Unlocking Value with Long-Term Investments

Long-term investments stand as key pillars of wealth creation and financial prosperity. Beyond the attraction of quick gains, long-term investments provide a solid foundation for sustained wealth.

In times past, traditional options like stocks, bonds, and real estate have dominated the discussion around sustainable investments. However, a new digital asset class built on blockchain technology offers a new dimension to long-term investments.

Security tokens bring a new era of possibilities to investments. Security tokens not only democratize access to high-value assets, but also offer opportunities for increased liquidity and transparency, reshaping the narrative of long-term financial success.

Understanding Long-Term Investments

Long-term investments are the foundation of insightful financial planning, as these investments embody a patient and strategic commitment to wealth accumulation over an extended period of time.

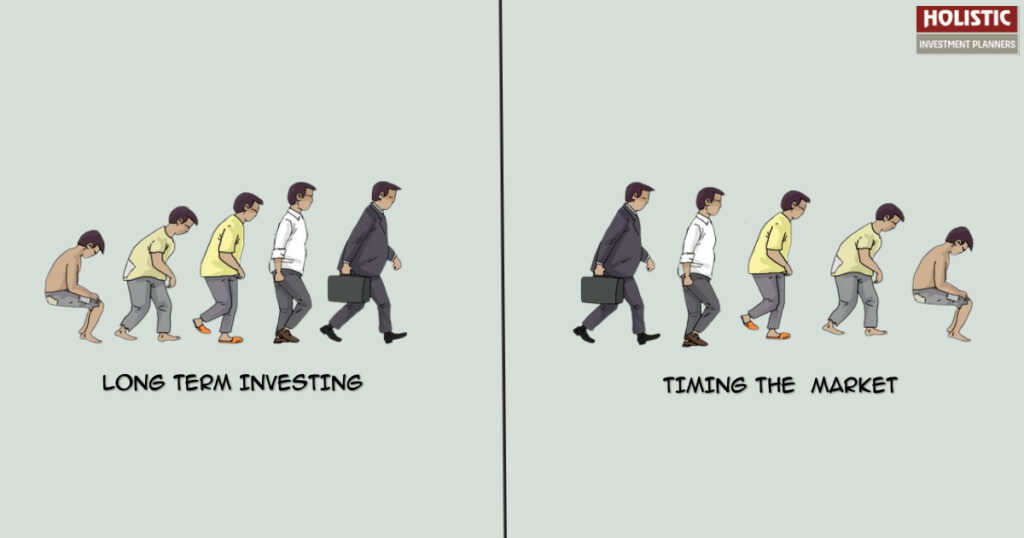

Long-term investments are a marathon, not a sprint, harnessing the power of compounding and weathering market fluctuations. Their role extends beyond mere financial gain, providing a shield against inflation and offering stability in the face of economic uncertainties. The advantages of this approach are not just theoretical; historical data consistently demonstrates that long-term investors outperform their short-term counterparts, reaping the rewards of time and resilience. In financial planning, embracing the enduring power of long-term investments can be likened to planting seeds for a future of lasting prosperity.

The Evolution of Investments

Traditional investments such as stocks, bonds, and real estate have acted as custodians of long-term financial strategy. However, they have their limitations. Stocks are prone to sharp swings based on market volatility while bonds may offer stability but limited returns. On the other hand, real estate demands significant capital at the early stages with reduced liquidity.

While these remain viable long-term investments, the development of blockchain technology with application in finance has opened new long-term pathways. This has seen the rise of cryptocurrencies and most recently, security tokens. The beauty of security tokens is the combination of the innovation of blockchain technology along with industry-standard regulation to provide long-term investors with a secure investment.

Security tokens also bring the opportunity for fractional ownership, democratizing access to high-value assets traditionally reserved for the elite. With increased liquidity and transparency, security tokens move beyond the constraints of conventional investments, forging a path toward a more inclusive and dynamic era in wealth creation.

Are Security Tokens a viable long-term investment?

The answer to this question is a resounding yes. Security tokens represent digital ownership of real-world assets on the blockchain. Unlike regular cryptocurrency, security tokens derive their value from tangible assets, offering a bridge between traditional securities and digital assets. Their distinction lies in the inclusion of regulations that mirror traditional securities but with enhanced efficiency and accessibility. The benefits are compelling:

- Fractional ownership enables investors to own a fraction of high-value assets

- Liquidity is increased as tokens can be traded 24/7, and

- Transparency is unmatched with every transaction securely recorded on the blockchain.

Thus, security tokens emerge as the architects of a more inclusive and efficient investment ecosystem.

Tips for Long-Term Investing

A strategic approach is required to maximize the benefits of long-term investing. These tips will help you have a balanced portfolio.

- Embrace diversification. Invest in a mix of traditional securities and digital assets. This will act as a shield against market volatility and rising inflation. The allocation of investments across various asset classes delivers increased compounding benefits to investors.

- Have a long-term perspective. While short-term gains might look enticing, the risks far outweigh the returns. Long-term investing on the other hand comes with significantly lesser risk with the possibility for multiplied returns over years.

- Consider alternative asset classes. The rise of digital assets such as security tokens provides a viable alternative while maintaining the strategic decisions of long-term investments.

The mix of a long-term perspective, diversification, and alternative asset classes will ensure sustained rewards in your long-term investment journey.

As you embark on the journey of wealth building, consider the potential of security tokens—a dynamic component that is shaping the future of long-term investments. Staying up to date with new financial developments will arm you with the ability to spot long-term investments and chart a sustainable wealth creation process.

Long-term investments FAQ

What exactly are security tokens and how do they differ from traditional investments?

Security tokens are digital representations of ownership or assets on a blockchain. Unlike traditional investments, they offer an opportunity for fractional ownership, increased liquidity, and transparency.

Is diversification important when including security tokens in my investment strategy?

Diversification helps spread risk and enhances the resilience of your portfolio. Including a mix of security tokens and traditional assets can provide a balanced and robust investment strategy.

How do security tokens provide liquidity, and why is it advantageous for long-term investors?

Security tokens can be traded 24/7 on digital platforms, offering increased liquidity compared to some traditional assets. This liquidity allows investors to adjust their portfolios more efficiently as market conditions change and allow for previously illiquid private investments to be sold on a secondary market.

Where can I find reliable information and resources for staying informed about security tokens and long-term investing?

The INX Academy is a key resource for finding reputable financial articles and insights on long-term investing with a focus on digital assets.

The INX Digital Company INC November 16, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.