A Beginner’s Guide to Understanding Wrapped BTC (wBTC)

Meta description: Wrapped Bitcoin is a tokenized representation of Bitcoin that is compatible with the Ethereum blockchain. It is pegged 1:1 to Bitcoin and operates like a type of bridge that connects the Bitcoin blockchain to Ethereum.

Wrapped Bitcoin is one of the interoperability hacks that lets Bitcoin transactions run seamlessly on the Ethereum network. It accurately mirrors the value of Bitcoin (BTC) directly on Ethereum and facilitates the use of Bitcoin within the Ethereum ecosystem.

In this guide, we explore what exactly is wrapped Bitcoin (wBTC), how it works, and why it matters to you as a crypto investor.

What is Wrapped Bitcoin?

A wrapped Bitcoin token is a representation of Bitcoin on another blockchain like Ethereum pegged to Bitcoin (BTC) at 1:1, meaning that 1 wrapped Bitcoin token equals 1 BTC. Wrapped Bitcoin tokens maintain a 1:1 value peg with Bitcoin through tokenization. They are referred to as “wrapped” because the original asset is put in a wrapper or kind of digital vault to be created on another blockchain. For example, wBTC, a type of wrapped Bitcoin on Ethereum, is ‘wrapped’ into the ERC-20 token format.

Wrapped cryptocurrencies are an innovative way to solve some of the interoperability challenges in DeFi. Creating a representation of crypto assets like Bitcoin (BTC) on another blockchain makes it possible to use the crypto asset on that blockchain. Since they are usually in ERC-20 or other smart contract token forms, it is possible to use them within the DeFi ecosystem.

The most popular example of wrapped Bitcoin tokens is the wBTC token launched in January 2019, jointly created by BitGo, Kyber, and Ren. wBTC is the first ERC-20 token backed by Bitcoin; the project is overseen by the WBTC DAO (Decentralized Autonomous organization).

What are Wrapped Bitcoin Tokens Used for?

In a way, wrapped Bitcoin tokens act like a bridge between the Bitcoin blockchain and the Ethereum ecosystem. For example, WBTC standardizes Bitcoin to ERC-20 format on Ethereum and makes it easier to integrate Bitcoin transfer in smart contracts. This way, Bitcoin users can access the DeFi ecosystem and use dApps (decentralized applications). It also makes it possible to use wBTC as collateral to borrow on some DeFi lending protocols.

Furthermore, the Ethereum ecosystem gets additional liquidity by making it possible to use Bitcoin for token trades. As Bitcoin currently holds the largest market cap, its access to more market value increases liquidity on Ethereum.

Lastly, it is easier for exchanges and wallets to support multiple currencies on one blockchain with wrapped cryptocurrencies.

How Does Wrapped Bitcoin (wBTC) Work?

