Understanding RWAs: An Introduction to Real-World Assets

In today’s rapidly evolving financial landscape, the term “Real-World Assets,” or RWA, is gaining significant traction. But what exactly are RWAs, and why are they becoming a focal point in modern finance? Let’s unpack this concept.

What are Real-World Assets (RWA)?

Real-World Assets refer to tangible or intangible assets that have intrinsic value and exist in the physical world. These can range from real estate properties, machinery, and commodities to intellectual properties, copyrights, and even certain types of contracts.

Unlike digital or virtual assets, RWAs have a physical presence or a real-world utility. They also have a long history in traditional finance, serving as collateral, investment vehicles, or assets held for appreciation.

Common examples of RWAs

- Real Estate: Properties, both residential and commercial, that can be leased, sold, or used as collateral

- Precious Metals: Assets like gold and silver, which have historically been a store of value

- Collectibles: Valuable items such as art, antiques, and rare coins.

- Agricultural Products: Essential commodities produced from farming activities.

- Commodities: Natural resources like oil, gas, and minerals that drive industries.

RWA Tokenization: Bridging the gap between the physical and digital

Tokenization involves converting the rights to a tangible or intangible asset into a digital token on a blockchain. This enhances the liquidity of traditionally illiquid assets and democratizes access to investment opportunities.

Beyond bringing real-world assets on-chain, RWAs also offer a way for companies to raise capital. Recently, there has been an increase in the issuance of capital market products or security token offerings on blockchains. In this case, RWAs are tokenized into security tokens and offered to retail investors through a security token offering (STO). These tokens can further be used as collateral for securing loans from DeFi protocols.

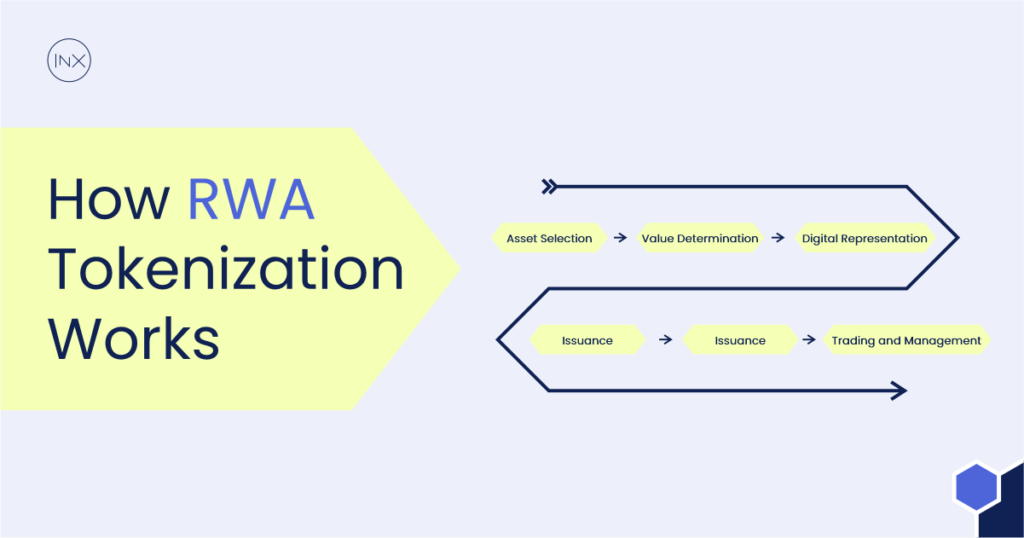

How does RWA Tokenization work?

At its core, tokenization involves representing ownership of a real-world asset through a digital token. The tokenization roughly follows the following steps:

- Asset Selection: The first step is to choose an asset for tokenization. This could be real estate, artwork, a financial instrument, or intellectual property.

- Value Determination: The asset’s value must be determined before tokenizing, often through an appraisal or valuation process.

- Digital Representation: The asset’s value is divided into shares or units. Each unit is represented as a digital token on a blockchain.

