Real Estate Tokenization: The Future of Property Investment

Imagine buying a piece of prime real estate by tapping a button on your phone. This is where real estate investment meets blockchain technology. Real estate tokenization, the process of transforming tangible real estate assets into digital tokens on the blockchain, is revolutionizing the way we invest in properties.

Real estate tokenization is disrupting the traditional real estate market. From increased liquidity and fractional ownership to global investment opportunities, it offers diverse benefits to investors and property owners.

Understanding Real Estate Tokenization

Real estate tokenization is modernizing property investment by converting physical real estate assets into digital tokens, which are securely recorded on a blockchain. This process allows property ownership to be divided into smaller, tradable portions, opening up real estate investments to a broader range of investors.

Blockchain technology ensures transparency, immutability, and trust in transactions. Smart contracts which are self-executing agreements on the blockchain automate tasks like rent collection and title deed allocation, offering an all-in-one package for property management.

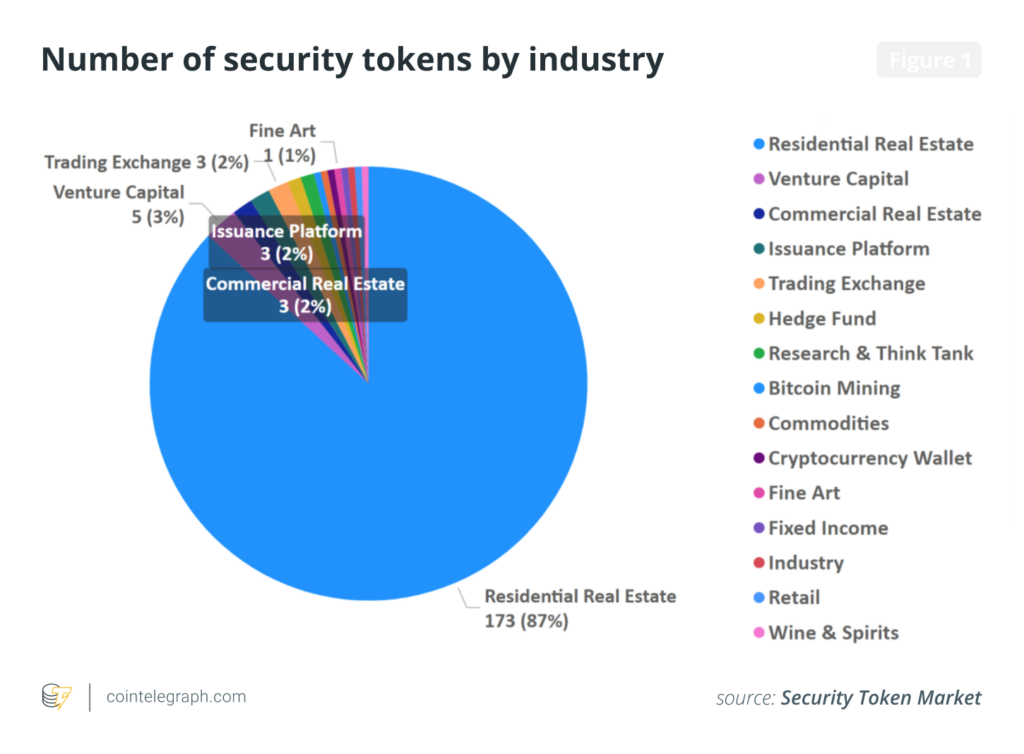

Assets that can be tokenized in real estate cut across a wide spectrum, including residential properties, luxurious estates, commercial office spaces, shopping malls, and even undeveloped land. This innovation democratizes access to real estate markets, providing liquidity and diversification for investors while reshaping how we view property ownership.

Benefits of Real Estate Tokenization

Real estate tokenization offers a suite of benefits for property owners and investors.

- Liquidity: Property owners benefit from instant liquidity with the ability to sell smaller portions of their holdings. For investors, tokenized properties can be bought and sold at any time on digital trading platforms, providing more flexibility.

- Fractionalization: Fractional ownership becomes seamless, as individuals can purchase fractions of high-value properties. It removes barriers to entry, enabling smaller investors to access premium real estate markets.

- Automation: Smart contracts can automate functions like rental payments, title deed transfer, etc.

The real estate market as a whole experiences increased trading activity and accessibility, attracting a global pool of investors. This innovation paves the way for diverse, global investment opportunities, ultimately reshaping how we view property investment and ownership in the modern era.

Real Estate Properties That Have Been Tokenized

Real-world success stories showcase the power of real estate tokenization. A powerful example is the St. Regis Aspen Resort, which tokenized a luxury ski resort in Colorado. Investors gained access to a piece of this prestigious property, experiencing both capital appreciation and a share of the rental income.

In another case, the Blockchain App Factory tokenized a 30,000-square-foot property in Manhattan. This project opened doors to global investors, offering them fractional ownership in prime New York real estate, once only accessible to a select few.

These projects exemplify how real estate tokenization democratizes access to high-value assets, delivering financial rewards to investors and property owners alike. This unlocks new investment opportunities and transforms the traditional real estate landscape.

