How Does Ethereum Staking Work? (And Is It A Security?)

Welcome to the world of Ethereum staking, where we unlock the secrets behind this cutting-edge process and delve into the question of its classification as a security. Ethereum’s transition to Proof-of-Stake (PoS) brought forth exciting opportunities for stakers to earn a reliable and passive income. But it isn’t without its risk. In this article, we’ll provide you with a comprehensive understanding of how Ethereum staking operates and how you can get involved. We’ll also dive into the heated discussion regarding Ether’s regulatory status.

What is Proof-of-Stake?

Proof-of-Stake (PoS) is an innovative mechanism utilized in blockchain networks to reach consensus and verify transactions. Unlike the energy-intensive Proof-of-Work (PoW), PoS selects validators based on the cryptocurrency they hold and “stake” in the network. Validators are chosen through a deterministic process that factors in the size of their stake and their active involvement in the consensus process.

Proponents of PoS love to point to the eco-friendly nature of this consensus mechanism since it does not require huge energy consumption like Proof of Work. In addition to the lower environmental footprint, PoS systems can also handle a larger chunk of transactions per second, boosting blockchain scalability.

Ethereum Embraces Proof of Stake: Revolutionizing Network Consensus

In a groundbreaking move, Ethereum, the world’s second-largest blockchain platform, successfully completed its transition from the energy-intensive Proof-of-Work (PoW) consensus mechanism to the cutting-edge Proof-of-Stake (PoS) protocol on September 15, 2022. This momentous upgrade, known as The Merge, represents a quantum leap in addressing scalability challenges and fortifying network security. The Merge reduces the energy consumption associated with traditional PoW-based networks, making Ethereum more sustainable and environmentally friendly.

Ethereum Embraces Proof of Stake: Revolutionizing Network Consensus

In a groundbreaking move, Ethereum, the world’s second-largest blockchain platform, successfully completed its transition from the energy-intensive Proof-of-Work (PoW) consensus mechanism to the cutting-edge Proof-of-Stake (PoS) protocol on September 15, 2022. This momentous upgrade, known as The Merge, represents a quantum leap in addressing scalability challenges and fortifying network security. The Merge reduces the energy consumption associated with traditional PoW-based networks, making Ethereum more sustainable and environmentally friendly.

Ethereum Staking Mechanics Unveiled: Minimum Amount, Yield, and Tech Prerequisites

Embarking on your Ethereum staking journey is an opportunity to unlock a world of exciting possibilities. As you dive into the realm of staking, it’s essential to understand the key mechanics that govern this process and the technical requirements involved. Let’s explore the minimum stake, potential yields, and the technological infrastructure needed to stake Ethereum with finesse.

When it comes to staking, Ethereum sets a minimum threshold for the amount of Ether (ETH) required to participate. While this minimum stake may vary depending on network rules and the current phase of the Ethereum 2.0 upgrade, the initial requirement for the Beacon Chain was a minimum stake of 32 ETH to become a validator. This ensures a robust level of participation and strengthens the integrity of the network.

