Top 5 Bitcoin Mining Stocks Leading The Gold Rush 2.0

As we navigate the thrilling tides of the digital era, the buzzword on everyone’s lips seems to be ‘Bitcoin’. This cryptocurrency has taken the world by storm, creating a flurry of interest from investors, tech enthusiasts, and financial institutions alike. Amidst this landscape, a new investment frontier is emerging – Bitcoin mining stocks. Harnessing the power of the decentralization wave, Bitcoin mining stocks are making a compelling case as a potentially lucrative investment opportunity.

From facilitating Bitcoin transactions to generating new Bitcoins, the mining process is a critical component of Bitcoin. As Bitcoin has grown, miners have gone from being hobbyists and coders mining on their laptops, to industrial giants churning thousands of machines to bring Bitcoin to life. This is where Bitcoin mining stocks come into play.

But what exactly is Bitcoin mining? How do Bitcoin mining stocks factor into this scenario? These questions and more will be addressed as we delve into the depths of the Bitcoin goldmine.

What are Bitcoin Mining Stocks?

Bitcoin mining is the lifeblood of the Bitcoin ecosystem, serving as the beating heart that maintains the network’s integrity and security. In its essence, it’s a meticulous process of appending transaction records to Bitcoin’s public ledger – the blockchain. The blockchain is an open book that verifies and validates past transactions to the rest of the network, keeping double-spending, a notable potential pitfall in the digital currency world, at bay. In return for spending electricity to secure the network, Bitcoin miners get rewarded with block rewards. These block rewards get cut in half every four years to maintain the scarcity of Bitcoin, with the next Bitcoin halving date in 2024.

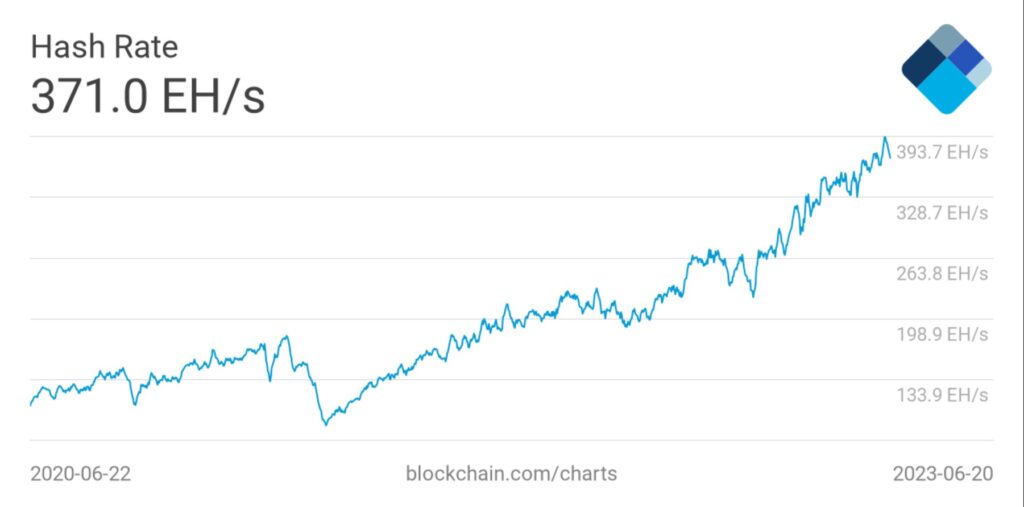

As the years have rolled by, Bitcoin mining has transformed dramatically. What was once the domain of tech-savvy hobbyists tinkering away on their laptops has become an industrial behemoth. Today, massive firms wielding cutting-edge ASIC machines steer the Bitcoin mining ship, contributing to the astonishing growth of this industry.

Fast forward to June 2023, and the Bitcoin network’s electricity consumption is an eye-popping 135 terawatt-hours per year. To put this into perspective, if we consider the average cost of electricity in the US at $0.165 per kWh, the annual expense to power Bitcoin mining balloons to an astronomical $22.27 billion. To say that Bitcoin mining is energy-intensive would be an understatement – it uses more electricity than entire countries, the Netherlands included, according to the Cambridge Centre for Alternative Finance.

