Barter, Banknotes and Bitcoin: Exploring the Rich History of Money

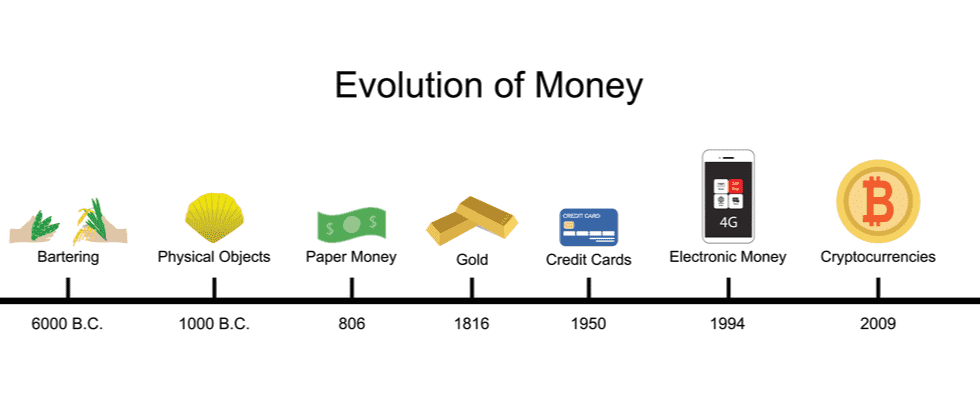

In the ever-changing world of finance, it is easy to forget the history that drives our understanding of money. From the humble beginnings of barter systems to the new wave of Bitcoin, the history of money is an interesting journey through human innovation and economic transformation.

Research shows that the first piece of recognized currency was the Mesopotamian Shekel which dates back over 5,000 years. Centuries later, paper money now popularly called the banknote emerged from the sands of China, birthing a new era in global trade. Today, cryptocurrencies like Bitcoin and Ethereum stand as the latest innovations in how we view and use money, challenging the very essence of traditional currencies.

Earliest Forms of Money

Taking a journey back in time, the earliest forms of money were made from cowrie shells, beads, and metal coins. These early forms of money cut across different people and civilizations. For instance, cowrie shells served as both currency and symbols of wealth in Africa, Asia, and the Indian region for years. Beads also held the same value in native American tribes.

As societies advanced, metal coins were developed from precious metals such as gold, silver, and copper. This laid the foundation for the monetary systems currently in use which has helped to simplify trade and promote economic growth.

The Birth of Paper Money

The entrance of paper money marked a unique moment in the world of finance. Chinese merchants in ancient China used promissory notes as a form of currency, before moving to government-issued paper money, which offered key advantages over metal coins.

Paper money’s advantages were evident – it was lightweight, easily transportable, and could be standardized in denominations. In today’s financial systems, central banks play a major role in issuing and regulating paper money. These institutions ensure the credibility of currency by backing it with reserves of precious metals or government bonds, instilling public trust in the fiat money system.

The Rise of Digital Payments

The shift from physical to digital transactions reshaped the very essence of money. The introduction of electronic payment systems such as credit and debit cards brought an era of ease and efficiency.

Credit cards offered instant access to funds and financial flexibility. On the other hand, debit cards simplified daily transactions and removed the need for physical cash.

Electronic payment systems like PayPal and digital wallets allow people to conduct transactions with just a few taps on a smartphone. This has removed land boundaries and redefined how we use and store money. Yet, money is taking another form with the birth of cryptocurrencies.

Bitcoin’s Entry

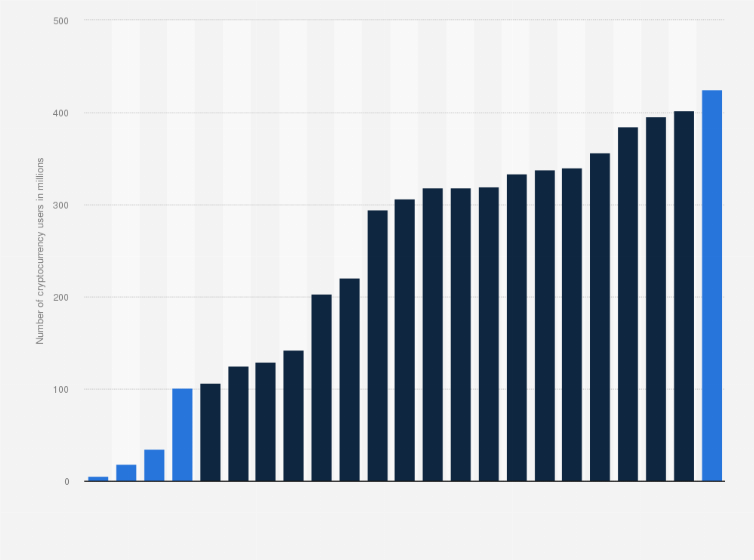

In 2009, an unknown individual/group with an online nickname called Satoshi Nakamoto unveiled Bitcoin, a digital currency that brought a new meaning to money. Nakamoto’s creation was more than just a new form of money; it was a concept that challenged traditional financial systems.

At the heart of Bitcoin’s innovation lies blockchain technology, a decentralized and transparent ledger that records all transactions across a network of computers. This innovation took out the need for banks and offered new levels of security and trust in financial transactions.

Bitcoin provided financial freedom to individuals, removing the need for traditional banking institutions. The rise of Bitcoin and blockchain technology started a global conversation on the future of finance and the potential for a decentralized, borderless, and secure financial ecosystem.

Cryptocurrency’s Impact on the Future of Money

Cryptocurrencies offer three main advantages over the current financial system: decentralization, security, and accessibility. Their decentralized nature removes the need for banks. This enhances security by minimizing the risk of centralized data breaches and fraud.

Furthermore, cryptocurrencies increase financial access by offering an inclusive system, providing individuals in underserved regions with access to financial services. However, challenges and regulatory concerns persist. The volatile nature of cryptocurrencies poses investment risks, while concerns about illegal activities and tax evasion have prompted governments to seek stricter regulations. Striking a balance between innovation and security remains a critical challenge as the cryptocurrency landscape continues to evolve.

The Rise of Central Bank Digital Currency (CBDC)

Central Banks have looked to address the volatile nature of cryptocurrencies through the introduction of a Central Bank Digital Currency (CBDC). This is the digital form of a country’s fiat currency, which is regulated by its central bank. Examples include the Digital Rupee by the Reserve Bank of India, the Digital Ruble by the Bank of Russia, and the Sand Dollar by the Bahamas Central Bank.

The journey of money from cowries to cryptocurrencies shows a series of innovations and transformations. With blockchain technology driving this chapter of money’s progression, it is vital to remain informed in the ever-changing world of financial systems.

Ensure to stay updated on financial innovations and invest responsibly on INX which guarantees notable levels of blockchain security and financial regulation.

History of Money FAQ

How did the concept of money originate?

The concept of money originated from the need for a medium of exchange to aid trade. Initially, barter systems were used, but as societies grew more complex, various items like cowrie shells, metal coins, and eventually paper money emerged as forms of currency.

Who created the first cryptocurrency, Bitcoin, and why?

Bitcoin was created by an individual or group using the alias Satoshi Nakamoto. The primary goal was to establish a decentralized digital currency that could operate without middlemen like banks, offering financial freedom and security.

What are the advantages of using cryptocurrency over traditional money?

Cryptocurrency offers advantages such as decentralization, security through encryption, and accessibility, as it operates globally, 24/7, with minimal transaction fees, providing financial freedom to users.

The INX Digital Company INC September 13, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.