How To Buy Avalanche (AVAX) on INX Safely

Avalanche stands out as a formidable player in the cryptocurrency space with its innovative technology and rapidly growing community. Known for its exceptional transaction speed, Avalanche offers a scalable and efficient blockchain platform.

AVAX, the native token, plays an important role in the ecosystem; most importantly it is used to pay transaction fees and governance on Avalanche. In this article, we cover how to buy and store your AVAX tokens safely.

What is Avalanche and AVAX?

Avalanche is more than just a cryptocurrency; it is a layer-one blockchain designed for high performance and flexibility.

The Avalanche blockchain tackles the scalability, security, and decentralization problems (blockchain trilemma) that most layer-one blockchains face uniquely. The blockchain also supports smart contracts and decentralized applications (dApps), positioning it as a direct competitor to the Ethereum Network.

AVAX is the native utility token of the Avalanche, and it serves several functions within the ecosystem. It is used for transaction fees, governance, and network consensus.

How To Buy Avalanche (AVAX) Tokens

The best place to buy AVAX is at a reputable and regulated crypto exchange like INX.one. Typically, you will be able to choose between a range of payment methods, like using credit cards, bank deposits, or other cryptocurrencies. How you buy AVAX should depend on the best payment method that works for you. For example, if you hold BTC or ETH, you can easily trade them for AVAX on the crypto exchange.

The platform’s safety is the most important thing to consider when buying AVAX. To avoid losing your funds to scams, ensure that you use only regulated and secure platforms like INX.one to buy AVAX. In the next sections, we will cover how to buy AVAX on INX and store your tokens securely.

Step-by-Step Guide to Buying AVAX on INX

The process to buy AVAX on INX is simple, but you need a verified account with INX to buy AVAX. In this section, we will cover what you need to buy AVAX on INX.

About INX.one

INX is the world’s first SEC-registered platform to offer trading of digital securities on the blockchain. INX is an SEC and FINRA platform that operates a Broker Dealer, Alternative Trading System (“ATS”), and has money transmitter licenses in almost all of the United States which allows INX to operate a cryptocurrency exchange. The INX.one Trading Platform allows investors access to multiple cryptocurrencies as well as security tokens.

Below is a step-by-step process you can follow to buy AVAX directly on the INX platform.

- Account Creation: Start by setting up an account on INX. This process involves providing basic personal information, setting up login credentials, and agreeing to the platform’s terms and conditions. If you have an account already, you don’t have to bother about this step. You can learn more about the account opening; see our page about the Account opening process.

- Verification: Complete the KYC (Know Your Customer) process. This step is crucial for meeting the financial regulations and ensuring the safety of your transactions. The KYC process will require you to submit your identification documents.

- Funding Your Account: Once your account is verified, you’re set to buy your token. But before then, you’ll need to fund your account with either fiat currency or cryptocurrencies. For fiat currency, you can deposit via a credit/debit card, bank wire transfer, or ACH. Check out our guide on how to buy cryptocurrency with a credit card and our page about funding INX.ONE account.

- Purchasing AVAX: To buy AVAX, navigate to the trading section on INX, select AVAX, and enter the amount you wish to purchase. Review and execute your transaction.

- Securing Your Investment: After purchasing AVAX, ensure the security of your investment. Transferring your AVAX to a secure wallet is recommended, especially if you’re planning to hold it long-term.

How Does Avalanche Work?

The Avalanche network is made up of three interoperable blockchains: the Exchange Chain (X-Chain), the Platform Chain (P-Chain), and the Contract Chain (C-Chain). The network uses a unique triple-chain architecture for high efficiency by segregating different operations across the three blockchains. This design is what allows Avalanche to achieve remarkable transaction speeds, scalability, and adaptability.

Each of the primary blockchains serve a specific function to run the architecture. The Exchange chain (X-Chain) manages the creation and exchange of assets, including AVAX, the native token, while the Contract Chain (C-Chain) facilitates smart contracts, compatible with Ethereum’s Solidity language and tooling.

