How Many Bitcoins Are There? A Comprehensive Guide to 21 Million

Bitcoin, the trailblazing cryptocurrency, has intrigued investors and technologists alike since its inception in 2009. One aspect often piques curiosity: the finite supply of Bitcoins. Understanding how many bitcoins are there, and why this number matters, provides key insights into its fundamental design and potential future value.

Understanding the Concept of Bitcoin’s Finite Supply

Unlike traditional fiat currencies that can be printed at will, Bitcoin was ingeniously designed with a hard cap of 21 million coins. This principle is rooted in its original blueprint, defined by the pseudonymous creator Satoshi Nakamoto. Essentially, Bitcoin’s finite supply is engineered to mimic the scarcity property of precious metals like gold, giving it a unique feature of ‘digital scarcity’. This scarcity is not just a characteristic but forms the backbone of Bitcoin’s value proposition, which we will explore in depth as we unravel the intriguing world of Bitcoin.

The Current State of Bitcoin Supply

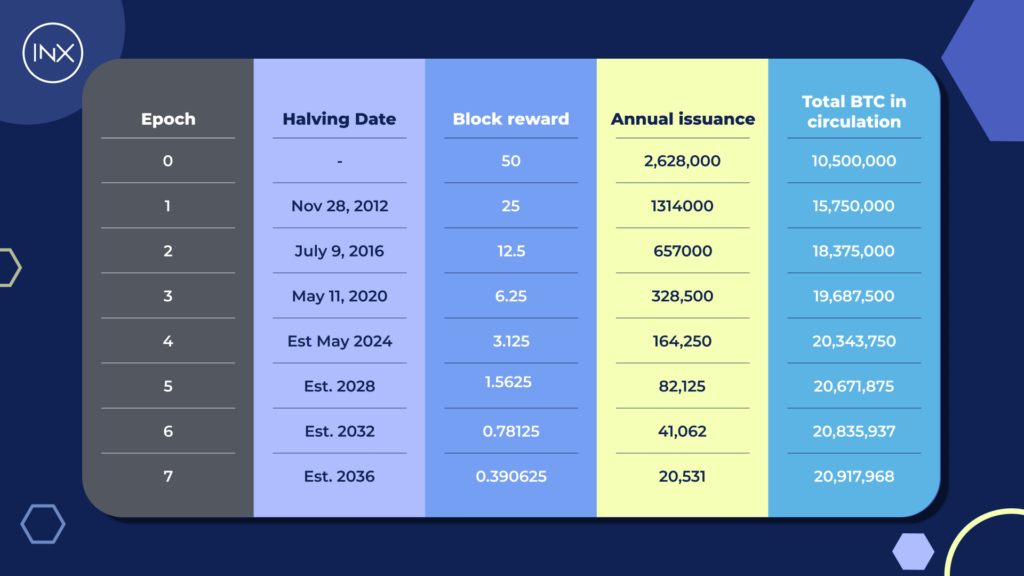

Bitcoin’s meteoric rise as a decentralized digital currency has captivated the world, but its limited supply adds an air of intrigue. Over 19.4 million bitcoin have already been mined, accounting for a whopping 89% of the total supply. It’s a mind-boggling figure that showcases the incredible growth and adoption of this groundbreaking cryptocurrency, as well as the scarcity of Bitcoin. Currently, miners added 328,500 bitcoin to the supply every year. That’s all going to change in May 2024, when the bitcoin halving cuts the supply down by half on that date.

Lost Bitcoins: The Elusive Quest for Untouched Wealth

As the Bitcoin saga unfolds, a fascinating aspect emerges – the notion of lost bitcoins. Yes, you heard that right. These digital treasures have vanished into the depths of the blockchain, forever out of reach. Whether they were victims of hardware malfunctions, misplaced wallets, or simply human forgetfulness, the reality remains: countless bitcoins are missing in action. In fact, some estimates suggest that the tally of lost bitcoins could reach several million, reducing the circulating supply and making Bitcoin even more scarce.

Anticipating the Last Bitcoin: When and What Happens Then?

Prepare to embark on a journey through time as we contemplate the arrival of a monumental event in the world of Bitcoin – the mining of its very last coin. Picture this: the year is 2140, and after years of block reward halvings, the ultimate prize is within reach. Miners will experience a seismic shift as the block reward ceases to exist, leaving them reliant solely on transaction fees. This watershed moment raises pivotal questions about the future sustainability and security of the Bitcoin network, and its impact on the miners and the wider cryptocurrency ecosystem.

David Azaraf June 8, 2023

Crypto enthusiast, help businesses plug into the token economy