5 Types of Alternative Investments To Transform Your Portfolio

Over the years, traditional investments such as stocks and bonds have been classified as the standard in financial investment. This was due to their relative safety and resistance to external shocks such as inflation.

Yet, the last decade has seen savvy investors shift toward alternative investments for a more robust financial portfolio. These alternative investments have increased in popularity, due to their resilience and uncorrelated nature with traditional financial markets.

Alternative investments with their potential for high returns and risk aversion, are no longer fringe players, but now form a strategic component in the modern investor’s playbook, reshaping the very definition of financial success.

What Are Alternative Investments?

Alternative investments defy the conventional duo of stocks and bonds, as they encompass a diverse category of assets. These unconventional investment vehicles include real estate, private equity, hedge funds, cryptocurrencies, commodities, and art, with each offering a unique avenue for capital growth.

Beyond the traditional financial markets, alternative investments have the power to reshape investors’ portfolios by providing a unique form of diversification. They act as financial disruptors, offering resilience in the face of market instability and unlocking new dimensions of profit potential for savvy investors.

In essence, alternative investments are not mere financial options; they are strategic tools that allow investors to navigate the complex world of the modern financial landscape.

Understanding The Transformational Power of Alternative Investments

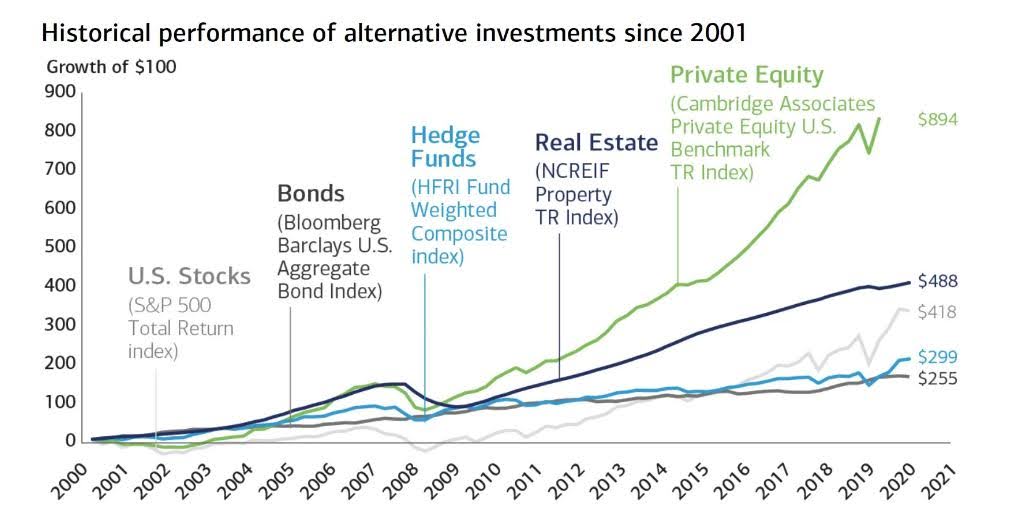

Looking at the historical performance of traditional investments compared to alternative investments, it is clear that they outshine their counterparts. Consider the success of hedge funds during market downturns, showcasing a resilience that goes against the trends of conventional assets.

Moreover, alternative investments act as a dynamic shield in volatile markets, embodying risk management at its finest. Beyond short-term gains, alternative investments show potential for long-term growth, as seen in the sustained upward trajectory of real estate and the rapid rise of cryptocurrencies. They are not just deviations from the norm; they are strategic choices that have historically outpaced, outshined, and outperformed the predictable confines of traditional investment strategies.

Types of Alternative Investments

Alternative investments cut across several industries. Here are the top four alternative investments shaking up the financial landscape:

- Cryptocurrencies, the disruptors of finance have rapidly ascended, offering unparalleled potential for returns. Yet, their swift rise is accompanied by volatility, urging investors to tread with a strategic balance of risk and reward.

- Real Estate, a dependable category of alternative investments, unveils a lot of benefits from stable cash flows to property appreciation. However, challenges still persist, demanding insightful navigation through market fluctuations and management difficulties.

