6 Thrilling Narratives Shaping the Future of Security Tokens

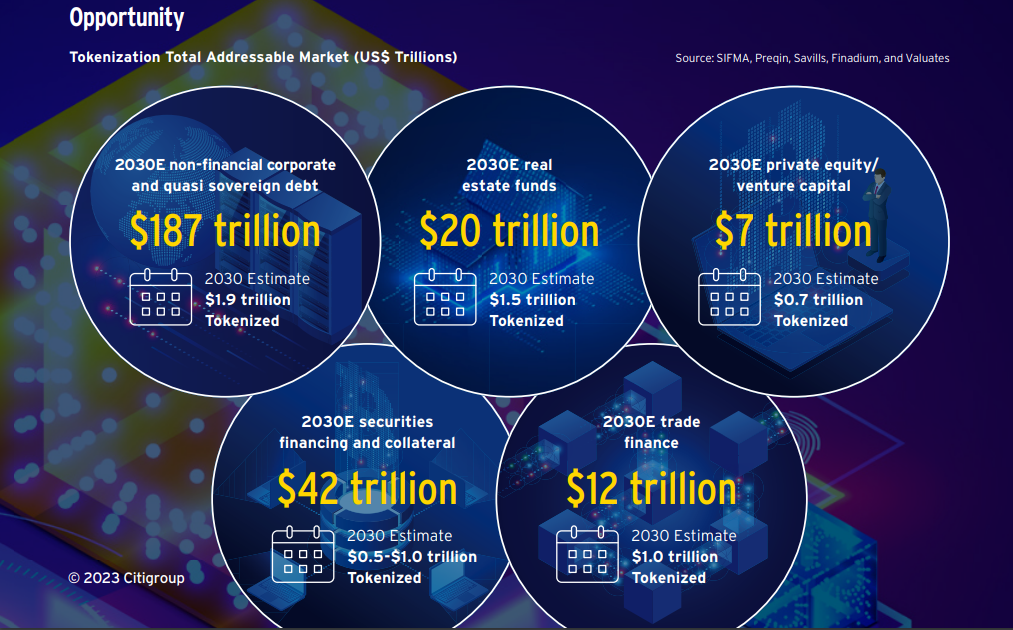

Tokenization of financial and real-world assets could be the killer use case driving blockchain’s breakthrough. According to Citi Bank, tokenization is expected to grow by a factor of 80x in private markets, reaching up to almost $4 trillion in value by 2030. However, while the future of security tokens is rapidly approaching an inflection point, these digital assets are yet to reach the instant recognizability and global impact of technologies like ChatGPT or mobile phones. As we look forward to the future of security tokens, six impactful narratives could propel this exciting field to reach its potential and create trillions of dollars in value.

These narratives are:

- Unlocking liquidity for private markets

- An increased appetite for fractionalized real-estate investments

- The growth of yield-bearing digital assets

- Evolving global regulation

- Disrupting traditional fundraising models for startups and SMEs

- The institutional desire for compliant Web3 investments

Unlocking Liquidity for Private Markets

Tokenization could streamline private markets by allowing all stakeholders to share a single infrastructure, a single “golden source” of data. Doing so would not only provide a significant upgrade of legacy systems, many of which haven’t seen an update since the previous millennia but it would also:

a. Give retail investors an opportunity to participate in private markets.

b. Drastically reduce the need for expensive reconciliation between disjointed systems.

c. Allow firms to fractionalize large chunks of private equity.

d. Increase transparency.

Citi analysts believe that private markets are most ripe for tokenization, and project the share of tokenized assets to reach 10% of all money in private equity and venture capital. Indeed, private equity giant KKR has taken the leap into the tokenized world by opening its healthcare fund up to tokenized investments from its clients.

An increased appetite for fractionalized real-estate investments

Real estate investments are attractive for several reasons. There’s the prestige of owning a piece of property, the capital appreciation from the price rising and the rental income investors earn on their property. Yet, for so long these advantages have been reserved for an exclusive few that could afford the high unit cost of buying real estate.

However, the future of security tokens is changing this landscape by enabling fractionalized real estate investments, which have gained increasing popularity among retail and institutional investors alike. Tokenization allows investors to own a fraction of a property, giving them access to an asset class that was previously only available to a select few. This new method of investing in real estate enables investors to diversify their portfolios and access higher yields with lower minimum investment requirements.

Moreover, fractionalized real estate investments also offer increased liquidity, as investors can sell their tokens more easily and quickly than traditional real estate assets. This makes it easier for investors to manage their portfolios and take advantage of market opportunities.

The tokenization of real estate also offers benefits to property owners, as it allows them to unlock the value of their assets and access a wider range of investors. This could result in increased capital flows into real estate, as well as improved price discovery and transparency in the market.

The Growth of Yield-Bearing Digital Assets

One of the most significant growth areas for the future of security tokens is in the realm of yield-bearing digital assets. With the rise of decentralized finance (DeFi), crypto investors have shown a strong appetite for yield, often chasing the highest returns without fully understanding the risks. However, the yield offered by many DeFi protocols can be unsustainable and volatile, leading to significant losses for investors.