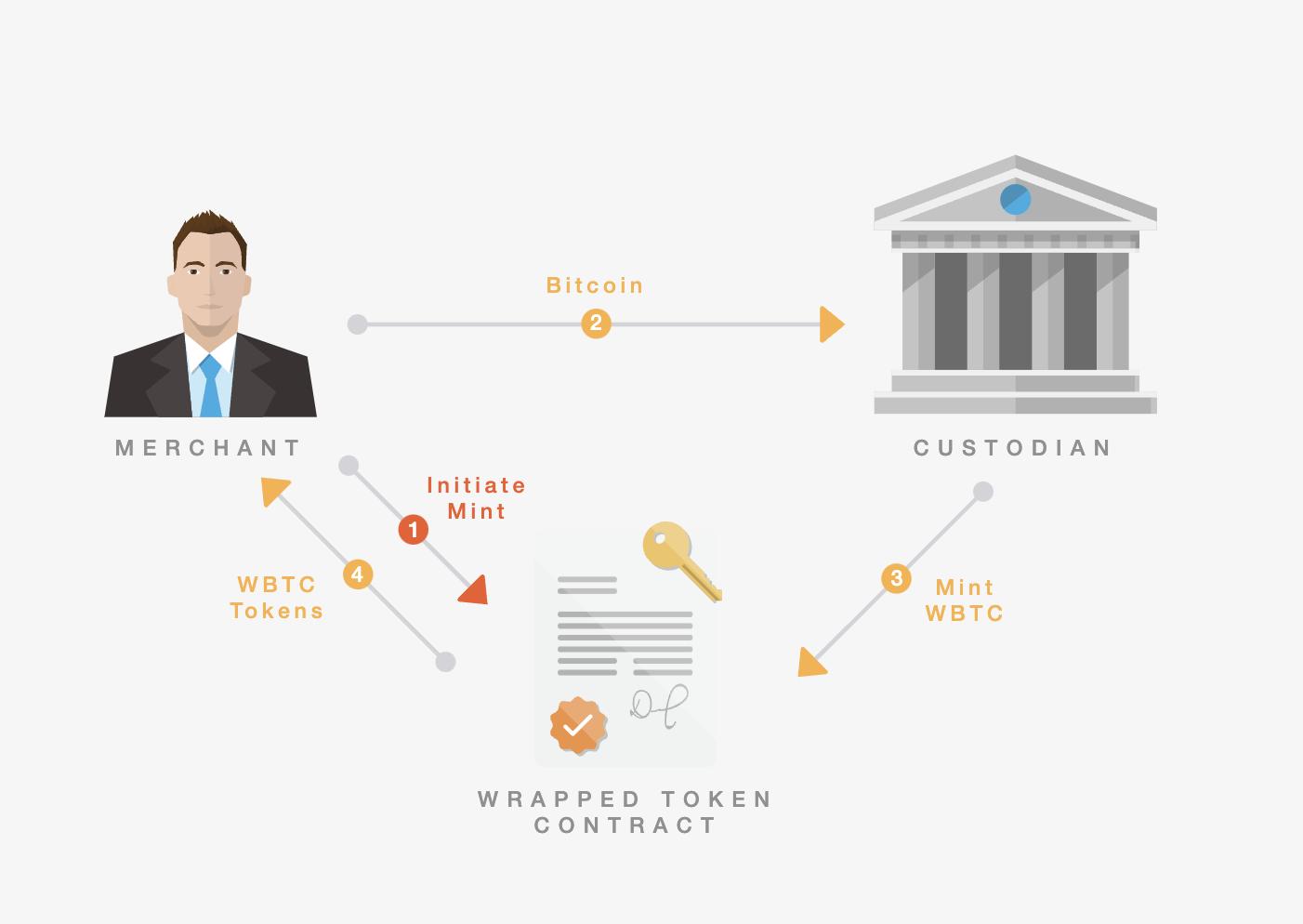

The operation of wBTC depends mainly on three entities: Custodians, Merchants, and the wBTC DAO.

- The Custodian is in charge of minting new wBTC and securing the Bitcoin reserve. It ensures all the wBTC are fully backed and verified with an on-chain proof-of-reserve.

- Merchants request wBTC from custodians and distribute it to users; they also destroy excess wBTC. Merchants are also in charge of transferring BTC to the custodian during the minting process.

- The wBTC DAO controls the addition and removal of merchants and custodial for wBTC. In addition, the keys to the multi-sig wallet are held by the DAO members. The DAO is made up of 17 members from the DeFi

New wBTC tokens are created through a minting process initiated by a merchant but carried out by the custodian. BitGo is currently the only custodian in charge of minting new wBTC tokens and keeping the Bitcoin reserve safe.

