What Is the Future of Bitcoin? Latest Forecasts from the Experts (Updated 2023)

What are the expectations for the future of Bitcoin? Do knowledgeable people think there is a future for Bitcoin? In terms of value, what can people expect from the value of this cryptocurrency to be in the future? Holders of digital assets and investors are keen on Bitcoin price forecasts.

Bitcoin is the giant of the financial cryptocurrency market. Many people continue to speculate about this specific digital currency’s future, making the central banks and fiat financial markets pause and take further notice.

The History of Bitcoin: From A Cypherpunk Experiment to an Emerging Reserve Asset”

The journey of Bitcoin is nothing short of extraordinary. It has weathered storms, soaring highs, and crushing lows, and yet has emerged as a financial phenomenon that has captured the world’s imagination.

In the early years, Bitcoin was predominantly associated with cryptographers interested in e-money experiments. The first time Bitcoin was priced in dollars was when Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin.

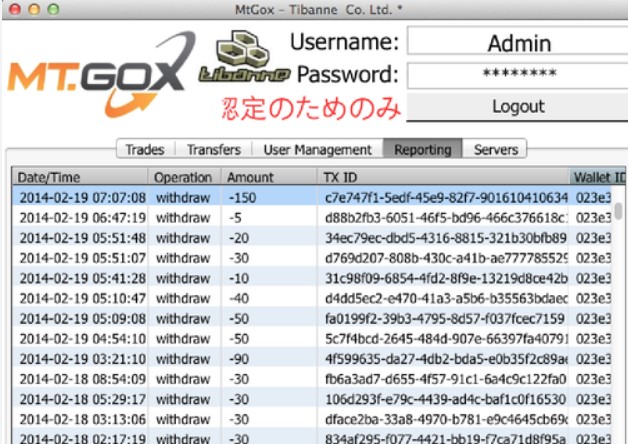

The advent of Bitcoin exchanges marked a significant shift in the evolution of this digital currency. Suddenly, Bitcoin wasn’t just a tool for cryptographers or a novelty used for purchases like Hanyecz’s infamous pizza transaction. With the creation of exchanges, Bitcoin gained a market value, and a new era of digital finance was ushered in. The first Bitcoin exchange, BitcoinMarket.com, opened in March 2010, and for the first time, Bitcoin had a listed exchange rate against the US dollar. At the time, the price was as low as $0.003. Other exchanges like Mt. Gox would emerge, and the price of Bitcoin peaked at $28 in 2011 before dropping back down to $2.

