Tokenized Wine and Whiskey: An Exciting Investment Opportunity

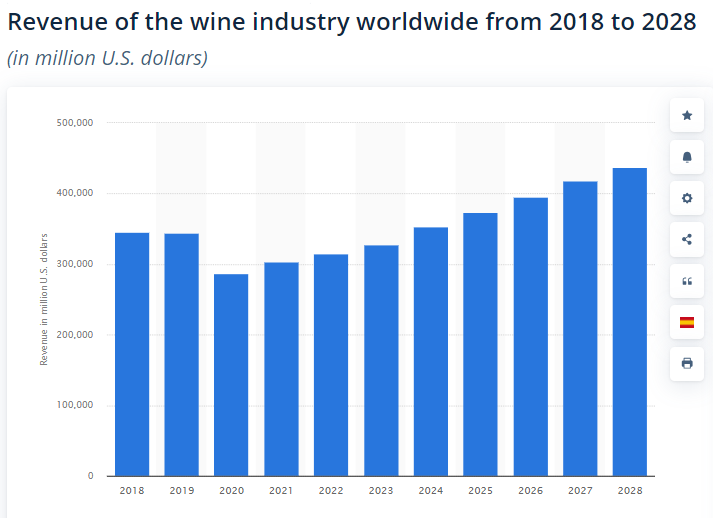

The global wine market is expected to reach a staggering $428.7 billion by 2027, while the whiskey market is projected to hit $108.2 billion by 2027. Owning a rare vintage wine or a cask of whiskey can be an attractive choice. However, it comes with its issues. For example, high upfront costs, complex storage requirements, and limited liquidity can make this opportunity inaccessible for many individuals.

However, tokenization has extended its reach to cover wine and whiskey investments. Tokenization allows you to bypass traditional barriers and participate in this exciting market in a secure and transparent manner.

With tokenized wine and whiskey, you can invest in spirits while taking advantage of blockchain technology. This article unpacks all you need to know about tokenized wine and whiskey.

Tokenized Wine and Whiskey: How It Works

In the past, investing in high-end wine and whiskey has been restricted to a select few. This is due to the high cost of entry, usually requiring tens of thousands of dollars for a single cask or bottle. Also, the complexities of secure storage, authentication, and resale, and limited participation made this investment difficult to get into.

Tokenization dismantles these barriers, offering a wave of exciting advantages for both investors and producers. In 2018, Whisky Vault, a whiskey investment platform, tokenized a cask of rare Macallan single malt whiskey. The cask was divided into digital tokens, which investors could purchase on Whisky Vault’s platform.

Also, in 2019, Vint (now known as AssetMantle), a blockchain company, partnered with several wineries to tokenize bottles of fine wine. Investors could purchase tokens representing ownership of a fraction of a bottle of wine, allowing for shared ownership of expensive wines.

Since then, the investment opportunity has expanded. Here are the major benefits investors can gain from tokenized wine and whiskey.

- Fractional Ownership: Tokenization allows you to invest in a portion of a valuable cask or bottle. A single cask or bottle can be divided into numerous tokens, making these coveted assets accessible to a broader audience with lower investment minimums. This gives room for a wider range of investors to participate in this previously exclusive market.

- Increased Liquidity: Unlike physical bottles locked in a cellar, tokenized assets can be easily traded on secondary markets. This increased liquidity allows investors to enter and exit positions easily. This can lead to a more vibrant and dynamic market.

- Enhanced Transparency and Security: Blockchain technology serves as the foundation for tokenization. This ensures secure record-keeping and transparent provenance tracking. It also reduces the risk of fraud and counterfeiting, which can be a major issue in the traditional wine and whiskey investment world.

- Potential for Higher Returns: Rare and vintage wines and whiskeys have a proven track record of value appreciation. Tokenization allows you to participate in this potential for growth without the burdens of physical ownership, such as storage costs and insurance.

Revenue of wine industry worldwide | Source: Statista

The Potential Challenges to Consider

While tokenization offers a wave of exciting possibilities for wine and whiskey investment, it’s important to understand the challenges and possible risks. Here are the biggest challenges facing this exciting innovation:

- Regulatory Uncertainty: The regulatory landscape surrounding tokenized assets is still growing. While regulations are being developed, the lack of clear guidelines in certain regions can pose challenges for both investors and platforms. This uncertainty can lead to concerns about consumer protection.

- Platform Security: Since tokenized investments rely on digital platforms, security breaches are a possible risk.

- Valuation and Liquidity: Unlike established markets with readily available pricing information, the valuation of tokenized wine and whiskey can be less transparent. Factors like limited trading history and the subjectivity of wine and whiskey quality can make it difficult to determine the true value of a token.

- Limited Track Record: Tokenization in the wine and whiskey investment space is quite new. The long-term performance of these investments remains to be seen. Also, since historical data is limited, it is challenging to accurately predict future returns or assess potential risks associated with price volatility.

- Physical Asset Management: The underlying physical assets (wine or whiskey) need to be securely stored and maintained throughout their maturation process. This means you’ll need to rely on the platform or a third-party custodian to ensure proper storage conditions. This can affect the quality and eventually, the value of the investment.

Launching a Tokenized Wine and Whiskey Collection

Launching a tokenized wine and whisky collection has different components that need to be structured effectively to deliver a solid investment. Here are the steps to be considered:

- Assets to be tokenized have to be carefully selected with consideration given to factors such as rarity, provenance, age, and market demand.

- Smart contracts that represent ownership of the tokenized assets must be developed, outlining ownership rights, dividends, and any other relevant terms.

- Compliance with the relevant regulatory bodies, as securities laws may apply.

- A Security Token Offering to raise funds and distribute ownership of the tokenized assets.

- Secondary Market Integration to facilitate trading of the tokenized assets on the secondary market.

INX offers a full-service suite for any project who wants to tokenize a wine & whisky collection. As an SEC-regulated platform, tokenized wine and whisky projects may benefit from regulatory compliance, blockchain development, and secondary market trading.

INX’s capital raise approach through security tokens offers a hassle-free way to issue a security on the blockchain, customize token holder rights, allow investment via fiat/crypto, and 24/7 trading for tokenized assets.

The Future of Tokenized Wine and Whiskey: Looking Ahead

The world of tokenized wine and spirits keeps changing. Emerging technologies like AI-powered valuation tools could further help the market by providing better investment insights. The regulatory landscape surrounding tokenized assets is also evolving, potentially leading to increased stability and wider adoption.

Fractional ownership, improved liquidity, and the potential for high returns make this a market brimming with opportunity.

Tokenized Wine and Whiskey: FAQ

Is tokenized wine and whiskey real?

Yes! The underlying assets (wine or whiskey) are physically stored in secure facilities, and ownership is represented by digital tokens on a blockchain.

How do I take possession of the physical wine or whiskey?

In most cases, taking physical possession isn’t the primary purpose of a tokenized investment. However, some platforms may offer options for acquiring the physical asset after fulfilling certain criteria (e.g. owning a majority of tokens for a particular cask).

What are the fees associated with tokenized wine and whiskey investments?

Fees can vary depending on the platform, but typically include transaction fees for buying and selling tokens, as well as storage fees for the underlying assets.

Is tokenized wine and whiskey a good investment?

Tokenization offers exciting potential, but it’s not without risks. As with any investment, careful research, understanding your risk tolerance, and diversifying your portfolio are crucial.

Meta: Explore the exciting world of tokenized wine and whiskey. Discover how this investment opportunity works, how to invest, and the potential challenges.

The INX Digital Company INC April 17, 2024

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.