Source: wBTCNetwork

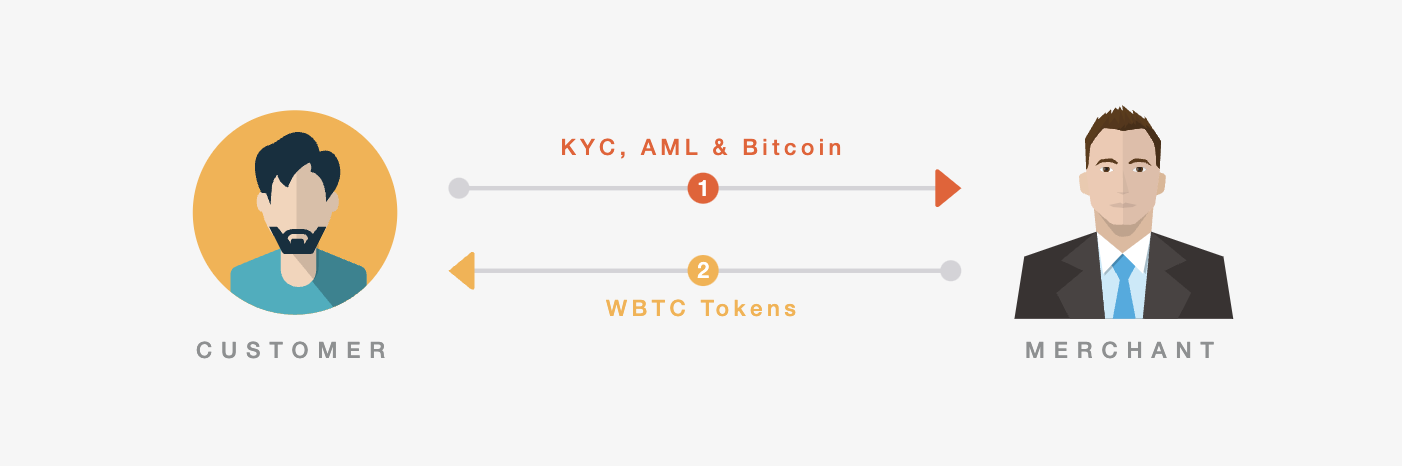

To receive wBTC, a user has to request from a merchant like Aave, Airswap, Maker, Coinlist, or 0x. The merchant will carry out all the necessary KYC/AML requirements to verify the user’s identity. After the initial verification, the users deposit BTC to swap for wBTC, which the merchant sends to the user.