- Issuance: These tokens are then issued through a platform supporting token creation and management like INX. This process often involves a smart contract, a self-executing contract with the terms of the agreement directly written into code.

- Trading and Management: Once issued, these tokens can be traded on secondary markets, just like cryptocurrencies. They can also be used in various financial operations, such as collateral in loans.

A security token platform like INX simplifies the tokenization process and ensures regulatory compliance. Working with such a platform makes it easier to get the support and regulatory expertise necessary for the tokenization process.

Benefits of tokenization

RWAs bridge traditional finance and the digital space, allowing DeFi to serve customers and businesses that are not crypto natives.

- Liquidity: Tokenization can make traditionally illiquid assets, like real estate or art, more liquid. Fractional ownership allows smaller investors to participate in the market, increasing demand and liquidity. For example, several investors can own a share of a property through fractionalization.

- Accessibility: By breaking down barriers to entry, tokenization democratizes access to investment opportunities previously reserved for wealthy or institutional investors.

- Transparency and Security: Leveraging blockchain technology ensures all transactions are transparent, immutable, and secure. Every token transaction is recorded, making fraud or asset manipulation difficult.

- Cost-Efficiency: Tokenization can reduce the need for intermediaries, streamlining processes and potentially reducing costs.

Challenges with tokenized RWAs

While RWAs offer several benefits, they are not without limitations and challenges. We have highlighted the significant issues with RWA below:

- Regulatory Landscape: The regulatory environment for tokenized assets is still evolving, and different governments may have varying rules and regulations concerning tokenized asset creation, issuance, and trading. Therefore, it might be challenging for RWA token issuers to navigate the legality of space.

- Valuation Complexities: Regular appraisals might be needed to ensure the token’s value accurately reflects the underlying asset, especially if the asset’s value can change over time.

- Custody Issues: Determining how the physical asset is stored, maintained, and insured can be challenging, especially when multiple token holders have a stake.

INX: Facilitating regulated Security Token Offerings (RWA)

As a US-regulated company, INX was the first company that offered a tokenized initial public offering (IPO) or a security token offering (STO) with SEC registration. Now, INX helps other companies issue security tokens/RWAs and facilitate their security token offering.

INX holds an SEC transfer agent license as well as a broker-dealer, and ATS licenses under FINRA (Financial Industry Regulatory Authority) and SEC (U.S. Securities and Exchange Commission). Therefore, the company can help with the full cycle of the STO process, from getting approval as an issuer to managing the security tokens. INX is actively involved in helping companies raise capital with security token offerings with full regulatory compliance.

Final Thoughts

The emergence of Real-World Assets (RWAs) in the digital realm signifies a transformative phase in the financial sector. By bringing physical assets on-chain, RWAs will reshape how we perceive value, ownership, and investment.

Tokenization offers a way to seamlessly blend the digital and physical worlds to enhance liquidity and democratize asset ownership. However, as with any innovation, challenges persist. The evolving regulatory landscape and complexities in valuation and custody underscore the need for a robust framework to ensure the sustainable growth of tokenized RWAs.

But, as the line between traditional and digital finance continues to blur, it’s evident that RWAs will play a pivotal role in shaping the future of decentralized finance.

FAQs

What are Real-World Assets (RWA)?

Real-World Assets refer to tangible or intangible assets that have value and exist in the physical world, such as real estate, machinery, copyrights, and certain contracts.

How do RWAs differ from digital assets?

Unlike digital or virtual assets, RWAs have a physical presence or a real-world utility, whereas digital assets exist solely in the digital realm.

What is the role of RWA in decentralized finance (DeFi)?

In the DeFi space, RWAs are being used as collateral for loans and other financial products, bridging the gap between traditional and digital finance.

How is the valuation of RWAs determined?

The valuation of RWAs can vary based on the type of asset. It can be determined by market demand, expert appraisals, or based on the asset’s utility and potential returns.

The INX Digital Company INC August 23, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.