Is Bitcoin Backed By Anything?

Bitcoin, the first digital currency, faces criticism for not having tangible backing. However, upon closer examination, we discover that Bitcoin is supported by cryptography, code, and a unique monetary system, setting it apart from traditional money. By putting the common criticism that Bitcoin isn’t backed by anything under the microscope, we can reveal the true nature of Bitcoin and the advantages that set it apart from other forms of money.

Bitcoin is Sound Money Backed by Cryptography and Code

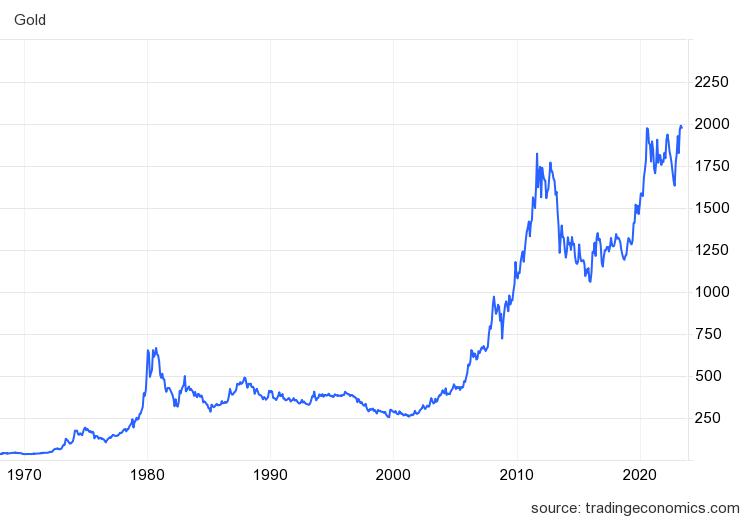

Think of Bitcoin as a rare asset supported by cryptography and code. This makes transactions secure and verifiable. Unlike regular money which can inflate without end, Bitcoin has a limit of 21 million coins. This scarcity makes it an ideal candidate for sound money in the 21st century, a defacto new version of the gold standard for the digital world. Sound money refers to a form of currency or monetary system that maintains its value over time, preserves purchasing power, and is resistant to inflationary pressures. It is a concept rooted in stability, predictability, and trust. It provides individuals with confidence that the value they hold today will retain its worth in the future.

Understanding Bitcoin’s Monetary Policy

Bitcoin has a fixed supply schedule, which is characterized by two key points

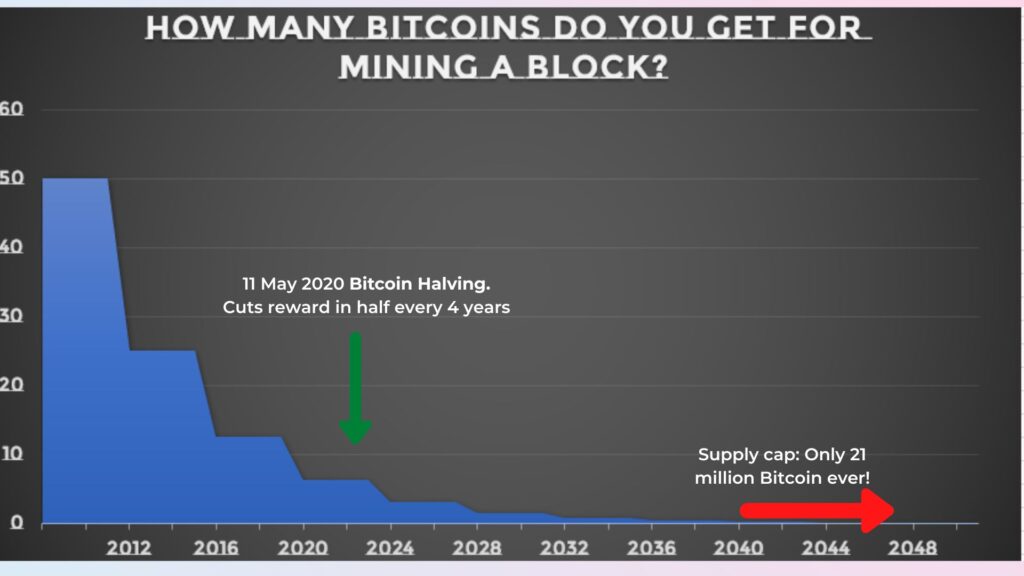

- Every 10 minutes, new coins are minted into existence by Bitcoin miners who validate transactions and provide security to the network.