Source: wBTCNetwork

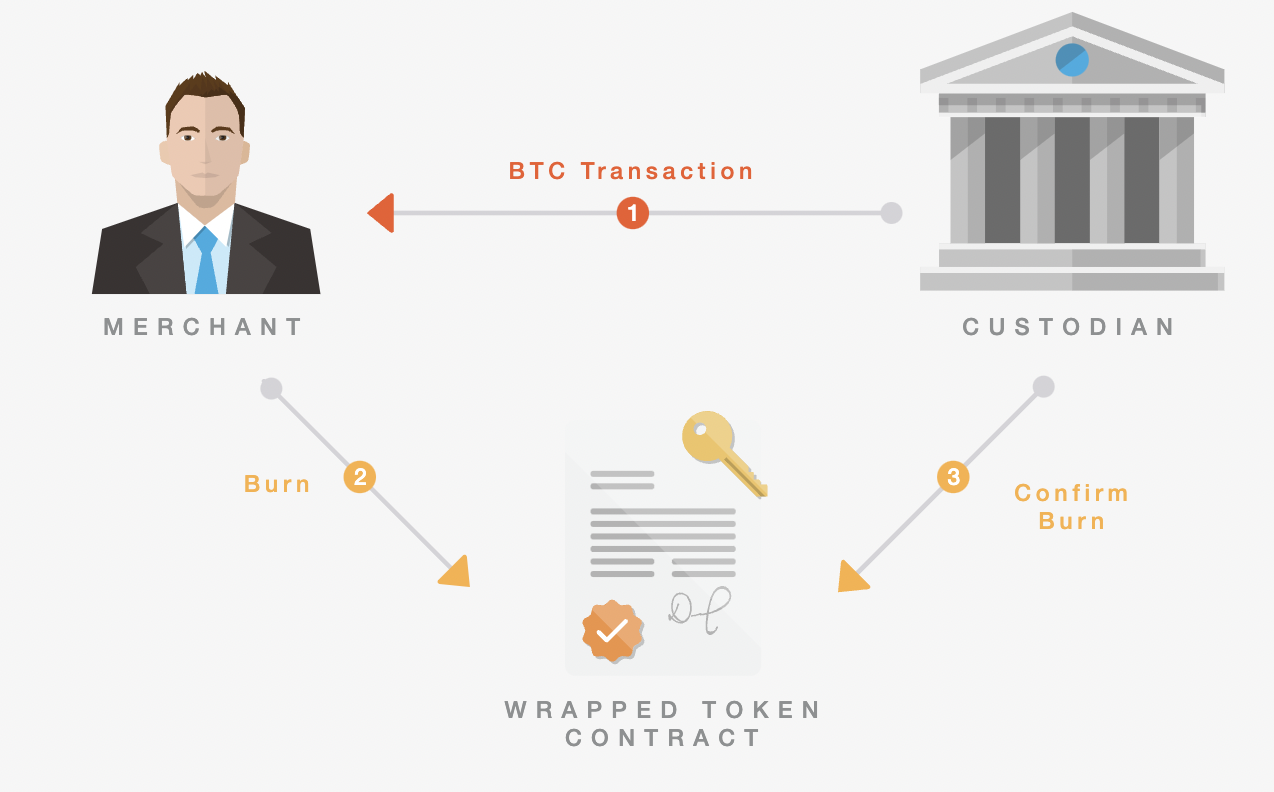

The last stage of a wBTC cycle is burning, which refers to the redeeming process for BTC. To redeem their wBTC for BTC, the user deposits their wBTC to a merchant and gets BTC in return. Burning can only occur through merchant’s addresses.

The merchant requests BTC from the custodian, and an equivalent of wBTC is burnt by deducting from the merchant’s wBTC balance on-chain. This way, the supply of wBTC is reduced, and the proof-of-reserve is balanced.

Source: wBTCNetwork

Wrapped Bitcoin (wBTC) vs. Bitcoin: What are the differences?

While Wrapped Bitcoin (wBTC) and Bitcoin are connected directly, they serve different functions and operate on different blockchains. Here are the significant differences between wBTC and BTC:

- Blockchain Network: Bitcoin (BTC) operates on its own blockchain network – Bitcoin – which is designed primarily for peer-to-peer transactions and is known for its decentralized nature and security. wBTC, on the other hand, is an ERC-20 standard token on the Ethereum blockchain, which makes it compatible with smart contracts and allows it to function in the DeFi ecosystem.

- Function and Use Case: Bitcoin (BTC) is primarily used as a digital currency for transactions and as a store of value. Its functionality may sometimes be limited because of the nature of the Bitcoin blockchain. While wBTC offers all the features of an ERC-20 token, it is smart contract compatible, making it possible to use it for DeFi functions like borrowing, stacking, and yield farming

- Interoperability: BTC use is limited to its blockchain, which restricts its direct involvement in smart contracts and other blockchains outside of its network. wBTC is highly interoperable within the Ethereum ecosystem, allowing seamless integration with smart contracts and DeFi protocols.

- Custodianship and Trust: BTC transactions are fully trustless and decentralized, relying on the Proof-of-Work (PoW) consensus mechanisms of the Bitcoin blockchain. While wBTC adopts a custodian model to maintain the 1:1 peg of wBTC to BTC. in this case, a trusted custodian holds the actual BTC and mints wBTC. This introduces a layer of centralization to the wBTC model.

Is Wrapped Bitcoin (wBTC) Safe?

Wrapped Bitcoin (WBTC) is generally considered safe from a technical perspective as it is backed by Bitcoin and operates on secure platforms like Ethereum or Binance Smart Chain.

