Weekly Analysis

January is already coming to a close, and we are just getting started…

Here’s a recap of the past week

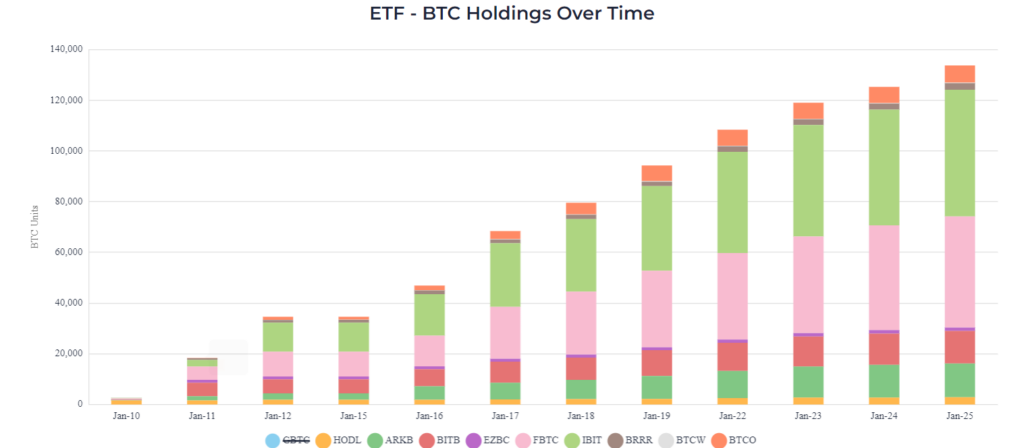

It’s Week 3! Bitcoin ETF Update

Bitcoin ETFs have been trading for 12 days and already, it seems like they are going to suck away Bitcoin supply as we continue along 2024. On the one hand, the GBTC sell-off continues to put downward pressure on Bitcoin, with 118,000 BTC sold by Grayscale to date. On the other hand, the other 9 ETF issuers are buying Bitcoin at a rapid clip. 133,767 have been purchased by the new ETF issuers since Jan 11, at an average of 11,147 BTC per day.

To put that into context, there are only 900 BTC mined each day, which will be cut by half during the next Bitcoin halving in April 2024. Another interesting fact to note is that with only 1.9m Bitcoin available on crypto exchanges, it will take another 158 trading days for the ETF issuers to buy up all the supply currently on exchange.

Insights into 2024 Trends

In our commitment to your 2024 financial goals, we’re diving into the megatrends shaping digital assets that will impact your financial objectives. You vote for what you want to learn about first, and we follow.

After our LinkedIn Audio on Real World Assets (“RWA”) and the upcoming X space on rapid CBDC advancements, let’s explore the next major financial opportunity.

What megatrend would you like us to prioritize in our next on-air broadcast?

- AI & Blockchain

- Compliant Assets and Evolving Regulatory Standards

- Institutional Embrace: From Bitcoin to ETFs and Beyond

Trading on INX.One

Don’t forget to review the list of primary and secondary security tokens offered on our platform, each representing a different industry and a unique opportunity.

Optimize Your Portfolio

One-Year Anniversary

This week, we celebrated the first anniversary of The INX Way book, which is now more relevant than ever. Known as the ‘Security Token Bible,’ it is a practical guide by INX’s leadership and top experts. Empower yourself with insights on real-world assets (RWA) and digital investments to reach your financial goals. Get your free digital copy today!

INX in the Media

Our COO & Deputy CEO, Itai Avneri, wrote a special piece for The Crypto Globe, in which he highlighted the unparalleled benefits of real-world asset tokenization and explained why and how tokenization serves as the bridge that could bring trillions of dollars from TradFi on-chain. This represents a true ‘best of both worlds’ for investors and asset owners alike.

Your Favorite Tweet

Your favorite tweet this week was our Fact Friday, where we highlighted three important facts about RWA tokens in the United States:

- It must be either registered or exempt from SEC registration under a valid exemption.

- It must be listed on SEC & FINRA-registered ATS.

- It must follow KYC/AML requirements.

That’s where we come in with INX’s end-to-end solution.

INX.One

What’s Trending on INX Academy

INX Academy offers multiple articles and guides to help you better understand this evolving market and the wealth of opportunities it has to offer.

This week was all about sparking curiosity regarding the extent of growth in digital economy opportunities, and your most searched articles on INX Academy reflected that focus!

Here are the top 3 searched articles:

INXers on Telegram

INXers, our global INX community on Telegram, engage in lively discussions, recognize trends, share news, and debate critical issues. Each week, we gain insights into their perspectives and preferences through a weekly poll.

Poll of the Week:

What excites you most about the future of the Security Token Industry?

INXers say:

- 44% Increased adoption and mainstream use cases.

- 22% Expansion of investment opportunities for retail investors and institutional investors alike.

- 17% Increased liquidity and accessibility to previously illiquid assets.

- 10% Regulatory advancements shaping a secure and compliant ecosystem.

- 7% Integration of blockchain technology for heightened security and trust.

The vote is still ongoing.

Join our community on Telegram to cast your vote.

We have a busy week ahead.

Stay tuned for more updates!

The INX Digital Company INC January 29, 2024

The INX Digital Company inc. is an expert in the field of finance, crypto and digital securities.