Weekly Analysis 2/26

In our unwavering commitment to assist you in achieving your financial goals for 2024, here’s a summary of our activities from the past week aimed at enhancing your journey:

Weekly Analysis

Is Bitcoin Consolidating Before a Major Move Up? Here’s What The Charts Say

As we venture into the last week of February, the Bitcoin landscape presents an intriguing blend of steadiness and subtle dynamism. Let’s unpack the story behind the numbers.

Bitcoin has been playing a game of equilibrium, hovering around the $52,000 mark. Last week’s price action saw Bitcoin bouncing within a narrow range, reflecting a market cautiously optimistic yet wary of making bold moves.

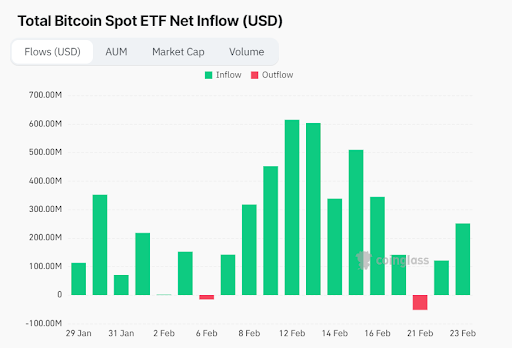

The price of Bitcoin isn’t the only thing consolidating. After a striking $2.4 billion in inflows the preceding week, Bitcoin ETFs observed a more modest influx of $500 million. This pattern suggests a momentary pause in institutional momentum, possibly as investors reassess their strategies in light of the market’s recent behavior.

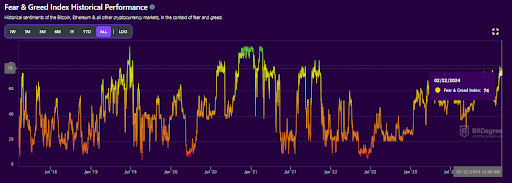

While the institutions are slowing down, the sentiment on the street is bullish as ever. The Fear and Greed Index, consistently above 70 throughout February, signals a robust appetite for risk. Investors’ willingness to buy into Bitcoin remains strong, painting a picture of underlying confidence in the market’s prospects.

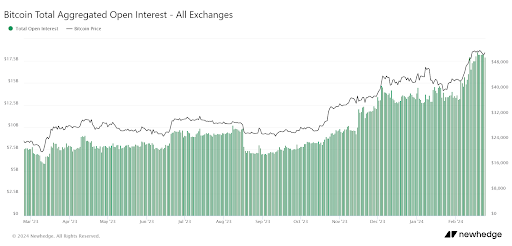

Additionally, February has seen a 15% month-over-month surge in open interest, corresponding to an additional $14 billion in futures positions. This climb is a testament to growing engagement and heightened anticipation among traders, setting the stage for potential volatility and opportunity.

How are the miners feeling?

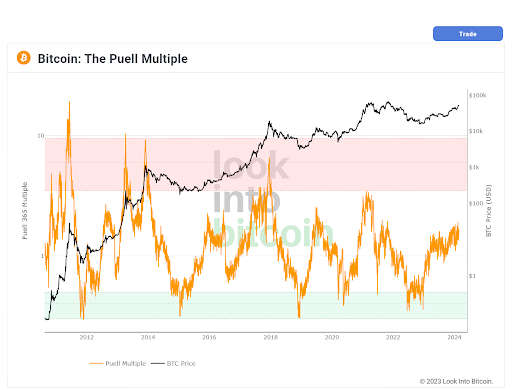

To gauge miner sentiment, we turn our attention to the Puell Multiple, currently standing at 1.48. This metric is calculated by dividing the daily issuance value of Bitcoins (in USD) by the 365-day moving average of daily issuance value. It’s a tool to gauge the mining ecosystem’s health and potential future behavior. A Puell Multiple above 1 suggests miners are making more than the yearly average for selling their Bitcoin, which can indicate market strength. At 1.48, we’re witnessing a scenario where miners are likely profitable, but not at extreme levels that historically signal a market top. It’s a delicate balance, indicative of a market that’s healthy but not overheated.

In summary, Bitcoin’s current phase is one of cautious optimism. The market dynamics, from ETF inflows to open interest and key indicators like the Fear and Greed Index and the Puell Multiple, all paint a picture of a market with potential energy, waiting for the right catalyst. As always, the key will be to navigate these waters with a balanced approach, keeping an eye on the indicators while being prepared for sudden shifts.

INX On Air

The Next Megatrend: Live Audio

Hope you’ve started your week with our special CBDC LinkedIn Audio, aimed to equip you with everything you need to know about this 2024 financial megatrend. With a panel of global experts, we delved into CBDC’s rapid acceleration, financial impacts, digital money shift, and global infrastructure changes.

INX solidifies its partnership with Republic

After finalizing our collaboration agreement extension with Republic for another year, reaffirming our commitment to offering unparalleled global financial opportunities, we hosted a lively and fascinating live AMA session. We were thrilled to receive your feedback and connect with true INXers, and we thank everyone who submitted their questions. We hope you found the session insightful and engaging, and we’re excited about the future ahead.

Trading on INX.One

Last Chance to Invest

Trucpal has successfully concluded its first tranche of STO after sharing its revenue with investors twice already and announcing another round of dividends.

This tranche is set to officially close in just 3 more days, on February 29th!

It’s your last chance to invest in Trucpal’s STO under the existing terms!

ACT FAST!

Don’t forget to review the list of primary and secondary security tokens offered on our platform, each representing a different industry and a unique opportunity.

Optimize Your Portfolio

Your Favorite Tweet

INXers are serious about their financial goals and are always eager to learn more about the best path to achieve them. This week, there was significant interest in understanding the role of broker-dealers in digital asset markets and why it is so significant for your bottom line that INX is a proud licensed #FINRA broker-dealer.

INX.One

What’s Trending on INX Academy

INX Academy offers multiple articles and guides to help you better understand this evolving market and the wealth of opportunities it has to offer.

This week, two new guides were added to the INX Academy, providing crucial info on the latest Web3 trends:

INXers on Telegram

INXers, our global INX community on Telegram, engage in lively discussions, recognize trends, share news, and debate critical issues. Each week, we gain insights into their perspectives and preferences through a weekly poll.

Poll of the Week:

Do you have 2FA turned on for your Digital Assets accounts?

INXers say:

– 20% No, I’m not bothered

– 73% Yes, of course

– 7% Sometimes

– 0% I’m not familiar with 2FA

The vote is still ongoing.

Join our community on Telegram to cast your vote.

We have a busy week ahead.

Stay tuned for more updates!

The INX Digital Company INC February 26, 2024

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.