The only concern with wBTC is the need to trust the custodian to maintain the wBTC value; this introduces a centralization factor. However, the project is managed by a DAO, which can vote to remove or add the custodian and merchants. The wBTC wallet is a multi-sig wallet with keys held by the DAO members.

Are there other Types of Wrapped Bitcoin Tokens?

Yes, while wBTC is the largest wrapped Bitcoin token, there are several other wrapped Bitcoin tokens.

HBTC (Huobi Bitcoin) was launched in 2020 by Huobi Global. Unlike wBTC, you can get HBTC directly by depositing BTC into your Huobi Global Exchange account without going through any merchant. To redeem your BTC, you just withdraw from the account.

RenBTC is another popular wrapped Bitcoin token, it was launched in 2020 as a more decentralized alternative to wBTC and HBTC. RenBTC uses a smart contract for the minting and burning process. To get RenBTC, you send BTC to Ren Protocol which locks it up in the smart contract. The protocol then verifies the transaction details before returning a minting signature that lets you mint renBTC.

Other examples of wrapped Bitcoin include BoringDAO’s oBTC, Keep Network’s tBTC, Synthetix’s sBTC, and Tokenlon’s imBTC.

What can You do with wBTC?

There are several ways to utilize wBTC tokens to earn profit, in fact, it offers more ways to earn than BTC. As a ERC-20 token, wBTC is compatible with DeFi protocols and smart contracts and is used widely in DeFi lending. Borrowers can collaterize/secure with wBTC on most lending platforms. You can also stake their wBTC in a lending pool to earn interest on most DeFi protocol

Staking wBTC on some protocols also qualifies you to earn governance tokens that let you vote on the protocol’s decisions. For example, when you stake wBTC on Compound, you receive $COMP, the native token of Compound which allows you to vote on things like staking model and protocol upgrades.

Another way you can earn with wBTC is through monthly dividend payment when you invest in certain security tokens through security token offering. For example, the Hashrate Asset Group pays out monthly wBTC dividends to their investors.

Introducing Hashrate Asset Group: Monthly WBTC Dividend Payment

Hashrate Asset Group (HAG) is the world’s first US-regulated security token that focuses on Bitcoin mining and paying out monthly dividends. HAG has built the world’s first sustainable, compliant and transparent Bitcoin standard arithmetic operating model with a mining farm located in the United States and managed by top industry experts.

The HAG tokens allow you to tap into this ecosystem and have an opportunity to receive real-time rewards on your investments. You get the opportunity to own an investment in an industry previously inaccessible and also receive a share of mined bitcoin directly into your digital wallets monthly in the form of wBTC. The tokens are available for sale on INX.one, a regulated platform for cryptocurrencies and security tokens.

FAQs

- How does Wrapped Bitcoin maintain its value with Bitcoin?

WBTC maintains a 1:1 value ratio with Bitcoin. For each WBTC, there is an equivalent amount of Bitcoin held by custodians, ensuring that the value of WBTC is pegged to that of Bitcoin.

- Where can I Buy WBTC?

You can buy WBTC on several crypto exchanges, both CEXs and DEXs, that support ERC-20 tokens since wBTC operates on the Ethereum blockchain.

- Can I convert my wBTC back to Bitcoin?

Yes, WBTC can be converted back to Bitcoin. The process typically involves sending WBTC to a custodian or smart contract, which then unlocks and releases the equivalent amount of Bitcoin.

- How can I store my wBTC?

WBTC should be stored in a wallet that supports ERC-20 tokens. It is recommended that you use a hardware wallet for significant holdings for added security.

- Are there any fees associated with converting Bitcoin to WBTC?

Converting Bitcoin to WBTC may involve transaction fees, depending on the platform used for the conversion. Therefore, It’s important to review the fee structure of your chosen platform.

The INX Digital Company INC March 4, 2024

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.