- Private Equity and Venture Capital beckon with opportunities to stake a claim in promising enterprises. However, the high stakes come hand-in-hand with risks, emphasizing the need for meticulous due diligence in the world of private investments.

- Precious Metals and Commodities are tangible assets that stand as guardians of diversification. They serve as hedges against inflation, but meticulous analysis is essential to harness their role effectively within a diversified portfolio.

Each alternative investment channel presents a unique landscape, promising rewards for the discerning investor who navigates the challenges with data-backed insight and market foresight.

A 5th Class of Alternative Investments: Security Tokens

The interesting perspective of alternative investments is the ability to tokenize them, bringing digital innovation to real-world assets. Tokenization is the transformation of real-world assets into digital tokens stored on blockchain technology. Tokenization can be done for real estate, art, commodities, and even intellectual property.

Security tokens take tokenization a step further by combining the technology of blockchain with the requirements of regulated securities markets to support the fractionalization and liquidity of assets.

A Security Token is a digital token representing a stake of ownership or a future benefit in an asset on a blockchain. Unlike cryptocurrencies, security tokens deliver added security and protection as they are only digital representations of underlying real-world assets and are usually delivered in the form of a smart contract. This provides an additional alternative investment for the modern-day investor.

Drawbacks of Alternative Investment

Navigating the terrain of alternative investments isn’t without its challenges. Certain alternative assets operate in regulatory gray areas, subjecting investors to potential legal complexities. Understanding and mitigating these risks through thorough research and compliance diligence becomes paramount in such scenarios.

Moreover, the performance of alternative investments isn’t immune to market conditions. Factors such as economic shifts and geopolitical events can significantly influence returns. Acknowledging these challenges proactively equips investors with the foresight needed to navigate alternative investments successfully.

Final Thoughts

In summary, the transformative benefits of incorporating alternative investments into your portfolio are profound.

The foray into alternative investments must be backed by research and due diligence. Investors must dive into historical performance, analyze market trends, and scrutinize asset specifics. This groundwork is the bedrock of informed decision-making, a prerequisite for success in the realm of alternative investments.

Alternative investments are tangible avenues for financial growth with a well-crafted alternative investment strategy serving as a pathway for long-term financial investment.

Alternative Investments FAQ

What are alternative investments and how do they differ from traditional investments?

Alternative investments are non-traditional assets like real estate, private equity, and cryptocurrencies. They differ from traditional investments by offering unique risk-return profiles, often having low correlation with traditional markets.

Can you provide examples of alternative investments and their potential returns?

Examples include real estate properties, private equity in startups, hedge funds, and cryptocurrencies like Bitcoin. Like all investments, potential returns vary; real estate may offer steady income and appreciation, while cryptocurrencies can be more volatile with the potential for higher returns.

How do I assess my risk tolerance before investing in alternative assets?

Assess your risk tolerance by evaluating your comfort with market fluctuations, financial goals, and time horizon. Understand that alternative investments may carry different risks than traditional assets, requiring a tailored risk assessment.

What are the benefits of including alternative investments in my portfolio?

Benefits include enhanced diversification, potential for higher returns, and resilience against market volatility. Alternative investments can act as a hedge, contributing to a well-balanced and more robust portfolio.

How do market conditions impact the performance of alternative investments?

Market conditions influence alternative investments differently; for example, real estate may thrive in a growing economy, while certain hedge funds may navigate downturns successfully. Understanding these dynamics is crucial for effective investment strategy.

What are the long-term growth prospects of alternative investments compared to traditional options?

Long-term growth prospects for alternatives can be favorable due to their potential for diversification and uncorrelation with traditional assets. However, individual performance varies, and thorough analysis is essential.

How can I find a reliable expert or financial advisor to guide me in incorporating alternative investments into my portfolio?

INX is a reputable digital assets firm offering several pathways to alternative investments. Click here to sign up and get started on your journey to building a diversified financial portfolio via alternative investments.

The INX Digital Company INC December 12, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.