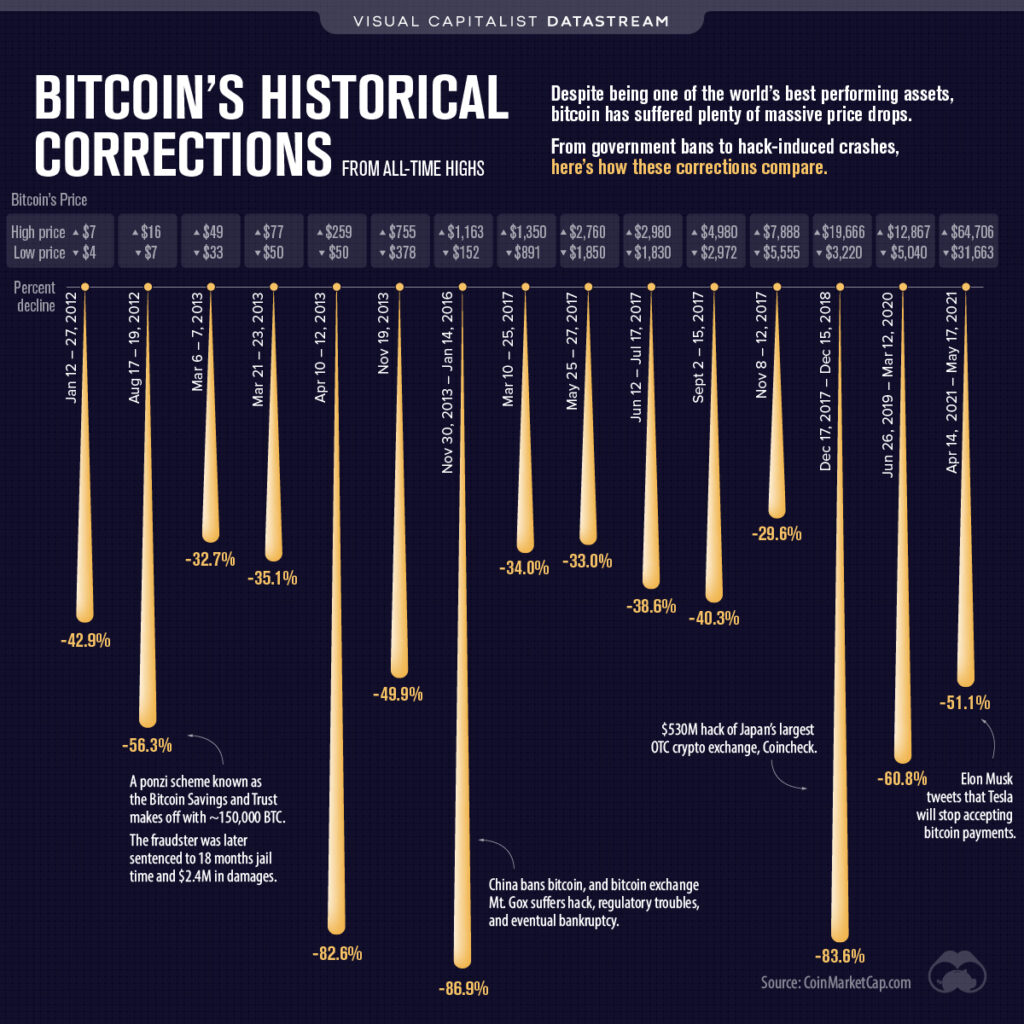

Bitcoin’s journey took a turn in 2011 when it gained wider recognition, albeit also an association with illicit activities. Then, in 2012, the first Bitcoin ‘halving’ event occurred, reducing the rate of Bitcoin creation. This, coupled with growing interest, led to a price increase, crossing the $100 mark for the first time in April 2013.

A surge in October 2013 saw Bitcoin’s price rise to over $200, and by November, it had exceeded $1,000 on some exchanges, largely due to increased adoption and speculative trading. By year-end, Bitcoin was solidly recognized as a traded asset with immense growth potential, despite its volatile journey.

After the meteoric rise to over $1,000 in late 2013, Bitcoin faced a significant downturn. This was partly due to regulatory concerns and the infamous Mt. Gox exchange hack. By early 2015, Bitcoin’s price had fallen to around $200, leaving many to question the future of the cryptocurrency. In 2016, Bitcoin’s second ‘halving’ occurred, further limiting the supply of new coins and providing upward pressure on the price. Throughout 2017, Bitcoin experienced unprecedented growth, with its price hitting $1,000 in January before catapulting to nearly $20,000 by December. This rise was fueled by a surge in interest from retail and institutional investors alike, with Bitcoin increasingly viewed as a potential hedge against traditional financial instability and a store of value.

Bitcoin chart by TradingView

2018 saw Bitcoin’s price take a sharp downturn, dropping from a peak of nearly $20,000 to around $3,200 by the end of the year. The crash was devastating as many individuals lost approximately 85% or more of the capital they invested into Bitcoin. 2019 brought a partial recovery, with Bitcoin’s price climbing back up to around $10,000. Then came 2020, a pivotal year for Bitcoin marked by the third ‘halving’ event in May. This halving reduced the block reward from 12.5 to 6.25 Bitcoin, further decreasing the supply of new coins.

Alongside this technical event, global macroeconomic factors began to play a major role. The COVID-19 pandemic and subsequent monetary policies caused a broad economic downturn, prompting investors to seek alternative stores of value. As a result, Bitcoin started to gain recognition as “digital gold,” a safe-haven asset in times of economic uncertainty.

In 2021, institutional adoption of Bitcoin accelerated. Corporate treasuries, such as MicroStrategy and Tesla, began adding Bitcoin to their balance sheets. Major payment platforms like PayPal also started supporting Bitcoin, further boosting its legitimacy and ease of use for everyday transactions. The culmination of these factors led to an unprecedented bull run, propelling Bitcoin to a new all-time high of over $64,000 in April 2021.

Following the 2021 peak, Bitcoin experienced another period of price correction, reiterating its notorious volatility. However, Bitcoin’s maturing infrastructure and growing institutional acceptance underlined its staying power. Amid ongoing global economic uncertainties, Bitcoin increasingly served as a hedge, further solidifying its status as “digital gold.” By 2023, Bitcoin’s price saw significant fluctuation, but its underlying technology, community, and vision remained unwavering.