This incredible landscape gives rise to Bitcoin mining stocks. These are not mere pieces of paper or digital tokens, but gateways to mammoth industrial firms that have staked their claim in the Bitcoin mining territory. When you invest in these stocks, you hitch a ride with these titans, sharing in their potential triumphs without tangling with the intricacies of a mining operation.

Top 4 Bitcoin Mining Stocks Leading the Gold Rush 2.0

A new, exciting Bitcoin mining investment is the Hashrate Asset Group (HAG) security token. Though not a stock per se, the HAG token represents a novel investment opportunity in the sector. Each HAG token embodies 1 terahash of perpetual mining hash rate for Bitcoin, transforming into tangible returns for investors in the form of monthly WBTC dividends. HAG has strategically partnered with INX Limited, a leading STO exchange in the US, ensuring full compliance with US securities laws. With a team consisting of industry-leading professionals from Bitmain, Goldman Sachs, and TSMC, the Hashrate Asset Group offers investors the opportunity to join their ecosystem and benefit from the Bitcoin mining industry. Keep an eye on this upcoming player as they bring innovation and compliance to the forefront.

Here are three other Bitcoin mining stocks to consider:

- Riot Platforms (RIOT): Riot Platforms, based in the United States, focuses on Bitcoin mining and aims to be one of the largest and lowest-cost producers of Bitcoin in North America. At the height of the Bitcoin bull market, the RIOT stock shot up 70x in a single year. Currently, it is sitting at around the $10 mark, down significantly from its all-time high of $70 but still up from the start of the year.

- Hive Blockchain (HIVE): Hive Blockchain is a Canadian company that mines both Bitcoin and Ethereum using green energy. They own state-of-the-art green energy-powered data center facilities in Canada, Sweden, and Iceland.

- Marathon Digital Holdings (MARA): Marathon is one of the largest enterprise Bitcoin self-mining companies in North America. The firm has aggressively expanded its mining capacity in recent years, expecting to deploy over 100,000 miners by the end of 2023.

Each of these Bitcoin mining stocks offers unique strengths and potential growth opportunities. As with any investment, it’s crucial to conduct thorough research and consider your investment goals and risk tolerance before diving in. The crypto gold rush is here, and these Bitcoin mining stocks are at the forefront, leading the charge.

The Case to Be Made for Investing in Bitcoin Mining Stocks

During the historic California Gold Rush of the 19th century, there was a popular saying: “During a gold rush, sell shovels.” This adage suggests that sometimes the most lucrative opportunity isn’t in the resource itself, but in the tools and infrastructure that enable its extraction. Similarly, in our present-day digital gold rush, Bitcoin mining stocks represent these very ‘shovels’.

With Bitcoin’s price continuing its upward trajectory, the allure of mining has grown. However, mining Bitcoin profitably requires significant investment in specialized hardware, operational expertise, and access to cheap electricity – barriers not everyone can overcome. But Bitcoin mining stocks offer a solution.

By investing in Bitcoin mining stocks, individuals gain exposure to the mining process’s profitability without dealing with its complexities. These stocks represent companies that have mastered the art of Bitcoin mining – boasting vast data centers filled with mining hardware, negotiating energy rates to reduce costs, and navigating the regulatory landscape.

However, like any investment, there are risks. Bitcoin mining stocks are volatile and closely linked to the price of Bitcoin. A crash in Bitcoin’s price can have a severe impact on these stocks. Furthermore, regulatory changes, technological advancements, and energy costs can also influence these stocks’ performance.

Investors must carefully consider their risk tolerance and investment goals before investing in Bitcoin mining stocks. However, for those willing to navigate these risks, these stocks offer an exciting opportunity to be part of the continuing Bitcoin story.

David Azaraf June 21, 2023

Crypto enthusiast, help businesses plug into the token economy