The P-Chain coordinates validators, tracks active subnets, and enables the creation of new subnets. Beyond the primary chains, Avalanche allows the creation of subnets which allow anyone to create their own customized blockchain with specific rules and parameters. Subnets can communicate and interact with each other within the Avalanche ecosystem. This makes them ideal for a variety of applications, from private enterprise solutions to public decentralized applications.

As for the consensus Mechanism, Avalanche uses a new and unique consensus protocol, the Avalanche Consensus Protocol, which differs from the conventional Proof of Work (PoW) or Proof of Stake (PoS). The Avalanche Consensus Protocol achieves high throughput, rapid finality, and energy efficiency through repeated sub-sampled voting. The repeated sub-sampled voting system adopts repeated, random sub-sampling of nodes, with each node sampling a small set of other nodes to gather their opinions on a transaction.

This consensus mechanism enables the network to process thousands of transactions per second and achieve transaction finality in under a second. It also allows for a high degree of decentralization and security.

Due to its impressive and robust infrastructure, Avalanche supports a wide range of applications, including DeFi and enterprise blockchain solutions.

More About AVAX the Token

AVAX is the native utility token of the Avalanche, and it serves several functions within the ecosystem. Firstly, the AVAX tokens are used to pay transaction fees on the Avalanche network, similar to the concept of gas fees on the Ethereum network. The amount of fees paid per transaction on Avalanche varies based on the nature of the transaction and the current network load.

AVAX is also used for governance on the network; holding the token grants users the right to participate in the governance of the Avalanche network. This includes voting on proposed changes or improvements to the protocol.

Furthermore, AVAX plays a critical role in the network’s security. Validators stake AVAX to participate in the network consensus, helping to secure the platform and validate transactions. Lastly, AVAX is used to create new subnetworks within the Avalanche ecosystem, allowing for customized blockchains with specific use cases.

A Brief History of AVAX Price Action

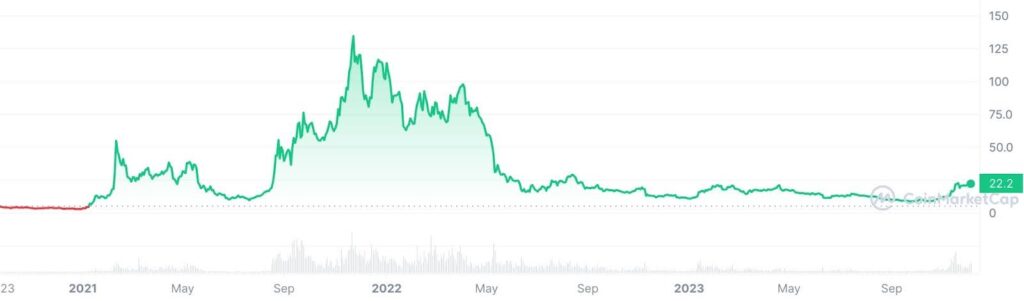

The AVAX token launched in September 2021 at around $5 with a capped supply of 720 million tokens. This limited supply model is designed to prevent inflation and ensure the token’s long-term value.

The AVAX token has grown steadily over several years, with the best performance between September 2021 and May 2022. It reached an ATH (All-time-High) of $146.22 in November 2021, and its all-time low was $2.79 in December 2020.

The token is currently trading at $22.21, gaining over 78.52% this month and 56.35% this year alone. But this price is 84.83% lower than the ATH.

How To Store AVAX Safely

To secure your AVAX, ensure that you choose a reliable wallet that supports AVAX. Hardware wallets offer the highest security for long-term holdings, while software wallets are convenient for active trading.

If you plan to hold a considerable amount of AVAX tokens, consider using a cold wallet such as a hardware or paper wallet to provide additional security because they are offline. Use strong, unique passwords and enable two-factor authentication. Also, regularly update your wallet software to reduce vulnerability to hacks.