- Every four years, the rate at which new Bitcoins are created is cut in half during an event known as the Bitcoin halving. This predictable reduction makes Bitcoin more scarce.

Unlike regular money that can suddenly lose value due to inflation or deflation, Bitcoin protects against sudden increases in inflation or a loss of value. People can trust that the rules for creating and distributing new Bitcoins are set and won’t change unexpectedly.

Fiat Currency and Lack of Backing

Contrast Bitcoin’s fixed and predictable supply with the way fiat currency is created. Fiat isn’t backed by anything tangible and hasn’t been since Richard Nixon ended the gold standard in 1971. Back then, the dollar was backed by gold at a rate of $35/ounce of gold. This backing prevented the Federal Reserve from being able to print as much money as it wanted. Other countries, in turn, pegged their currencies to the US dollar and expected the US to redeem their gold at the agreed-upon price.

Since 1971, the link between fiat currency and tangible value has been broken. This change allowed governments and banks to have more control over money, which can lead to creating too much money and causing inflation.

Banking Problems and Bitcoin’s Security

One of the critical advantages of Bitcoin is its enhanced security and independence compared to traditional banking systems. When you deposit money in a bank, it essentially becomes a debt owed to you by the bank. This arrangement puts your funds at the mercy of the bank’s financial stability and solvency. In contrast, Bitcoin provides individuals with direct ownership and control over their assets, offering an extra layer of security and protection.

To illustrate the importance of this distinction, let’s consider the situation in Lebanon. In recent years, Lebanon has faced severe economic and financial challenges. The country’s banking system, once considered stable, has been marred by corruption, mismanagement, and economic crises. In 2023, the fragility of the Lebanese banking sector became evident as citizens found themselves unable to access their funds. Withdrawal restrictions were imposed, preventing people from taking out their money when they needed it most.

In a similar vein, we have witnessed instances where banks worldwide have faced significant failures, leading to substantial losses for customers. One example occurred when major banks such as Silicon Valley Bank experienced insolvency in 2023. Those banks held $500 billion in assets collectively. Without federal intervention and bailouts, their customers could have faced devastating financial consequences.

In contrast, Bitcoin operates on a decentralized network, removing the reliance on any single institution or authority. As a bearer instrument, Bitcoin grants individuals full control and ownership over their digital assets. The decentralized nature of Bitcoin’s blockchain ensures that transactions are transparent, secure, and resistant to censorship. This independence from traditional banking systems offers a level of security that cannot be easily undermined or affected by the failures or mismanagement of financial institutions.

It is important to note that while Bitcoin’s security and independence provide unique advantages, it also requires users to take responsibility for safeguarding their own assets. Proper storage practices, such as using secure hardware wallets and following best security practices, are essential to mitigate the risk of potential theft or loss.

Why Does Bitcoin Have Value?

Bitcoin has value in different ways. It’s like a safe place to store wealth over time. Bitcoin’s limited supply and decentralized nature protect it from losing value like regular money does. Also, Bitcoin can be used to buy things, making it a useful way to exchange goods. As more people accept Bitcoin, it could become a standard way to price things in the digital world. Some even think that the future of Bitcoin as a scarce, hard currency could see it become could become the main global currency in the future.

The idea that “Bitcoin isn’t backed by anything” is often used to criticize it, but in reality, fiat money is the one without a solid backing. Rather, fiat money is backed by the full faith of the issuing government. In the case of the dollar, the US government gives its full backing to maintaining the dollar’s value, which in many people’s opinion makes it a safe bet. Bitcoin offers an alternative financial system that lets people protect their wealth and take part in a digital economy that isn’t controlled by a central authority.

If you wish to get started with Bitcoin, read our guide about how to buy and trade Bitcoin safely.

David Azaraf May 21, 2023

Crypto enthusiast, help businesses plug into the token economy