Striking a balance between profit-seeking activities and maintaining a level playing field is essential to foster a fair and efficient crypto market ecosystem.

Risks and benefits of MEV for traders and investors

The world of MEV presents both enticing benefits and potential risks for traders and investors. On one hand, savvy traders can capitalize on lucrative arbitrage opportunities and profit from timely transactions. Increased liquidity from MEV-related activities can also enhance market dynamics.

On the other hand, MEV enables frontrunning and unfair practices that could lead to substantial losses for uninformed traders. Additionally, excessive MEV extraction might lead to reduced transactional privacy and vulnerability to manipulative behaviors. Understanding these risks and benefits is crucial for traders and investors seeking to navigate the crypto market landscape wisely.

FAQ

What is MEV?

MEV stands for Maximal Extractable Value and represents the potential profit miners can extract by manipulating the order of transactions in a block, impacting cryptocurrency prices and traders’ profits.

How does MEV impact cryptocurrency prices?

MEV can lead to increased price volatility due to transaction manipulation by miners and traders. Sudden price fluctuations may occur as a result of exploitative practices, affecting overall market sentiment and investment decisions.

What are the types of MEV attacks?

The common types of MEV attacks include frontrunning, where traders exploit time-sensitive information to execute transactions ahead of others, and backrunning, where traders capitalize on the execution of others’ transactions to their advantage.

How do MEV bots work?

MEV bots are automated trading algorithms designed to detect and capitalize on profitable opportunities resulting from transaction sequencing in blockchain blocks. They monitor pending transactions and quickly submit their own transactions to optimize profits.

How do you prevent MEV attacks?

Preventing MEV attacks involves implementing measures such as fair ordering mechanisms in blockchains, like Ethereum’s EIP-1559, which reduces the incentive for miners to prioritize transactions based on profit. Additionally, decentralized exchanges can adopt certain protocols to minimize frontrunning risks.

The INX Digital Company INC August 8, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.