The price of Bitcoin remains highly volatile, but many industry professionals continue to have high hopes for this cryptocurrency. With a brief understanding of the history of Bitcoin, it’s time to look at its prospects. What can people expect from the crypto economy in 2024? Various industry professionals have given predictions of the future movement of Bitcoin based on their market experience.

How Many Bitcoins Will There Be in 2030?

As of now, there are approximately 19.4 million Bitcoins in circulation, with only 2.6 million left to be mined. By 2030, we would have gone through the 2024 and 2028 halving events. Consequently, the reward for mining each block will drop to just 1.5625 bitcoin per block, or 82,125 per year. At this rate, by June 2030 there will be 20.7 million bitcoin in circulation. By that point, the inflation rate of Bitcoin will be a measly 0.3% a year.

No discussion about the future of Bitcoin is complete without a dive into the scarcity of Bitcoin, a key feature designed to mimic the finite supply of gold. Bitcoin halvings, which occur approximately every four years, reduce the rate at which new Bitcoins are created. This decrease in supply will significantly affect Bitcoin’s yearly issuance and demand.

Bitcoin Predictions 2030: What The Experts Say About This Decade

Providing a thorough analysis of Bitcoin based on estimates is a challenging game to play. With the extreme volatility and uncertainty, no one, not even an “expert,” can provide specific and accurate forecasts about the future of Bitcoin. However, some professionals do have a slight ability to predict positive growth trends.

Here’s a list of leading experts and their predictions for the future of Bitcoin:

- Bobby Lee – The first exchange (BTC China) CEO in China, Bobby Lee believes Bitcoin can reach $1,000,000 in 20 years. His other predictions include the coin amounting to $330,000 in 2021 and falling to $41,000 in 2023. Lee’s predictions proved to be correct for 2020; hence, you may want to take note of what he has to say.

- Anthony Pompliano – This respected and well-known crypto enthusiast predicts a price of $100,000 in 2021. Pompliano is the founder of Morgan Creek Digital, a user-friendly, cryptocurrency asset management organization.

- Mark Yusko – This former Bitcoin skeptic now predicts a $500,000 price for the digital coin in 2030. Yusko also stated that he believes Bitcoin can reach gold equivalence in the years to come.

- John Pfeffer – The Pfeffer Capital partner predicts a price of $700,000 in 2030, which he backs up with mathematical calculations.

- Citibank – This 2021 prognosis, from the American multinational financial services corporation and investment bank, sees Bitcoin reaching $120,000 in 2021. Like many other professionals, they are positive about what Bitcoin has to offer in the future.

- Philip Swift – While Swift believes that this currency is an early asset with a high number of associated risks, he has Bitcoin forecasts between the range of $92,000 and $137,000 in 2023. Additionally, Philip based his prediction on previous cycles that have played out in the crypto market regarding this popular coin.

Is There a Possibility of Bitcoin Disappearing?

Most likely, you do not have to worry about the disappearance of Bitcoin. Future price predictions are promising, and it is an established network that stays in place as long as investors utilize the platform. The only chance of this network disappearing is if every miner stopped transacting via the system, which is highly unlikely considering the Bitcoin price forecasts. People have invested billions of dollars in the infrastructure of Bitcoin, so it appears it is here to stay.

However, that being said, one risk potential investors should note is even though the system would not disappear, the value of cryptocurrency could fall to zero at any point in the Bitcoin cash future, meaning it could potentially be worthless one day, like many other volatile financial products.

Is Bitcoin The Future?

Is Bitcoin the future? As you have seen, the estimated prices and predictions for the future of Bitcoin from a cross-section of the industry appear very bullish. While we cannot specifically say what the years ahead may offer regarding this cryptocurrency, one thing is becoming more and more certain – the crypto market and blockchain technology have the potential to redefine financial products as we know them in the near future.

People may save, earn, engage, and spend in Bitcoin trading at their own free will. Advanced developments and applications are already being created and implemented to make this even more accessible. Here’s to agreeing that Bitcoin looks like the future!

If you want to buy Bitcoin quickly and safely, sign up for INX.One here.

David Azaraf May 11, 2022

Crypto enthusiast, help businesses plug into the token economy