Catalysts for Real Estate Tokenization

While real estate tokenization looks promising, it presents potential challenges. The unfamiliarity of traditional investors with crypto user interfaces (wallets, tokens etc) limits adoption. In addition, the average crypto investor is more likely chasing the next meme coin than investing in real estate. However, these initiatives can speed up the adoption process:

- Rent-to-Own Models: Real estate tokenization can provide tenants with the opportunity to own a piece of the property they live in. This could change rental markets.

- Positive Sentiment: More investors could be drawn to real estate tokens, as real-world asset tokenization gains traction.

- DeFi Integration: The ability to use real estate tokens as collateral in decentralized finance could open up new avenues for property owners.

How to Get Started with Real Estate Tokenization

For those eager to venture into real estate tokenization, the path to success involves a few key steps. First, understanding the concept and potential benefits. Next, identifying a reputable platform or service provider specializing in real estate tokenization. These platforms facilitate the process, from property assessment to token creation and management.

When it comes to selecting a platform, consider established names in the industry like RealT known for their compliance and security measures. Investing time in due diligence and partnering with trusted providers will maximize the benefits of real estate tokenization for both investors and property owners.

The Future of Real Estate Tokenization

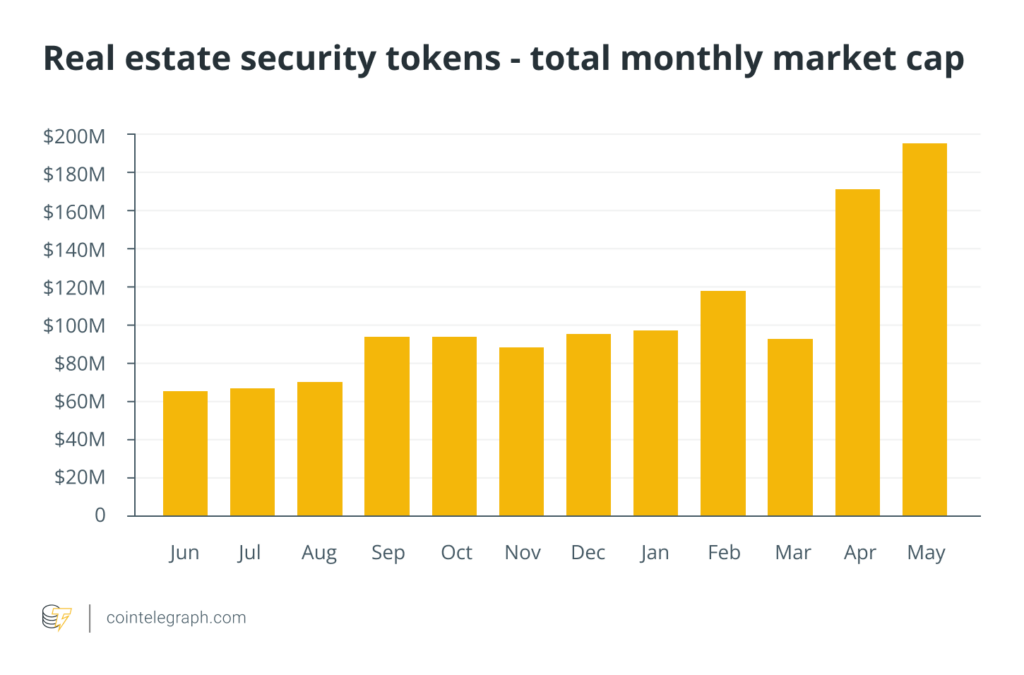

The world of real estate tokenization is constantly evolving, driven by innovation and growing investor preferences. It will democratize real estate on a global scale, offering access to a wider range of investors. Technology advancements, including increased blockchain scalability and interoperability, will enhance tokenization’s efficiency and reach.

As real estate tokenization matures, it will play an integral role in redefining how we buy, sell, and invest in real estate, making it more inclusive, efficient, and accessible.

Real Estate Tokenization FAQ

How does real estate tokenization work?

Real estate tokenization involves converting physical real estate assets into digital tokens on a blockchain. These tokens represent ownership or shares in the property. Investors can then buy, sell, or trade these tokens, facilitating fractional ownership and liquidity.

What are the benefits of investing in tokenized real estate?

Investing in tokenized real estate offers benefits like increased liquidity, lower barriers to entry, fractional ownership opportunities, global access to markets, potential for diversification, and streamlined property management through smart contracts.

Can I invest in real estate tokens with a small budget?

Yes, real estate tokenization allows investors with small budgets to participate by offering fractional ownership. This means you can invest in high-value properties with a relatively small capital outlay.

How do I ensure the security of my real estate tokens?

To secure your real estate tokens, use reputable and secure platforms for tokenization. Employ best practices for digital asset security, such as using hardware wallets, enabling two-factor authentication, and staying informed about cybersecurity threats.

What happens if I want to sell my tokenized real estate investment?

Selling tokenized real estate investments typically involves listing your tokens on a compatible platform. Once a buyer is found, the transfer can occur digitally, often with minimal time and paperwork compared to traditional real estate transactions.

What are the differences between traditional real estate investment and tokenization?

Traditional real estate investment involves buying physical properties, often requiring significant capital and extensive paperwork. In contrast, tokenization allows for fractional ownership, easier entry, global reach, and digital trading, revolutionizing the real estate investment landscape.

The INX Digital Company INC October 4, 2023

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.