For cold wallets, keep a secure backup of your wallet’s private keys or seed phrase in a safe location. Lastly, stay vigilant against phishing attempts; never share your private keys or wallet credentials. You can read our article about avoiding crypto scams for more tips to secure your tokens and

Is Now the Right Time Buy Avalanche (AVAX)

Investing in AVAX, like any other cryptocurrency, should be after thorough research and a clear understanding of the token’s market dynamics. Ensure you also consider your risk tolerance and investment goals because cryptocurrencies, including AVAX, are known for their volatility.

A great way to decide when to buy AVAX is to determine how it fits into your overall investment strategy. Investing in Avalanche (AVAX) can be a great addition to your portfolio for several reasons. Firstly, Avalanche’s unique architecture and fast transaction speeds make it one of the leading layer-one blockchains.

The AVAX token is expected to see potential growth as use cases increase for the adoption of its blockchain. The expanding Avalanche ecosystem, with increased use in DeFi, NFTs, and enterprise solutions, already suggests potential for growth.

In addition, the capped supply of AVAX controls the token supply, thus preventing inflation and helping the token’s potential long-term value. Consequently, investing in Avalanche (AVAX) now can offer investors an opportunity to participate in this asset in the early adoption phase.. Entering the market before the platform reaches its full potential and growth may result in significant returns on investment.

Another great way to take advantage of the Avalanche protocol is to invest in the yield-bearing assets built on the Avalanche blockchain. The Republic Note is an example of such a digital asset; it is a dividend-bearing asset on the Avalanche and available only on INX.one.

Invest in Private Equity with the Republic Note Token on INX

The Republic Note is a dividend-paying asset that is linked to the Republic’s vast venture portfolio. The token is an RWA (real-world asset) backed by an expanding private equity portfolio in a multi-trillion-dollar industry.

Republic is a private investing platform that curates private investing opportunities with high-growth potential across several industries like gaming, Web3, and real estate. The Republic Platform has raised over $2.5 billion into thousands of startups since 2016. Examples of their investment portfolio include $2.3 million purchased into SpaceX with Republic and over $11 million purchased into Robinhood.

With the Republic Note, you can have an opportunity to earn dividends from the Republic venture portfolio for deals unavailable to most investors. The Note was listed on INX on the 6th of December, 2021, and is currently trading.

The best part is that you can hold your Note token in the Republic Wallet, which is a multi-chain, self-custody, and secure wallet.

FAQs about Avalanche (AVAX)

How Can I Buy AVAX?

You can buy AVAX tokens on cryptocurrency exchanges like INX. You will need to create an account with INX and complete the necessary KYC procedures. You will also need to fund your account through the accepted payment method to buy AVAX.

How much do I need to Invest in AVAX?

There is no minimum deposit amount to buy AVAX tokens; the only restriction is usually from the platform you use. Some exchanges have a minimum buy order when buying, but that is usually a small amount. The amount of AVAX you buy should depends on your financial situation, investment goals, and risk tolerance. Considering the volatility of cryptocurrency, it is advisable to invest only what you can afford to lose.

How long can I keep my AVAX?

You can keep your AVAX tokens for as long as you want. There’s no time limit for holding them. The decision to hold or sell depends on your investment strategy, market conditions, and personal financial goals.

Is Avalanche crypto risky?

Like all cryptocurrencies, investing in Avalanche (AVAX) carries inherent risks, including market volatility, technological and regulatory developments, and broader economic factors. Therefore, it’s important for investors to conduct thorough research, consider their risk tolerance, and potentially seek advice from financial professionals before investing in Avalanche or any other cryptocurrency.

How Fast are Avalanche Transactions?

The Avalanche network can process up to 4,500 transactions per second (TPS). The network is best known for its speed, boasting transaction finality times as fast as less than two seconds. The speed is attributed to its unique consensus mechanism and architecture which is designed for high throughput and quick finality. This enables Avalanche to handle a large number of transactions efficiently and swiftly.

Is Avalanche environmentally friendly?

Yes, Avalanche is considered more environmentally friendly than traditional proof-of-work (PoW) blockchain networks. Its consensus mechanism is based on proof-of-stake (PoS), which requires significantly less energy consumption.

The INX Digital Company INC December 18, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.