Security tokens, on the other hand, offer yield with actual value backing up the token, providing a more stable and secure investment option. This is because security tokens are backed by real-world assets, such as real estate or commodities, which provide tangible value to the token. As such, security tokens offer investors the potential for reliable and sustainable yield, making them an attractive investment option for those seeking a stable return on their investment.

Companies like Ondo Finance are already enabling investors to buy tokenized US Treasuries and use those as collateral to get loans. This enables investors to leverage their investments and access capital more efficiently, unlocking new opportunities for growth and diversification.

Evolving Global Regulation in the Digital Asset Space

Let’s face it, most crypto tokens are being defined by regulators as unregistered securities passing as such. Any token that offers yield, sold in an ICO, or has a team responsible for price appreciation is at risk of being classified as a security. If six years ago regulators were largely ignorant of the happenings inside the crypto markets, today they are focused on bringing this new financial frontier under their domain.

In the European Union, the Markets in Crypto Assets (MiCA) regulation has been passed, which will regulate the issuance and trading of crypto assets, while security tokens continue to fall under existing securities regulation. In the United States, digital assets are also coming under increased scrutiny, with the Securities and Exchange Commission (SEC) taking an active role in regulating the space. This has led to increased caution among Web3 entrepreneurs, who cannot afford to risk the wrath of the SEC. As a result, launching security tokens from the outset has become a popular approach, as it ensures compliance with regulatory requirements from the start.

Disrupting Traditional Fundraising Models for Startups and SMEs

Historically, raising capital for early-stage companies has been a challenging and often expensive process, with most startups turning to venture capital firms for funding. However, security tokens are changing this paradigm by offering a range of new fundraising options that can help startups and SMEs access capital more efficiently and cost-effectively.

One of the most significant benefits of security tokens is the ability to do a non-dilutive round. Unlike traditional fundraising models, where companies often have to give up equity in exchange for capital, non-dilutive rounds allow startups and SMEs to raise capital without giving up ownership. This can be particularly appealing for companies that want to retain control over their operations while still accessing much-needed funding.

Security tokens also offer the ability to raise capital from a broader range of investors, including individual investors and members of the community. This can be particularly appealing for startups and SMEs that have a strong local presence, as they can tap into the support of their community to raise capital more easily and effectively.

Another benefit of security tokens is the ability to provide liquidity to investors. Unlike traditional VC investments, where investors often have to wait for a liquidity event to realize their returns, security tokens offer a more liquid investment option. This means that investors can buy and sell their tokens more easily, providing them with greater flexibility and control over their investments.

The Institutional Desire for Compliant Web3 Investments

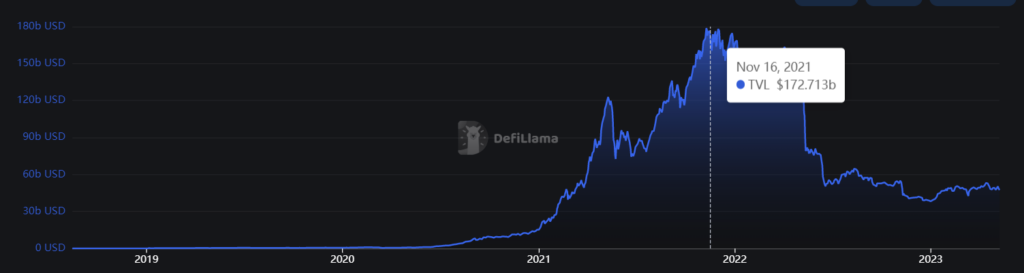

DeFi reached $171 billion in value locked at its peak, but it was not attractive for institutional investors due to regulatory concerns. Institutions want to trade in a clearly regulated environment, with concrete rules and the knowledge that their counterparties are legitimate and transparent.

Security tokens can bring regulatory clarity to DeFi, enabling institutional investors to participate in the Web3 ecosystem without compromising on compliance. By leveraging blockchain technology, security tokens can offer a transparent and secure investment vehicle that is compliant with regulatory requirements. Trillions of institutional dollars can flood into the DeFi space, unlocking a massive new source of liquidity and driving further innovation for the future of security tokens.

INX is Tokenizing The Way to Financial Freedom

INX is leading the way in the tokenization of real-world and financial assets, unlocking new opportunities for investors and creating a more efficient and transparent investment ecosystem. As the home of security tokens, INX has a competitive advantage in the rapidly growing market for digital assets, offering investors access to a range of innovative investment options that were previously unavailable on our tokenization platform. With a commitment to regulatory compliance and a focus on creating value for its investors, INX is well-positioned to shape the future of security tokens and drive the growth of the Web3 ecosystem.

If you wish to raise money through a security token offering, visit our raise page.

David Azaraf May 9, 2023

Crypto enthusiast, help businesses plug into the token economy