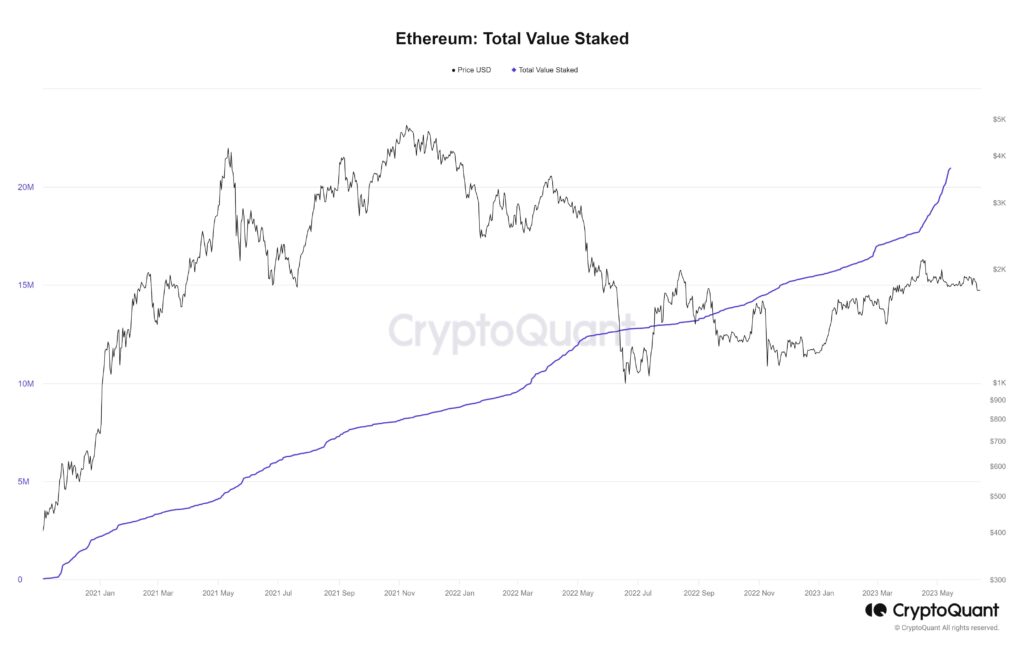

Now, let’s talk rewards! Ethereum’s Proof-of-Stake (PoS) system doesn’t operate on a fixed interest rate. Instead, the rewards you receive for staking Ether are influenced by several factors, including the total amount of ETH staked and the overall level of network participation. Estimates from Ethereum stakeholders suggest that the annual percentage yield (APY) for staking Ether can range from 5% to 15%, though it’s important to note that these figures may fluctuate over time. Your rewards will reflect your contribution to securing and maintaining the Ethereum network.

Of course, staking Ethereum requires a solid technical foundation. To stake solo, you’ll need to run an Ethereum node and set up a validator client software. This requires a device with a minimum of 4 to 8 GB of RAM and at least 2 TB of storage space to accommodate the blockchain data. Additionally, maintaining a stable internet connection is crucial to ensure seamless participation in the staking process. The Ethereum community provides extensive documentation and resources to guide you through the technical setup, ensuring you have the necessary tools to stake with confidence.

Is Ethereum A Security?

The classification of Ethereum as a security has become a contentious issue, especially in the United States, sparking robust debates among various stakeholders. The Securities and Exchange Commission (SEC), has, through a series of lawsuits, indicated its stance that Bitcoin is the only digital asset that definitively falls outside the purview of securities. However, Ethereum was not included in their list of coins deemed as securities, putting it in somewhat of a grey area.

Meanwhile, the New York Attorney General‘s office has claimed that Ether is a security in a lawsuit against the cryptocurrency exchange Kucoin. On the other hand, the Commodity Futures Trading Commission (CFTC), which oversees commodity regulation, categorizes Ethereum as a commodity, not a security.

One crucial aspect of this debate pertains to Ethereum’s transition to a Proof-of-Stake (PoS) consensus mechanism. Even though the SEC has not explicitly labeled Ethereum as a security, it has pursued several cryptocurrency exchanges that offer ‘staking-as-a-service’ on the Ethereum network. Notably, digital assets based on the Proof-of-Work (PoW) consensus algorithm have yet to draw the SEC’s attention in this regard, further adding complexity to Ethereum’s classification discussion.

Should I stake Ethereum?

The decision to stake Ethereum largely depends on your personal risk tolerance and investment goals. Staking Ethereum, particularly following its shift to the Proof-of-Stake (PoS) consensus mechanism, can potentially yield returns via transaction fees and block rewards. Alternatively, you can simply hold or “store” Ether in your digital wallet.

Regardless of your decision to stake or store, the initial step is to buy Ethereum safely, which can be purchased on INX. Always remember to do your due diligence before engaging in any form of investment activity.

David Azaraf June 13, 2023

Crypto enthusiast, help businesses plug into the token economy